CEXs

Centralized exchanges (CEXs) are primarily controlled by a handful of major players, with Binance leading the pack by a significant margin in terms of trading volume.

As of March 25, Binance reported around $17 billion in trading volume over a 24-hour period, far surpassing any other exchange. With approximately 1,868 markets featuring 479 different coins, Binance captures a substantial portion of global trading—often exceeding 50% of all crypto spot volume.

In comparison, Coinbase recorded $2.8 billion in volume within the same timeframe, showcasing 431 markets and listing 289 coins. Although Coinbase’s volume is considerable, it is roughly one-sixth that of Binance. This US-based exchange benefits from direct fiat on-ramps and institutional clientele, although it has a smaller global reach.

Both OKX and Bybit witnessed trading volumes of $2.5 billion, while Bitget and MEXC each approached around $2.20 billion. Collectively, the top 10 CEXs account for the majority of crypto trading, with Binance alone representing between 34% and 60% of total spot volume on any given day.

While the group of CEXs boasts thousands of markets, their listing strategies can vary greatly. For instance, exchanges like Gate.io and MEXC each list more than 4,000 markets, which is significantly higher than that of major regulated exchanges.

These exchanges explore a wide range of digital assets, which can inflate reported volumes as active traders engage with numerous smaller tokens. Conversely, Coinbase maintains fewer than 500 trading pairs, prioritizing quality and liquidity. Binance’s ~1,868 markets strike a compromise, listing many coins—including new project launches—while also concentrating volume on a select few top pairs (e.g., BTC/USDT, etc.).

Typically, a higher number of markets can attract niche trading activities. Nevertheless, the predominant share of trading volume on CEXs still comes from a limited number of top pairs, such as BTC, ETH, and popular altcoins like Solana and XRP in relation to USDT or fiat.

DEXs

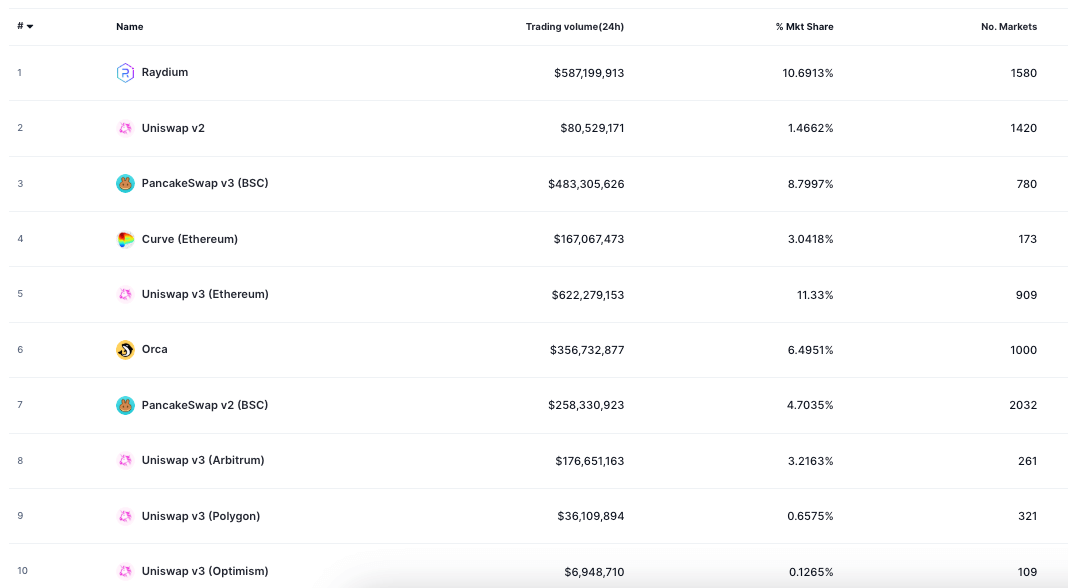

Decentralized exchanges (DEXs) have experienced significant growth since 2020. The current landscape of DEXs spans various chains and trading models, including automated market makers (AMMs), aggregators, and order book DEXs. The top 10 DEXs by daily volume feature both Ethereum-native platforms and those based on alternative Layer-1s and Layer-2s.

Stabble achieved the highest trading volume on March 25, exceeding $6 billion. This Solana-based stablecoin DEX/aggregator is specifically designed for low-slippage stablecoin exchanges, with USDT/USDC trades alone accounting for approximately $4.7 billion of its total volume.

The substantial activity around stablecoin swaps allowed Stabble to capture over 50% of the total DEX volume during its peak days. Its innovative liquidity model, which claims to use 97% less liquidity while maintaining depth and efficiently integrating with Solana’s ecosystem (Serum/Jupiter aggregators), likely contributed to its impressive volume.

On March 25, Uniswap v3 recorded a daily volume of between $600 million and $700 million. As the premier AMM on Ethereum, it is well-known for its concentrated liquidity pools and supports around 909 trading pairs on the mainnet, covering major WETH-stablecoin pools as well as a multitude of ERC20 token pairs.

Uniswap v3 regularly captures the largest market share of DEX volume on Ethereum and has historically been recognized as the leading DEX brand, although its market share is now distributed across several deployments (Ethereum, Arbitrum, Polygon, among others).

