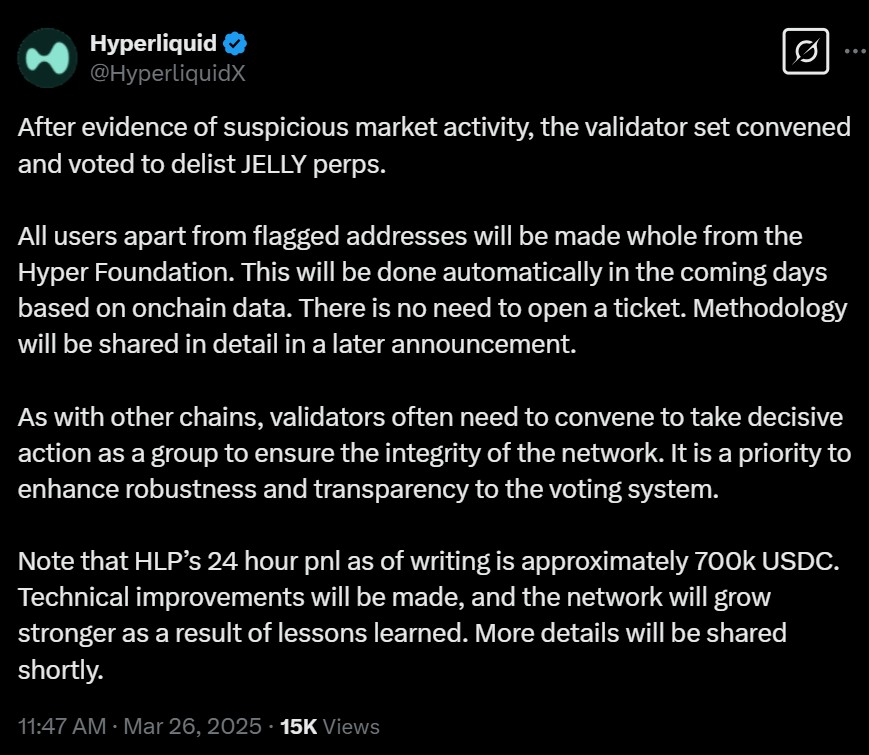

A recent announcement has confirmed the delisting of perpetual futures linked to the JELLY token due to the detection of “evidence of suspicious market activity” associated with these trading instruments, according to the blockchain network.

The nonprofit organization supporting the Hyperliquid ecosystem will compensate most users for any losses incurred from this situation, as stated in a recent update on March 26.

“All users, except for those flagged, will receive full restitution from the Hyper Foundation,” the statement noted. “This process will occur automatically over the next few days using on-chain data.”

Hyperliquid also mentioned that their primary liquidity pool, HLP, has reported a positive net income of approximately $700,000 within the last 24 hours.

Earlier, on March 14, the platform raised margin requirements for traders after experiencing significant losses in its liquidity pool during a major liquidation event involving Ether.

Image source:

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions

This story is continually evolving, and updates will be provided as more details are available.