Several areas within decentralized finance are set for expansion in 2025, including specialized decentralized exchanges (DEXs), stablecoins, and tokenized assets, as outlined by the founder of Curve Finance.

The growth of decentralized exchanges will be fueled by new platforms designed for specific purposes, such as exchanges dedicated to stablecoins linked to various fiat currencies, which aim to address the foreign exchange challenges faced by stable tokens. The Curve founder mentioned in a recent interview:

"There hasn’t been a proper solution for exchanging stablecoins of different denominations, like the Euro and US dollar. The question of how to provide liquidity without incurring losses, while maximizing profits, is a challenge that I believe will soon be resolved."

Additionally, the range of centralized and decentralized stablecoin options is anticipated to increase as both financial institutions and blockchain developers introduce new variants.

That said, the regulatory framework must evolve alongside the rapid advancements in the DeFi sector, as current regulations still reflect outdated laws created for the traditional financial system of the 20th century.

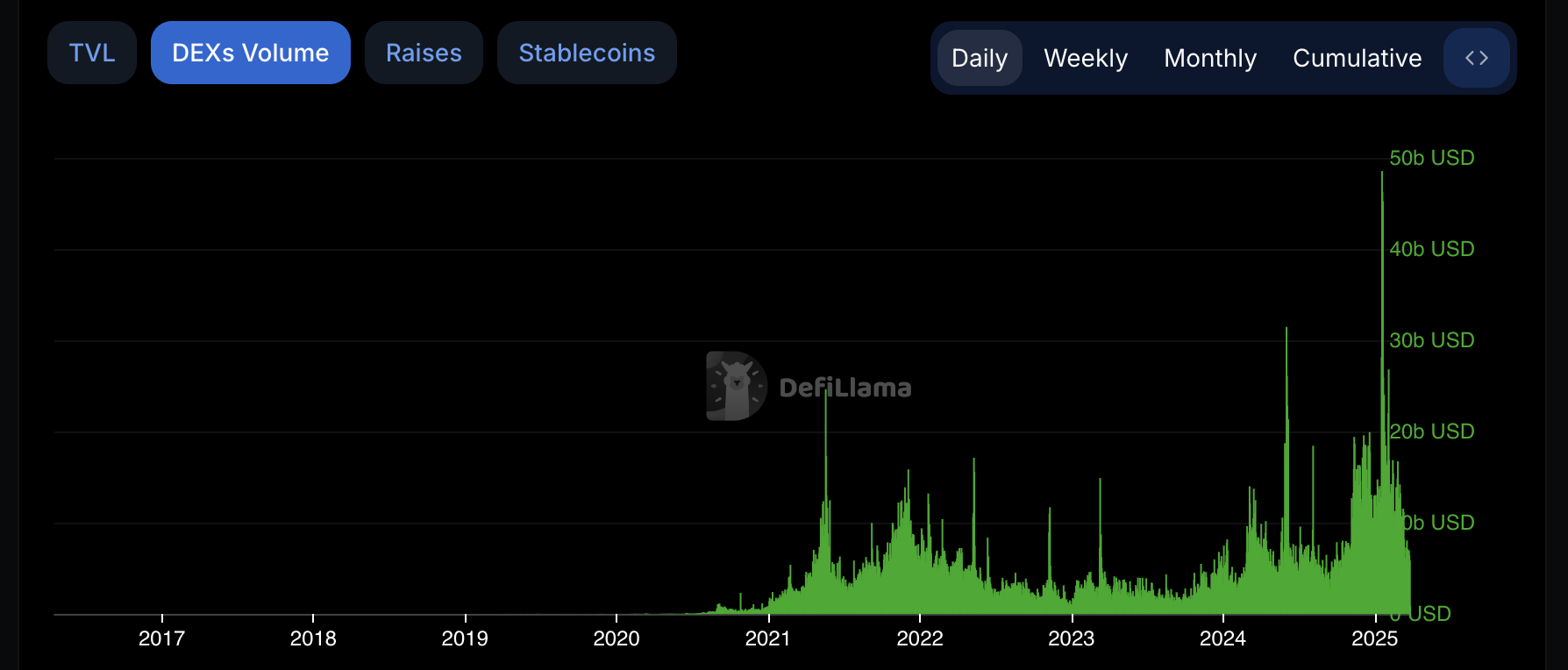

DEX volume soared to new levels in the initial months of 2025. Source: DeFiLlama

Related: DeFi lender Nostra pauses borrowing after price feed error

U.S. Lawmakers Vote to Repeal DeFi Broker Regulation

U.S. legislators recently voted to revoke the Internal Revenue Service’s (IRS) regulation that requires decentralized finance platforms and protocols to disclose financial information to the agency.

On March 4, the U.S. Senate successfully passed a motion to repeal the IRS broker rule with a vote of 70 to 27, which was followed by the House of Representatives’ decision to eliminate the rule on March 11.

