A notable investment firm is reportedly nearing the completion of tests for a stablecoin pegged to the US dollar, a move that highlights its renewed focus on digital assets amidst a more favorable regulatory environment for cryptocurrency following the Trump administration’s policies.

The asset management giant, with $5.8 trillion under its management, is gearing up to roll out the stablecoin through its digital currency division, further aligning with its commitment to expanding into crypto services. Recent reports indicate this initiative follows their plan to introduce an Ethereum-based “OnChain” share class tied to its US dollar money market fund.

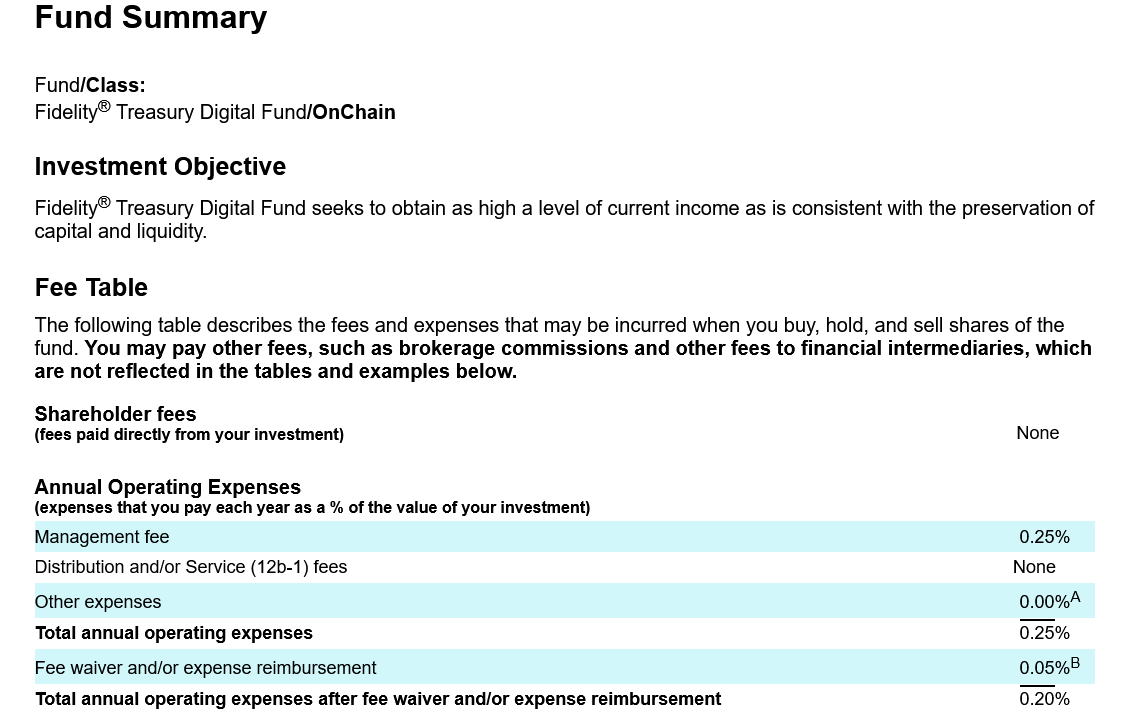

The firm’s documentation filed with US regulatory authorities mentions that the OnChain share class will facilitate tracking transactions related to the Fidelity Treasury Digital Fund, which is primarily composed of US Treasury bills valued at $80 million.

While the filing for the OnChain share class awaits regulatory clearance, the company anticipates it will become active by May 30.

The company’s submission to register a tokenized version of the Fidelity Treasury Digital Fund.

An increasing number of financial institutions in the US are venturing into cryptocurrency products following a regulatory shift indicated by President Trump’s election.

Source related to the recent developments in the stablecoin market.

The Trump administration has explicitly stated its intention to prioritize cryptocurrency policy and position the US as a leading center for blockchain innovation.

The stablecoin initiative as a “regulatory litmus test”

The firm’s endeavor to launch a stablecoin coincides with the Cboe BZX Exchange’s request to list a proposed exchange-traded fund (ETF) that includes Solana, as indicated in recent filings. This newfound interest may shed light on regulatory perspectives concerning Solana ETFs, according to insights from a venture capital firm specializing in crypto.

Experts believe this filing serves as more than just a product idea; it represents a significant regulatory examination. If it receives approval, it could demonstrate the SEC’s evolving recognition of the unique functionalities offered by different blockchains.

“This would stimulate the innovation of compliant financial instruments associated with next-generation assets,” the expert added, emphasizing the potential for enhanced market offerings.

In the meantime, stakeholders in the cryptocurrency space are keeping a close watch on impending US legislation regarding stablecoins, which may surface within the next couple of months.

The proposed GENIUS Act aims to set clear collateralization standards for stablecoin issuers and enforce compliance with Anti-Money Laundering regulations. Signs indicating that this stablecoin legislation could reach the president for review soon have emerged, as shared by a senior council member on digital assets.

Magazine Insight:Recent SEC shifts on cryptocurrency regulatory frameworks bring forth several unresolved questions.