- BlackRock acquired more than 1,200 BTC for $107.9 million, indicating a strong interest in Bitcoin from institutional investors.

- The family supported by Trump, alongside World Liberty Financial, Custodia Bank, the state of Wyoming, and Fidelity, has revealed plans to launch stablecoins.

- The Shiba Inu community is worried as the project leader, Shytoshi Kusama, has been absent from online interactions for over a week.

- Bitcoin remains around $87,000, while Shiba Inu is testing significant resistance at $0.00001428.

On Wednesday, BlackRock, managing $11.5 trillion in assets, invested $107.9 million in BTC. This move aligns with the growing interest in Bitcoin from institutional players.

In response to renewed interest in cryptocurrency, several financial institutions have unveiled their plans for stablecoins this week.

Despite meme coins being adversely affected by Donald Trump’s ongoing tariff announcements, the absence of Shytoshi Kusama from social media platforms has sparked unease among SHIB holders.

BlackRock’s Major Bitcoin Acquisition

The effects of Trump’s tariff policies are weighing on crypto prices, with Bitcoin trading just under the $87,000 threshold as of Thursday. Increased institutional interest might help Bitcoin recover, especially in light of a nine-day streak of positive flows into US-based spot ETFs.

By securing 1,230 BTC for $107.9 million, BlackRock is making waves in the realm of institutional cryptocurrency investment.

Significance of This Move

Traders in Bitcoin remain anxious due to the unpredictability stemming from Trump’s tariffs and broader US economic issues. The Fear & Greed Index currently sits at 40 out of 100, indicating a heightened sense of fear compared to the previous week.

With the ongoing uncertainty in the market, institutional interest in Bitcoin may play a crucial role in recovery and can create a more favorable outlook for BTC among investors.

Looking Ahead

Bitcoin may attempt to retest its resistance at the $90,000 mark; a daily close above this level could boost BTC towards the psychologically significant $100,000 benchmark.

Currently, Bitcoin is less than 4% from the $90,000 resistance and is approaching support in the range between $84,539 and $85,519.

BTC/USDT daily price chart

Institutions Focusing on Stablecoins

This week has seen a flurry of stablecoin announcements, including those from Trump’s family business, World Liberty Financial’s USD1 stablecoin, Custodia Bank’s AVIT, WYST from the state of Wyoming, and Fidelity’s money market fund FYHXX.

