Traditional and cryptocurrency investors are keenly anticipating the upcoming Personal Consumption Expenditures (PCE) report on Friday, as it could ease inflation worries and enhance investor interest in risk assets like Bitcoin.

The US Bureau of Economic Analysis (BEA) will unveil the PCE data on March 28, providing insights into the inflation of prices that consumers are experiencing for various goods and services.

Analysts believe that the PCE inflation figure could serve as a significant catalyst for Bitcoin (BTC) and other risk assets. A digital asset firm based in Singapore noted this in a recent update.

In their remarks, they stated:

“As we approach Friday’s quarterly expiry, with the highest open interest in calls above $100K, we don’t anticipate major volatility driven solely by options positioning. However, all eyes will be on the PCE inflation figure, which has the potential to be the next key driver.”

Risk assets have seen a notable rebound following indications from Trump that trading partners may gain exemptions or reductions, providing some relief that has calmed market fears.

Related: Michael Saylor’s Strategy surpasses 500,000 Bitcoin with latest purchase

Other market experts have identified global trade war anxieties as a major barrier to investor enthusiasm.

Despite several encouraging developments specific to cryptocurrency, concerns surrounding global tariffs are expected to weigh on the markets at least until April 2, according to a Nansen research analyst.

“I’m eager to see how tariffs evolve after April 2nd; there’s a chance some might be reduced, but it depends on whether all nations can reach an agreement,” the analyst remarked.

BTC/USD, 1-day chart. Source: TradingView

Since the announcement of import tariffs on Chinese goods by President Trump on January 20, Bitcoin’s price has declined over 14%.

Nonetheless, analysts anticipate that the PCE report could alleviate inflation concerns, potentially sparking a significant rally for Bitcoin in April.

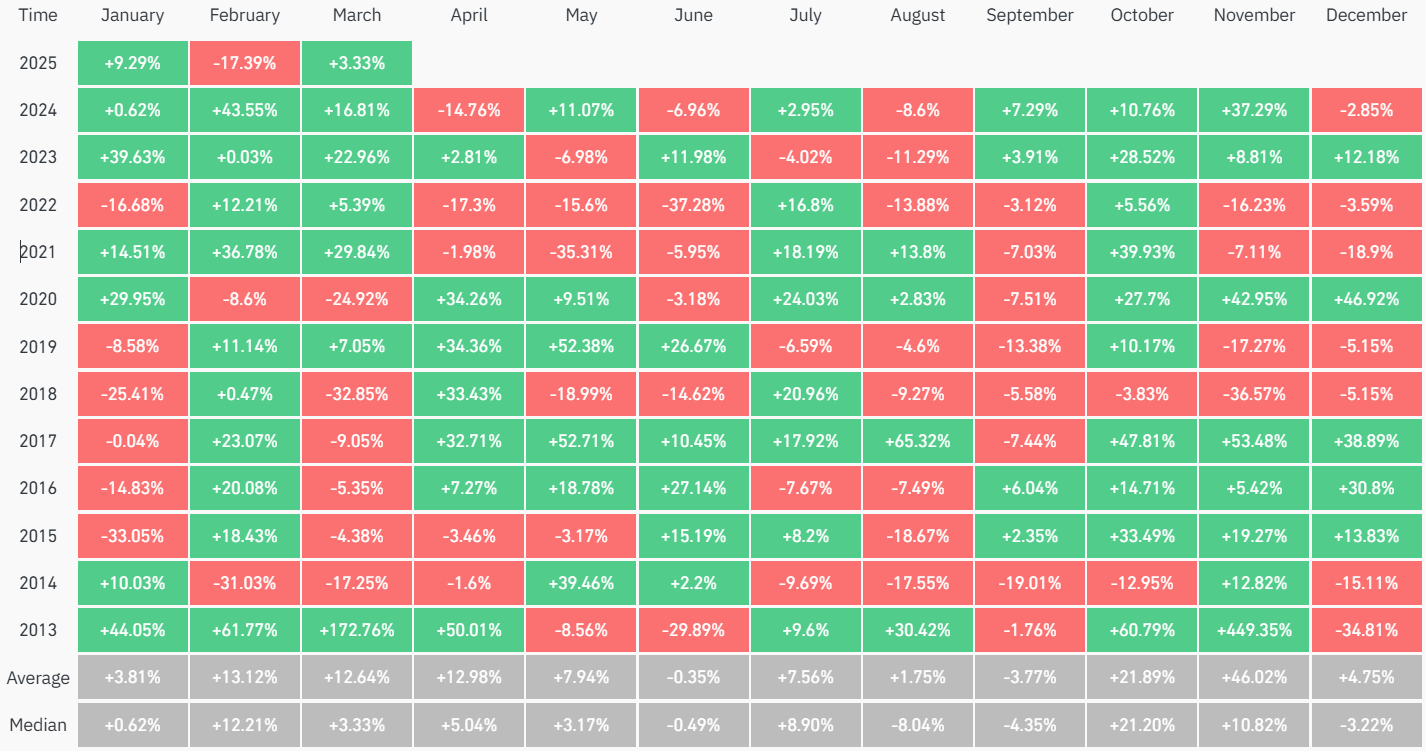

Source: CoinGlass

Historically, Bitcoin has averaged more than 12.9% monthly returns in April, making it the fourth-best performing month for Bitcoin prices, according to CoinGlass data.

Related: Crypto debanking is not over until Jan 2026: Insights from Caitlin Long

Bitcoin could surge to $110,000 as inflation concerns soften

Arthur Hayes, the co-founder of BitMEX and chief investment officer of Maelstrom, suggested that Bitcoin is more likely to reach a new record of $110,000 before potentially retracing to $76,500.

Juan Pellicer, a senior research analyst at IntoTheBlock, indicated that this surge to the $110,000 mark seems feasible in the current market climate.

“BTC shows signs of recovery, buoyed by increased institutional interest and substantial investments from major players,” the analyst stated, adding:

“The recent decision by the Federal Reserve to ease its monetary tightening could further enhance liquidity, supporting price growth in the near term.”

“While market volatility presents a risk that might trigger a pullback, current momentum and support indicators suggest Bitcoin is more likely to approach the higher target first,” Pellicer concluded.

Magazine: ETH may bottom at $1.6K, SEC delays multiple crypto ETFs, and more: Recent Digest, March 9 – 15