The introduction of a new European Bitcoin exchange-traded product (ETP) represents a significant development for institutional adoption of Bitcoin in Europe, although experts anticipate that its inflows will be less robust compared to its U.S. equivalent.

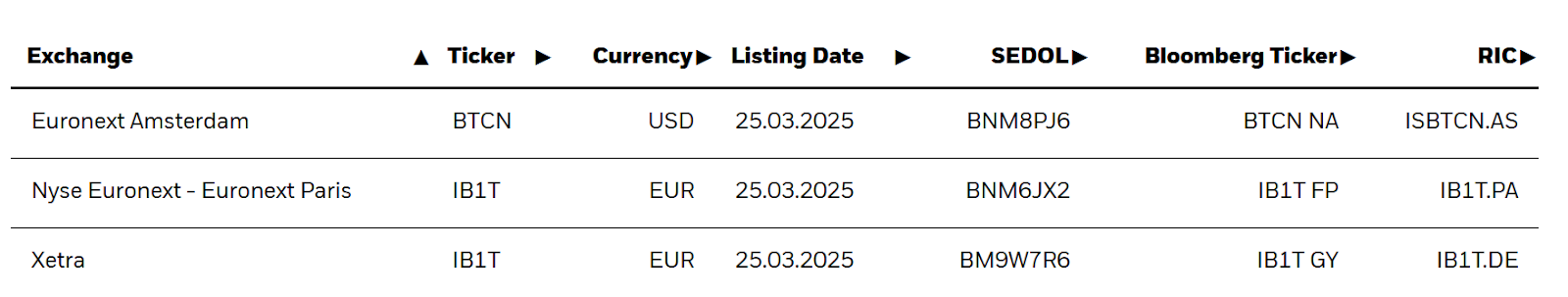

The iShares Bitcoin ETP, operated by the largest asset management firm globally, started trading on March 25 on platforms such as Xetra, Euronext Amsterdam, and Euronext Paris.

While this launch signifies a considerable advancement in providing European investors with access to Bitcoin (BTC), analysts at Bitfinex believe the product is not likely to achieve the same level of success as the U.S.-based iShares Bitcoin Trust exchange-traded fund (ETF), which has experienced significant demand from both institutional and retail investors.

iShares Bitcoin ETP listings.

According to Bitfinex analysts, “The U.S. spot Bitcoin ETFs benefitted from substantial pent-up institutional interest, a well-established capital market, and good participation from retail investors.” They went on to state:

“The introduction of a Bitcoin ETP by BlackRock in Europe is still a positive step toward mainstream acceptance, and with increased regulatory clarity, interest from institutions may expand over time.”

They further noted that while the market for Bitcoin ETPs in Europe may evolve more slowly, it is still a crucial component of the overall trajectory of Bitcoin’s global adoption.

BlackRock, managing over $11.6 trillion in assets, has the potential to drive wider acceptance of Bitcoin investment products across Europe and create new opportunities for institutional investment in the cryptocurrency market.

