The compliance protocol based on zero-knowledge proofs has introduced its Know Your Customer (KYC) and Anti-Money Laundering (AML) integration for the Uniswap decentralized exchange (DEX).

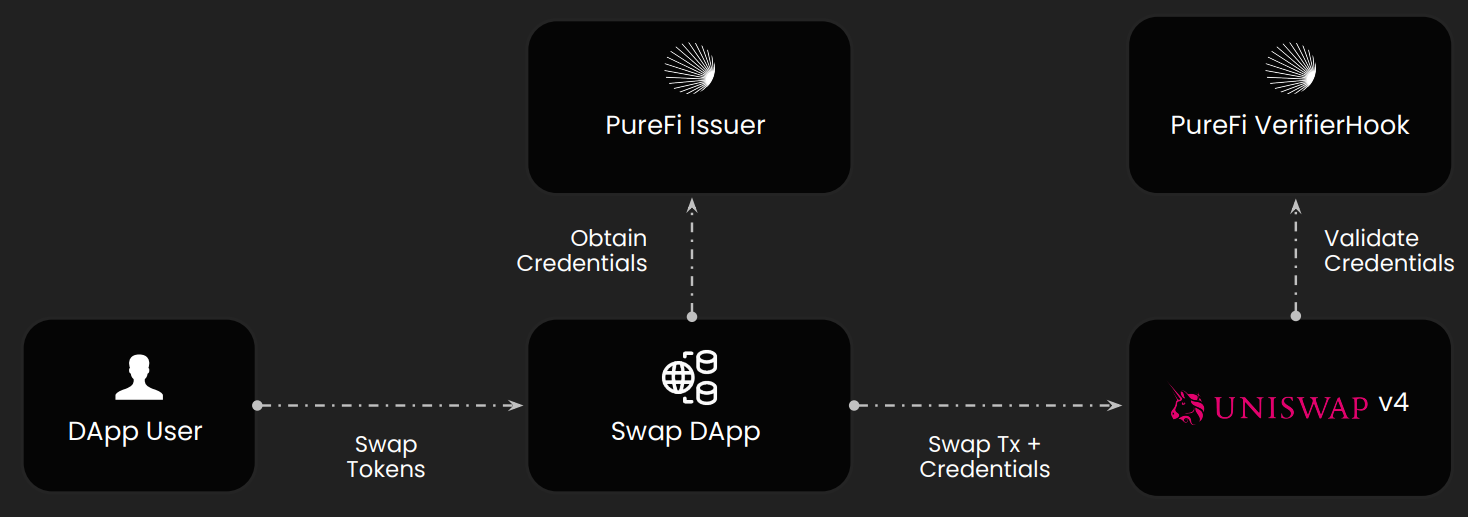

In a recent announcement, it was stated that this ZK-proof-based KYC and AML integration for Uniswap aims to tackle security and compliance challenges at the protocol level. This integration can be utilized within any Uniswap v4 pool and has been specifically deployed as part of the PureFi DEX Uniswap project, substituting standard interfaces with tailored compliance routers.

The innovative decentralized finance (DeFi) platform also presents a tiered verification process that adjusts checks according to transaction volume. This process ranges from basic identity and sanctions verification for lower volumes to comprehensive KYC protocols with risk-based wallet assessments and real-time supervision for higher volumes.

Not everyone agrees

The chief compliance officer at a DEX aggregator developer expressed concerns over the reliance on transaction volume thresholds for compliance enforcement, suggesting it doesn’t adequately address the complexity of risks inherent to DeFi and financial systems. She noted:

“Risk assessment should encompass a variety of factors, rather than relying solely on transaction volume as an indicator.”

The CEO of PureFi emphasized that compliance is typically applied at the front-end (user interface) rather than in the backend smart contracts. This method can leave protocols exposed to exploitation by malicious actors directly interfacing with smart contracts. He elaborated on the benefits of their latest implementation:

“By utilizing the Uniswap v4 hook, we tackle a long-standing blind spot in the industry. DeFi needs to find a balance that upholds privacy while still meeting regulatory demands.”

PureFi Uniswap v4 Hook Infographic.

Currently, the exchange operates fully for the UFI/BNB trading pair; this implementation serves as a foundational model for future developments. Its modular design allows for off-chain updates to compliance regulations, centralizing aspects that need alterations as legal frameworks change, thus facilitating smoother adaptation.

The ongoing compliance struggle in DeFi

The compliance officer underscored the necessity of a more customized approach in DeFi, explaining that solutions tailored for centralized finance do not translate effectively to decentralized systems due to differing priorities. She remarked:

“Methods that work in centralized finance often clash with the decentralized ethos, which values privacy and personal freedom.”

This distinction, she pointed out, is critical to understanding the compliance challenges in the crypto and DeFi sectors. She highlighted that while privacy coins and mixers are under scrutiny by regulators, the implementation of zero-knowledge proofs might provide a solution:

“If zero-knowledge proofs can facilitate compliance-friendly privacy, regulators may be more willing to permit privacy-respecting financial tools.”

Furthermore, she noted that gaining regulatory acceptance remains a major hurdle for DeFi, as regulators often equate “financial transparency with the ability to see every transaction and identity.” She questioned whether regulators might embrace proofs over raw data as a way forward.

Zero-knowledge proofs are complex cryptographic techniques that allow for the demonstration of certain aspects of data without disclosing the actual data itself. For example, they can verify that a user is not on a sanctions list and is eligible for a financial service—without revealing full documentation or personal information, thereby maintaining anonymity.

A correctly implemented ZK-proof guarantees that no unnecessary information is disclosed, ensuring the validity of the claim without additional leakage. Moreover, these proofs are often more data-efficient, making them ideal for on-chain storage, as seen with ZK-rollups.