The resolution must clear another Senate vote before reaching the President, who has indicated his support for it.

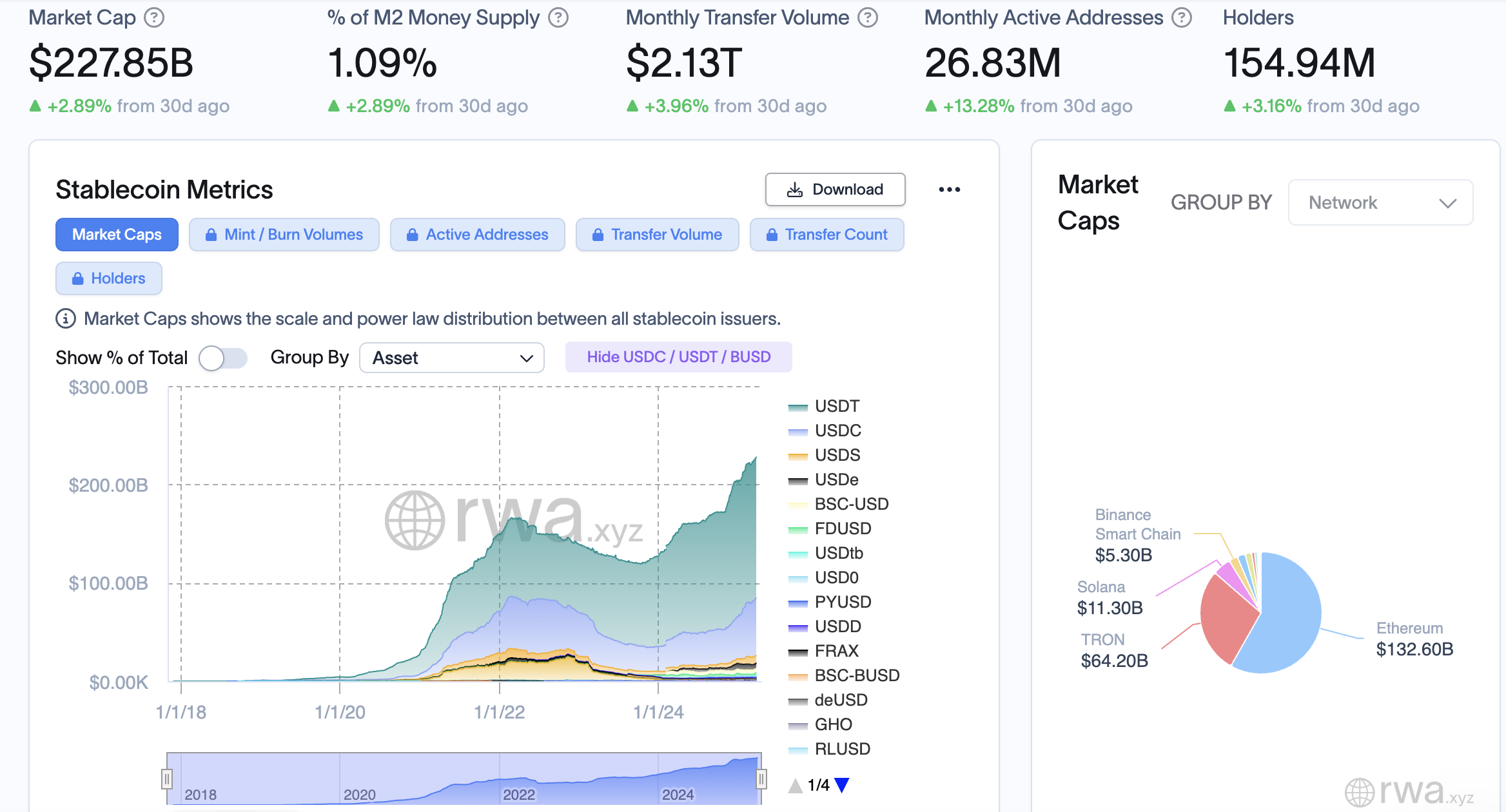

A recent report titled The State of Stablecoins 2025: Supply, Adoption & Market Trends from Dune Analytics and the onchain analysis firm Artemis underscores a remarkable 53% year-over-year surge in stablecoin adoption.

Stablecoins have surpassed a market cap of $227 billion. Source: RWA.XYZ

The report monitored active stablecoin addresses from February 2024 to February 2025 and found that the number of active accounts rose from 19.6 million to 30 million.

Additionally, a report from Coinbase and EY-Parthenon released on March 18 revealed that 83% of surveyed institutional investors plan to increase their cryptocurrency allocations in 2025.

Magazine: DeFi and Ethereum are the ‘new narrative’: Michaël van de Poppe, X Hall of Flame