Even with substantial institutional interest, Bitcoin (BTC) has faced difficulties in bouncing back to the $100,000 mark for the last 50 days, prompting investors to ponder the reasons for the persistent downturn despite an apparently favorable environment.

This price stagnation is particularly noteworthy in light of the US Executive Order on the Strategic Bitcoin Reserve issued by former President Donald Trump on March 6, which permits BTC purchases as long as they align with “budget-neutral” strategies.

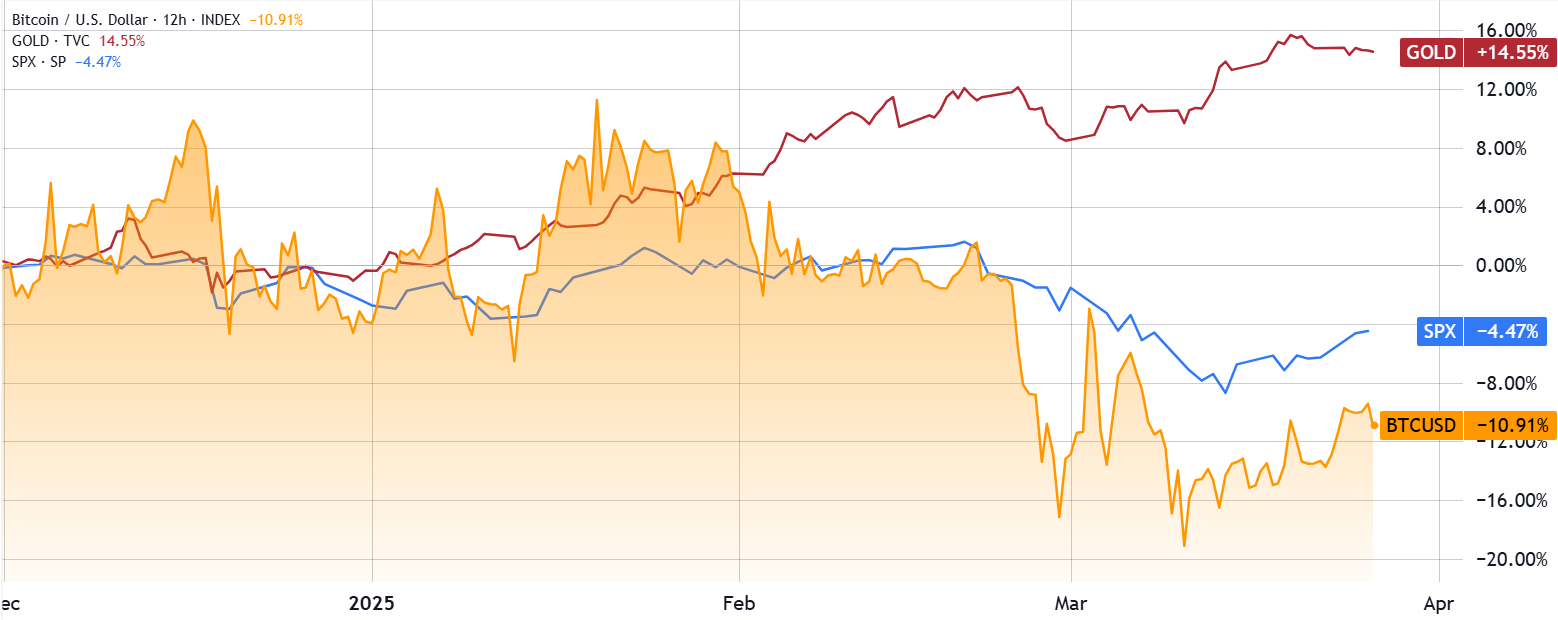

Bitcoin lags behind gold’s performance despite favorable developments

On March 26, GameStop Corporation (GME), the North American retailer specializing in video games and electronic devices, revealed its intention to allocate part of its corporate reserves to Bitcoin. The firm, which almost faced bankruptcy in 2021, successfully navigated a historic short squeeze, amassing an impressive $4.77 billion in cash and equivalents by February 2025.