Why CEXs Lead

In contrast to CEXs, liquidity on DEXs is dispersed across numerous chains. Even the largest DEX, Uniswap across all networks, typically processes under $1 billion per day on-chain, which is significantly lower than the volume seen on top CEXs. Total DEX spot volume averages around 10–15% of the overall CEX volume. For instance, early in 2024, DEXs collectively accounted for about 20% of centralized exchange volume, marking an all-time high for that ratio.

This represents a considerable increase from 2022, when DEXs comprised only around 3% to 5% of the market by volume. Nevertheless, no individual DEX comes close to matching Binance’s trading volume. Uniswap (across all versions) often achieves daily volumes between $1 billion and $1.5 billion, which can compete with or surpass mid-tier CEXs like Kraken or KuCoin, yet remains a small fraction of Binance’s activity.

There are occasional instances where DEXes and CEXs converge on volume during specific timeframes—such as during the DeFi Summer of 2020 when Uniswap’s daily volume first outpaced Coinbase’s. In March 2025, PancakeSwap’s multi-chain volumes briefly exceeded those of Uniswap, reaching around $1.4 billion in a 24-hour period compared to Uniswap’s $674 million, and $14.9 billion to $8.3 billion in weekly volume. While these occurrences are noteworthy, they are not the standard; generally, top CEXs manage 5 to 10 times the volume of the leading DEXs.

A significant advantage of DEXs is their open listing policy—allowing anyone to provide liquidity for any token pair, theoretically permitting an unlimited number of markets. Practically speaking, Uniswap (v3) on Ethereum has about 900 active pairs, but when considering all long-tail ERC20 pairs created, Uniswap v2 and v3 support thousands of markets.

Platforms like 1inch or Matcha can route trades across tens of thousands of token pairs without requiring permission. This leads to an extensive variety of assets traded on DEXs, often surpassing that of any single CEX. However, market share on DEXs tends to be concentrated among a few top pairs, commonly involving stablecoin pairs and WETH/USDC, similar to the CEX market dynamics.

CEXs have the advantage of having established substantial user bases. Reportedly, Binance has over 100 million users, while Coinbase boasts more than 70 million registered accounts. These platforms provide easy access via web or mobile applications, facilitate fiat currency onboarding, and feature familiar interfaces (like order books and charts), thereby lowering entry barriers for retail traders.

Meanwhile, DEXs typically require a web3 wallet and some blockchain knowledge, historically limiting their use to more crypto-savvy individuals. This is changing as wallet technologies and user interfaces improve, but user-friendliness still tends to favor CEXs. Additionally, many institutional and algorithmic traders operate on CEXs through APIs, taking advantage of established infrastructures and customer support—while utilizing a DEX necessitates new tools (such as web3 wallets and on-chain execution).

This difference in user demographics translates into volume: Binance’s extensive user base generates large liquidity and continuous trading transactions. Even with competitive technology on DEXs, they must consistently attract more users to approach CEX volume levels.

Liquidity fosters volume. Binance enjoys highly liquid order books—characterized by tight bid/ask spreads and substantial volumes at each price level—allowing traders to execute sizable trades with minimal slippage. In contrast, early DEXs had limited liquidity pools that would shift significantly even with moderate trades, deterring larger traders from using them.

However, for many leading tokens, slippage during DEX trades is similar to that on CEXs, especially with stablecoin pairs. Still, professional traders prefer CEXs or over-the-counter (OTC) desks for executing very large orders. CEXs also unify global liquidity—a market order on Coinbase or Kraken draws from all liquidity providers on that order book, whereas a DEX trade typically accesses just one pool or aggregator route at a time. CEXs remain the preferred choice for high-frequency and larger-volume trading, which contributes to their superior overall volume.

The volume dynamics of CEXs and DEXs reflect their ability to integrate within the wider ecosystem. CEXs gain advantages through partnerships with fintech companies and institutional players—for instance, Coinbase’s volume is enhanced by its connections with institutional trading desks and custody services, while Binance draws volume not only from retail users but also from brokers, API traders, and its broader ecosystem (including Trust Wallet and Binance Pay, which ultimately direct users towards trading).

Conversely, DEXs benefit from DeFi composability, where a significant amount of DEX volume is generated by other smart contracts and protocols leveraging them beneath the surface. For example, a DeFi lending platform might liquidate collateral via Uniswap, or a yield optimizer could rebalance via Curve. These programmatic trades boost DEX volume without any direct involvement from “human traders.”

Moreover, wallets like MetaMask and Coinbase Wallet offer swap functionalities that route through DEX aggregators, bringing in retail users who may not even realize they are engaging with a DEX.

In conclusion, while CEXs typically outperform in raw volume due to established trust, vast user bases, and advanced trading capabilities, DEXs excel in asset diversity, innovation, and open access. The gap in trading volume is narrowing as DEX technologies evolve—thanks to Layer-2 scalability, enhanced liquidity, and more user-friendly interfaces, DEXs continue to encroach on CEX dominance.

We have witnessed structural changes, similar to those seen in 2020 and 2022, that have allowed DEXs to secure lasting positions in areas once dominated by CEXs. While it may be improbable for DEXs to completely supplant CEXs in the near future, the competitive pressure has indeed prompted CEXs to innovate.