The largest decentralized prediction market is facing criticism after a contentious outcome has sparked worries about possible governance manipulation in a significant political wager.

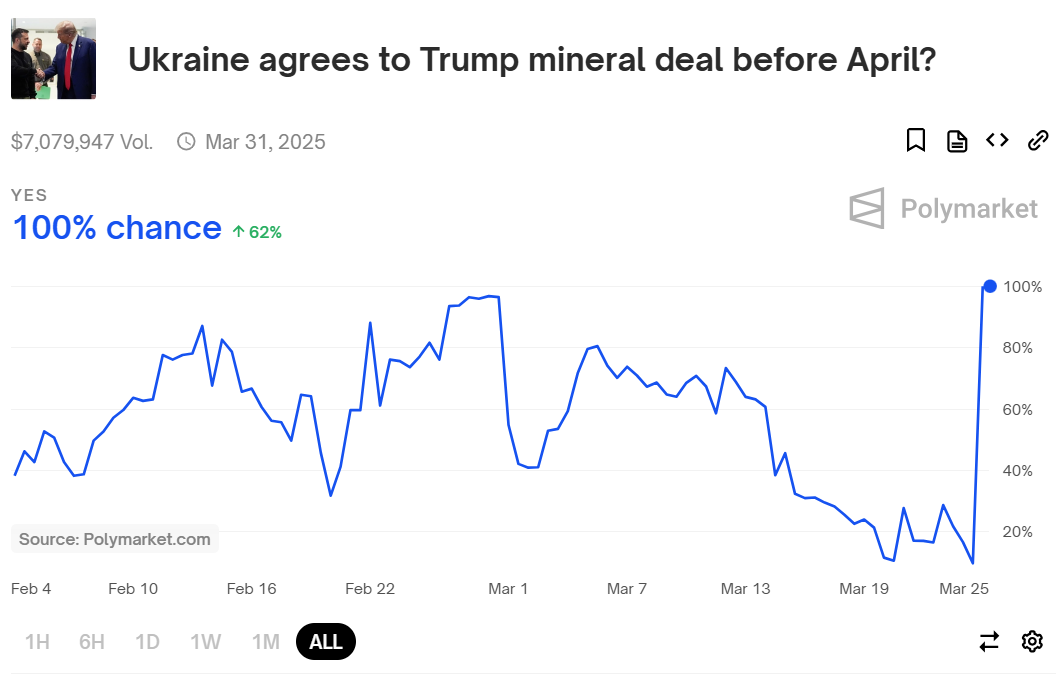

An inquiry on the platform addressed whether US President Donald Trump would take on a rare earth mineral agreement with Ukraine prior to April. Although no such deal occurred, the market was closed with a “Yes” resolution, generating backlash from users and industry analysts.

This situation might indicate a “governance attack” whereby an influential player from the UMA Protocol allegedly exploited his voting authority to influence the oracle, leading to the settlement of inaccurate results and the ability to profit from it, according to cryptocurrency threat analyst Vladimir S.

Vladimir claims that the individual cast 5 million tokens through three accounts, representing 25% of all votes. He mentioned in a post on March 26 that the platform is dedicated to ensuring such incidents do not happen again.

Image Credit: Vladimir S.

The platform utilizes blockchain oracles from UMA Protocol to gather external data to determine market outcomes and validate real-world events.

Market statistics indicate that it accumulated over $7 million in trading volume before settling on March 25.

Image Credit: Polymarket

However, not everyone believes that this was a coordinated effort. An anonymous user on the platform, Tenadome, maintained that the decision was due to carelessness.

“There is no ‘tycoon’ who ‘manipulated the oracle,’” Tenadome stated in a post on March 26, elaborating:

“The individuals who decided this outcome include the same UMA participants involved in each dispute who (1) are primarily associated with the UMA team and (2) do not participate in trading on the platform; they simply opted to overlook the clarification to obtain their rewards and to evade penalties.”