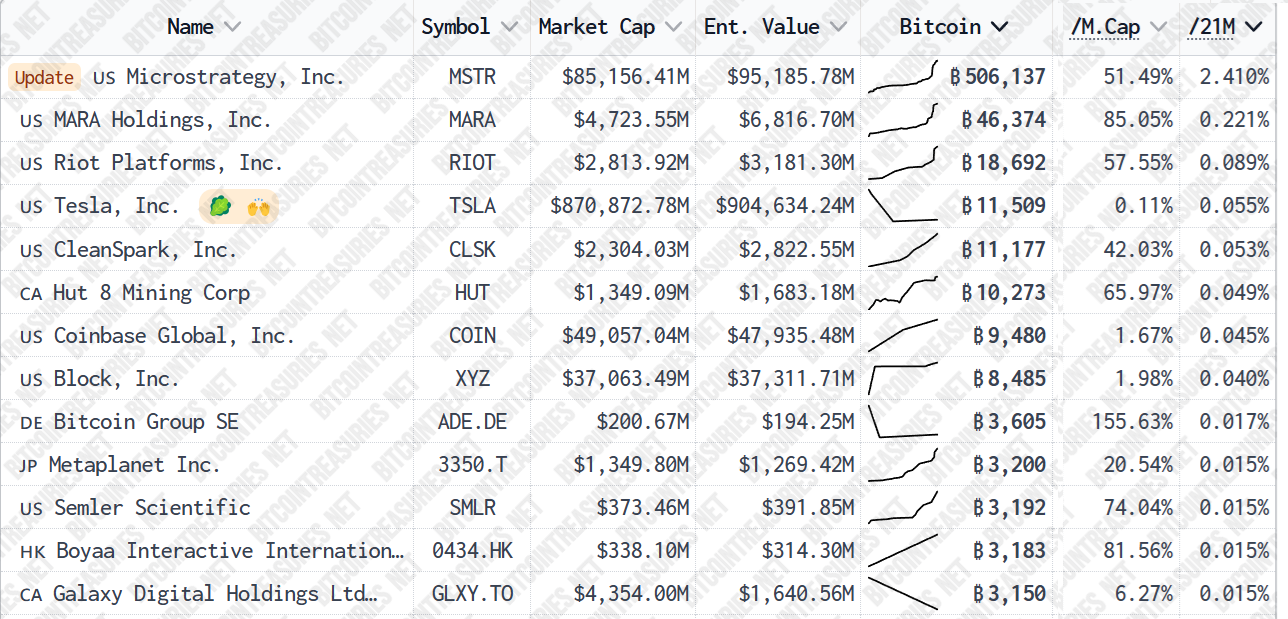

Largest corporate Bitcoin holdings. Source: BitcoinTreasuries.NET

Many US and international firms have been inspired by Michael Saylor’s Strategy (MSTR), including Metaplanet, a Japanese company that recently brought Eric Trump onto its newly formed strategic advisory board. Likewise, the mining conglomerate MARA Holdings (MARA) has implemented a Bitcoin treasury policy to “retain all BTC” and expand its exposure through debt offerings.

Clearly, there must be compelling reasons prompting Bitcoin investors to divest their holdings, especially considering that gold is trading only 1.3% below its peak of $3,057. For instance, while the US government adopted a pro-crypto position following Trump’s election, the essential infrastructure necessary for Bitcoin to function as collateral and merge with traditional financial systems remains largely underdeveloped.

Bitcoin/USD (orange) vs. gold / S&P 500 index. Source: TradingView / Cointelegraph

The US spot Bitcoin exchange-traded fund (ETF) is confined to cash settlements, barring in-kind deposits and withdrawals. Nonetheless, a prospective rule revision currently being evaluated by the US Securities and Exchange Commission may reduce capital gains distributions, improving tax efficiency, according to insights from Chris J. Terry, chief architect at Bitseeker Consulting.

Regulatory issues and Bitcoin’s integration into traditional finance remain a challenge

Financial institutions like JPMorgan mainly act as intermediaries or custodians for cryptocurrency-related products such as derivatives and spot Bitcoin ETFs. The recent repeal of the SAB 121 accounting regulation on January 23, an SEC ruling that imposed stringent capital requirements on digital assets, does not necessarily ensure broader acceptance.

For example, certain traditional investment firms, including Vanguard, still prohibit their clients from trading or holding shares of spot Bitcoin ETFs, while administrators like BNY Mellon have restricted mutual funds’ exposure to these products. In reality, a significant number of wealth managers and advisors are unable to provide any cryptocurrency investments to their clients, even when these are listed on US exchanges.