The Importance of Such Developments

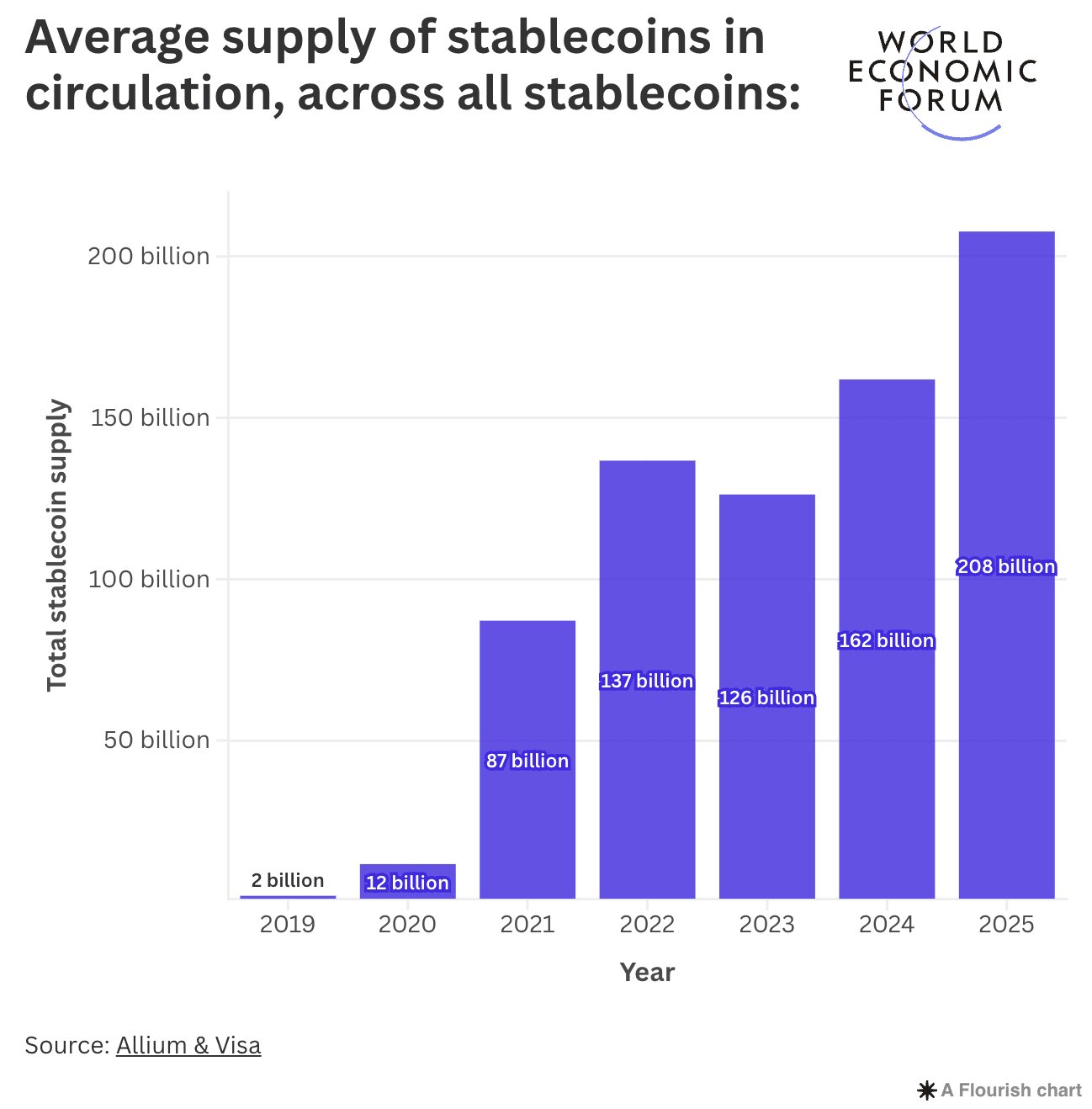

A report from the World Economic Forum revealed that the average supply of stablecoins in circulation reached $208 billion in 2025. These stablecoins serve as crucial fiat on and off-ramps for traders, becoming significant indicators of cryptocurrency’s relevance and adoption. An uptick in stablecoin circulation suggests broader acceptance of crypto among market participants.

Average supply of stablecoins in circulation

Future Expectations

Growing adoption of stablecoins could lead to increased capital inflow into crypto tokens, platforms, and protocols. This would likely enhance liquidity for traders over the long haul.

Concern Surrounding Shiba Inu Leader’s Absence

Shytoshi Kusama, the head of the Shiba Inu ecosystem, has been silent online for more than a week. This prolonged absence has led members of the SHIB community to express their concerns on social media.

Previously, Kusama has taken similar breaks, often resurfacing with updates about partnerships and plans for the development of the SHIB ecosystem. It remains uncertain what lies ahead for Shiba Inu and whether Kusama will return shortly.

Significance of Kusama’s Return

Analysis indicates that the Shiba Inu ecosystem has seen a rise in long-term investor holdings compared to projects such as Bitcoin, Ethereum, Tron, and Avalanche. Kusama’s re-engagement with the online community is essential to alleviate the worries of SHIB holders and sustain ongoing growth in the ecosystem.

Percentage of long-term holders

Anticipated Developments

Shiba Inu might soon challenge significant resistance at $0.00001532, which marks the upper boundary of the Fair Value Gap on the SHIB/USDT daily chart. A daily close above this level could support a narrative suggesting a potential trend reversal for Shiba Inu.

The Shiba Inu price is currently less than 10% away from this crucial resistance level, and technical indicators on the daily timeframe suggest a positive outlook for SHIB’s prospects.

SHIB/USDT daily price chart

-638786816460818430.jpeg)