Related: Increased Trump Odds Raise Concerns of Market Manipulation

No Refunds from the Platform

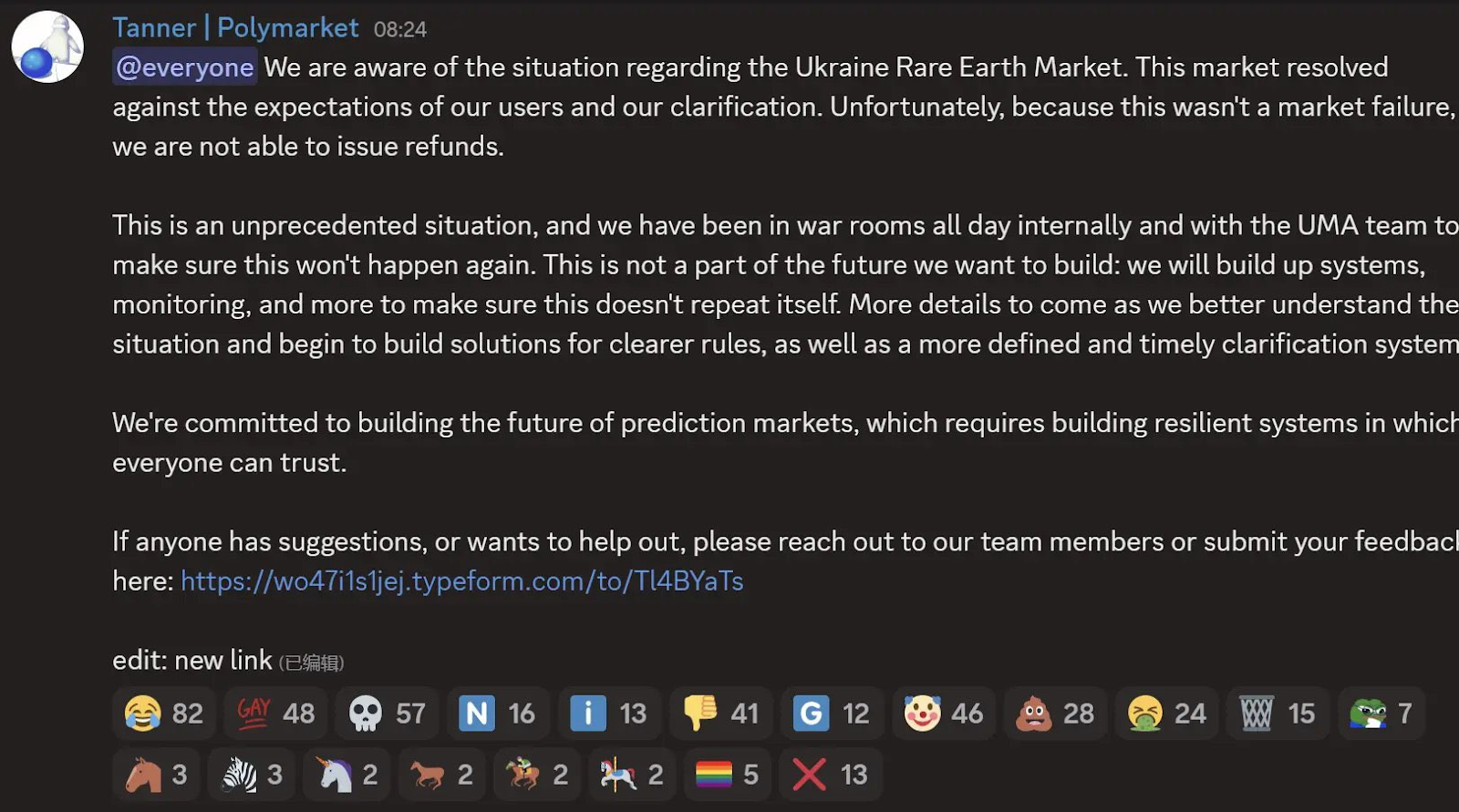

In light of user dissatisfaction, the platform’s moderators have announced that no refunds will be provided.

“We are aware of the issues concerning the Ukraine Rare Earth Market. This market resolved contrary to user expectations and our clarifications,” moderator Tanner stated, adding:

“Regrettably, since this was not a market malfunction, we can’t issue any refunds.”

Image Credit: Vladimir S.

The platform has announced plans to enhance its monitoring systems to prevent such “unprecedented situations” from recurring.

Related: eToro Trading Platform Seeks U.S. IPO

Surge in Prediction Markets Linked to U.S. Elections

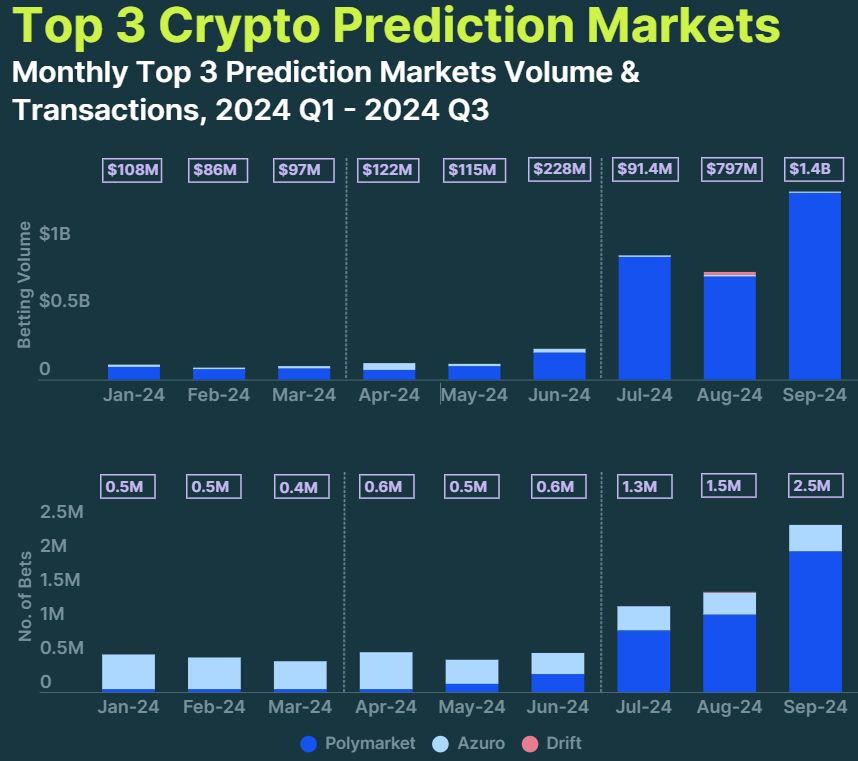

Prediction markets experienced substantial growth during the third quarter of 2024, largely due to wagering on the upcoming U.S. presidential election.

Top three crypto prediction markets. Image Credit: CoinGecko

Wagering volume across prediction markets skyrocketed by over 565% in Q3, reaching $3.1 billion across the three largest platforms, rising from just $463.3 million in the previous quarter.

The most well-known decentralized platform accounted for over 99% of the market share as of September.

Magazine Feature: Memecoins May Be Dying — But Solana is ‘100x Better’ Despite Revenue Drop