The price of Ether (ETH) regained the $2,000 support level on March 24, yet it remains 18% lower than the $2,500 mark seen three weeks earlier. Recent data indicates that Ether has lagged behind the altcoin market by 14% over the last month, prompting traders to speculate about the potential for a bullish comeback and the factors that could lead to a price reversal.

Ether/USD (left) compared to total altcoin capitalization, USD (right).

Ether appears to be in a favorable position to draw in institutional interest and significantly lessen the fear, uncertainty, and doubt (FUD) that have hindered its growth potential. Critics have long maintained that the Ethereum ecosystem is outpaced by its competitors in overall user experience and continues to face limitations in base-layer scalability, negatively affecting network fees and transaction efficiency.

Could the Ethereum Pectra upgrade influence ETH prices?

Many issues facing the Ethereum network are set to be tackled in the upcoming Pectra network upgrade, which is anticipated to take place between late April and early June. Among the proposed changes is an increase in the data capacity for each block, which should help to reduce fees related to rollups and privacy-enhancing methods. Additionally, the expense associated with call data will rise, motivating developers to utilize blobs—a more efficient data storage approach.

Another significant enhancement introduced with this upgrade will be smart accounts, allowing wallets to act like smart contracts during transactions. This feature will enable gas fee sponsorship, passkey authentication, and the ability to batch transactions. Furthermore, various improvements will focus on streamlining staking deposits and withdrawals, offering enhanced flexibility, and extending the block history for smart contracts that rely on historical data.

Arthur Hayes, co-founder of BitMEX, predicted a price target of $5,000 for ETH on March 25, asserting that it should significantly outperform rival Solana (SOL).

Source: CryptoHayes

Despite the reasoning behind Hayes’s price forecast, ETH options traders seem less optimistic. The September 26 call option with a $5,000 strike price costs merely $35.40, indicating extremely low probability of success. However, Ethereum still dominates the smart contract space and remains the only altcoin with a spot exchange-traded fund (ETF) in the United States, boasting $8.9 billion in assets under management.

Growth in Ethereum TVL and dwindling ETH supply on exchanges

Ethereum’s network currently shows a total value locked (TVL) of $52.5 billion, greatly outpacing Solana’s $7 billion. More notably, deposits on the Ethereum platform have risen by 10% in the past month, reaching 25.4 million ETH, whereas Solana experienced an 8% decrease in the same timeframe. Key highlights on Ethereum include Sky (previously Maker), which saw a 17% deposit increase, and Ethena, whose TVL soared by 38% over 30 days.

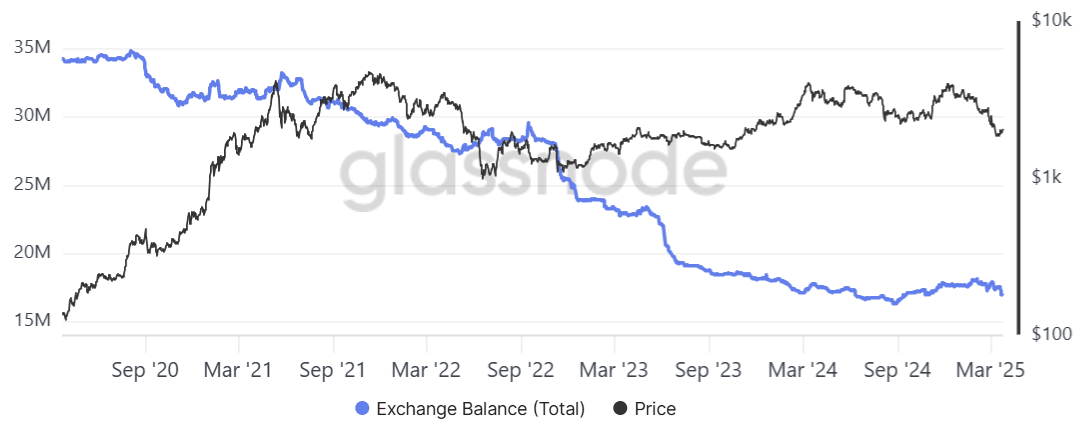

Ether balance on exchanges, ETH.

As of March 25, the Ether supply on exchanges was 16.9 million ETH, only 3.5% above a five-year low of 16.32 million ETH, according to industry data. This trend suggests that investors are withdrawing funds from exchanges, indicating a long-term capital commitment. Additionally, inflows into spot Ether ETFs remained relatively subdued during March 24 and March 25, in contrast to the $316 million in net outflows recorded since March 10.

Related: Ethereum developers finalize Pectra testing ahead of the mainnet launch

Lastly, the Ethereum network is gaining traction in the Real World Asset (RWA) sector, especially after the BlackRock BUILD fund exceeded $1.5 billion in capitalization. The Ethereum ecosystem, alongside its layer-2 scalability solutions, constitutes over 80% of this market according to RWA.XYZ data, highlighting Ethereum’s leading role in the decentralized finance (DeFi) arena.

The drop in Ether’s price below $1,900 on March 10 may have stemmed from overly pessimistic expectations. However, the situation seems to be shifting as the Ethereum network displays resilience and traders continue to withdraw from exchanges, potentially paving the way for a rebound towards $2,500.

This article is intended for general informational purposes and should not be construed as legal or investment advice. The opinions expressed here are solely those of the author and do not necessarily reflect the views of any specific entity.