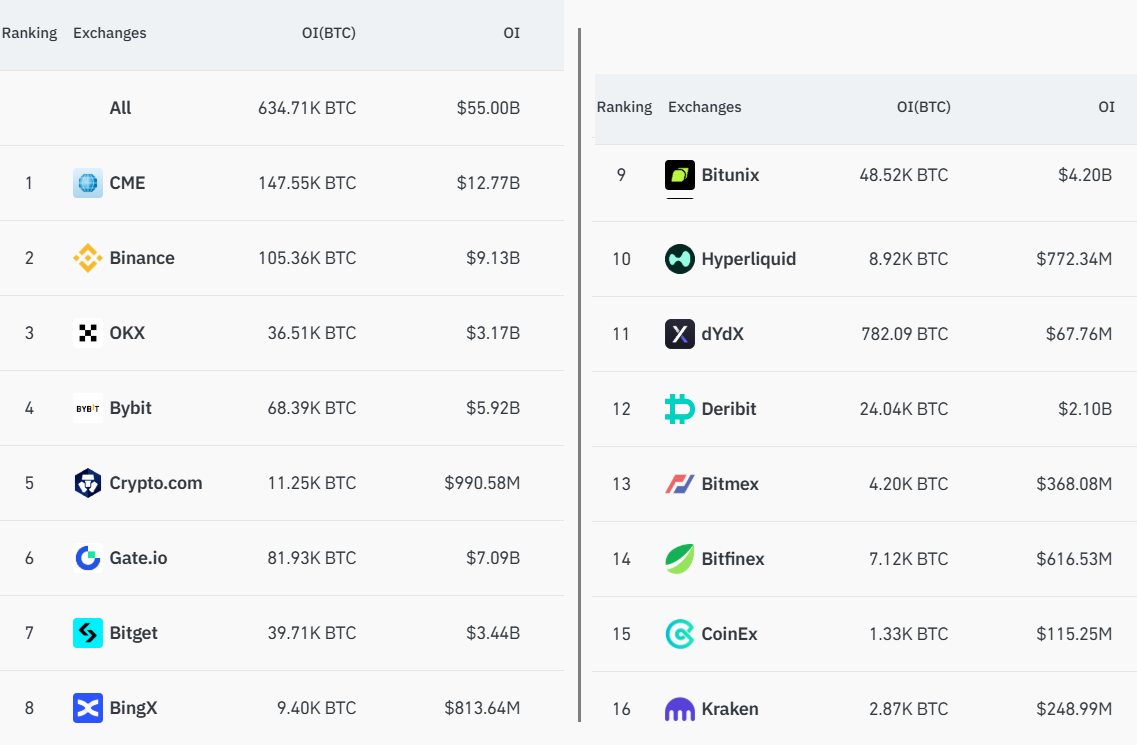

The Bitcoin derivatives market suffers from a lack of regulatory clarity, with many exchanges opting to prohibit North American participants and registering their businesses in tax havens. Although the Chicago Mercantile Exchange (CME) has grown considerably over the years, it still represents only 23% of Bitcoin’s $56.4 billion in futures open interest, as competitors take advantage of fewer capital restrictions, simpler client onboarding, and reduced regulatory scrutiny on trading.

Related: SEC plans to hold 4 more crypto roundtables on trading, custody, tokenization, DeFi

Bitcoin futures open interest ranking, USD. Source: CoinGlass

Institutional investors are wary about gaining exposure to Bitcoin markets due to fears of market manipulation and a lack of transparency among leading exchanges. The significant fines that Binance, KuCoin, OK, and Kraken have incurred from US authorities for potential anti-money laundering violations and unlicensed operations only add to the negative sentiment within the sector.

Ultimately, the limited interest from a handful of companies is insufficient to elevate Bitcoin’s price to $200,000, and further integration with the banking sector remains uncertain, despite more favorable regulatory conditions.

Until then, Bitcoin’s upside potential will likely continue to be restricted as risk perceptions remain heightened, particularly among the institutional investment crowd.

This article is for informational purposes only and should not be construed as legal or investment advice. The opinions expressed here represent the author’s personal views and do not necessarily reflect the views of any associated entities.