Bitcoin (BTC) maintains a price target of $138,000 for 2025 as the market adjusts following US trade tariffs, according to new analysis.

Recent data on prediction markets indicates that BTC/USD could potentially rise around 60% from its current levels this year.

“Cautious” prediction market participants limit BTC price potential to 60%

Predictions for a Bitcoin bull market have faced significant challenges this quarter, largely due to various obstacles affecting cryptocurrency and the broader risk-asset landscape.

An evaluation of potential BTC price trajectories suggests that the bullish cycle may be restricted to approximately 60% before 2026.

The findings were shared by a user on March 27 and indicate that price predictions vary as low as $59,000.

“The value of this analysis is that it not only offers a snapshot of market sentiment, similar to the Fear and Greed Index, but also provides expected price targets for both bearish and bullish outcomes,” the user explained.

“This allows one to compare their price expectations with the broader market perspective.”

BTC price targets. Source: User on X

The methodology employed to analyze various prediction markets revealed a potential BTC price range from $59,040 to $138,617.

“While the $138,000 price target might not sound overly optimistic to seasoned Bitcoin enthusiasts, who are used to hearing extravagant predictions, the market appears to be taking a more conservative stance in light of the uncertainty stemming from the tariffs,” the user added.

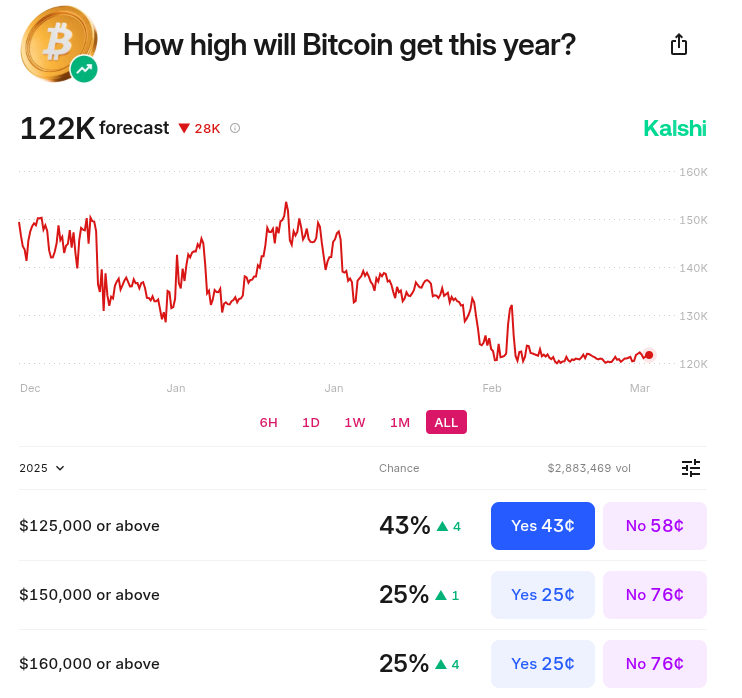

These modest targets for BTC/USD are echoed on other platforms as well. On another prediction site, the average BTC price target is currently around $122,000—only $11,500 higher than the previous all-time highs.

BTC price odds (screenshot). Source: Another platform

Risk of Bitcoin support failure persists

As reported by various sources, market participants have established critical support levels that must be maintained to safeguard the ongoing bull market.

Related: Bitcoin price recently broke a 3-month downtrend as a significant shift begins.

These support levels include the vicinity of previous all-time highs at $73,800 and the peak from 2021 at $69,000.

Earlier this month, a forecasting tool known for its accuracy suggested that there is a 95% chance that $69,000 will hold as support.

In a recent update, a well-known trader emphasized that it is crucial for the yearly average of $76,000 to remain intact.

“It’s extremely important for the price to hold above the year-long average,” he advised his followers on March 26.

BTC/USD chart. Source: Trader on X

This content does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and readers are encouraged to conduct their own research before making any choices.