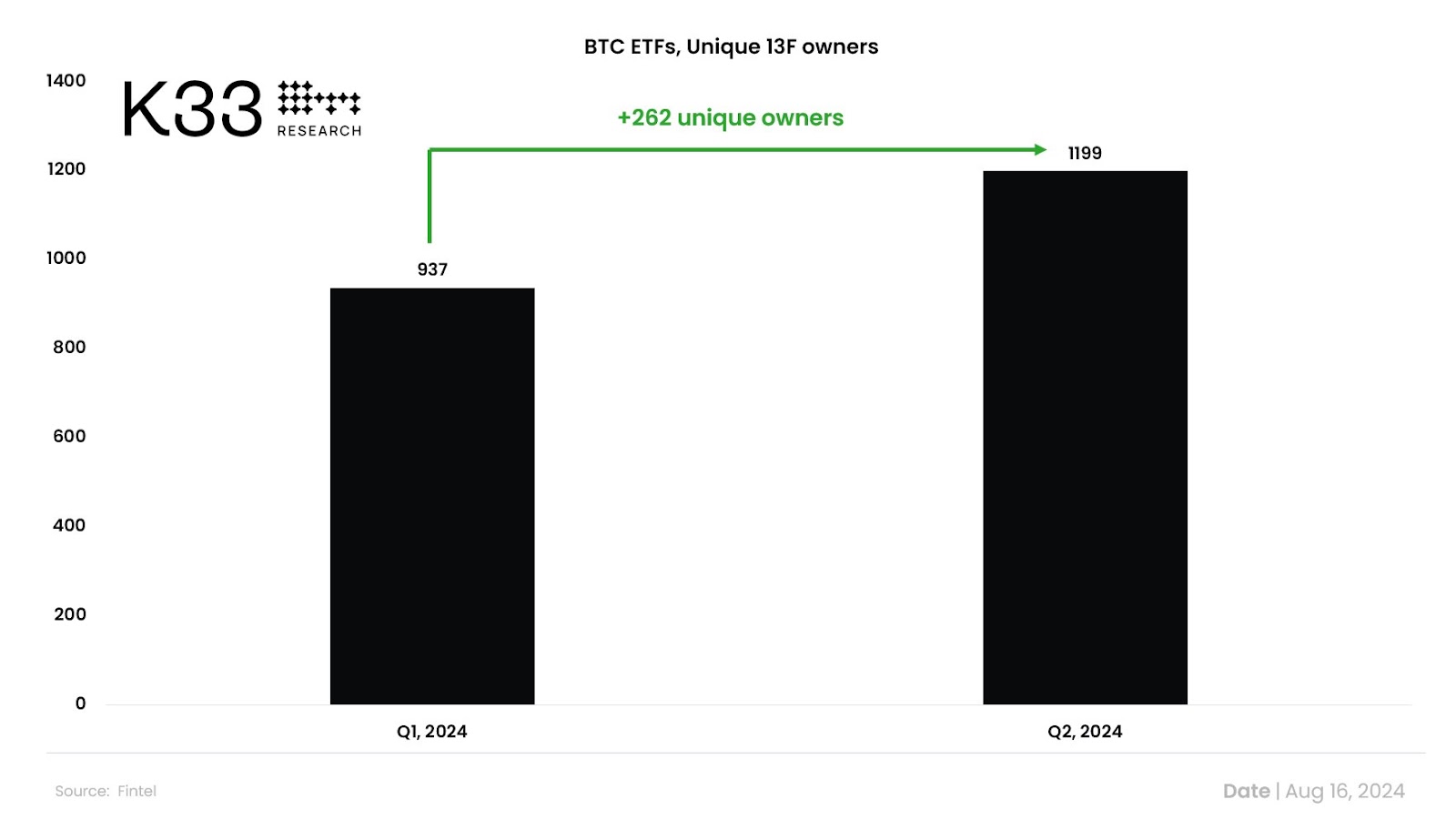

Growth in Bitcoin ETF institutional holdings.

Meanwhile, in the U.S., the adoption of Bitcoin ETFs by institutions surged beyond 27% during the second quarter of 2024, with over 262 firms investing, as reported on August 16.

BlackRock’s Global Standing May Foster European Bitcoin ETP Growth

The international reputation and expertise of BlackRock may “slowly create momentum” for the adoption of European Bitcoin ETPs, according to Iliya Kalchev, a dispatch analyst at a digital asset investment platform.

Kalchev commented, “Modest inflows shouldn’t be seen as a failure, but rather as a reflection of the structural differences within the market,” and he added:

“Long-term success in Europe may rely less on initial week inflows and more on ongoing access, education, and infrastructure—key aspects that BlackRock is in a strong position to provide.”

Even though BlackRock’s European fund might not experience the rapid growth seen by its U.S. Bitcoin ETF, this should be understood in context rather than as a negative indicator, taking into account the limited liquidity of the smaller European market.

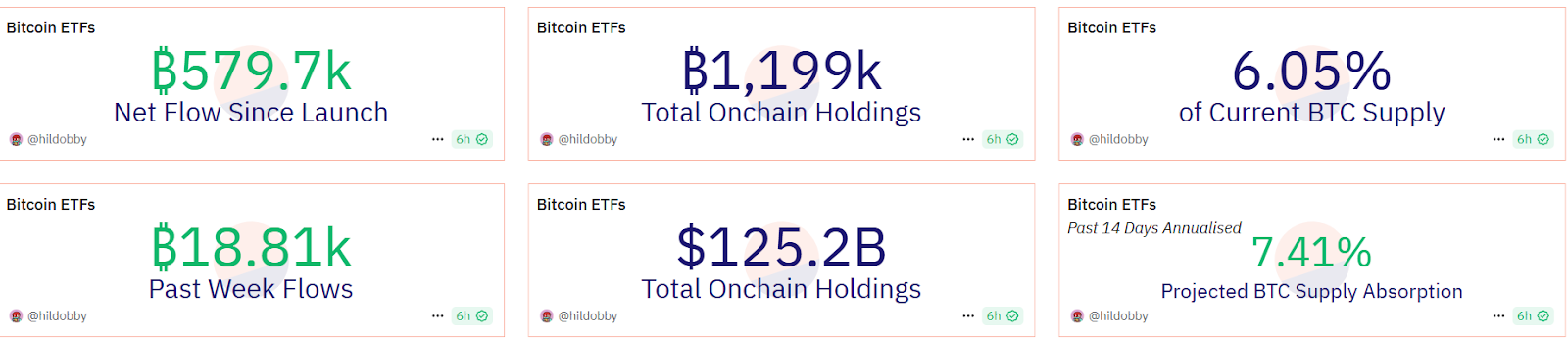

Bitcoin ETF overview.

In the U.S., BlackRock’s spot Bitcoin ETF briefly exceeded $58 billion in assets, making it the 31st-largest ETF in the world among both conventional and digital asset funds, as reported on January 31, with U.S. Bitcoin ETFs collectively surpassing $126 billion in total BTC holdings.

Currently, BlackRock’s ETF accounts for more than 50.7% of the market share of all spot U.S. Bitcoin ETFs, valued at $49 billion as of March 27, according to data.

Magazine: Exploring Bitcoin’s potential for June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8