- On Thursday, Bitcoin’s price remains around $87,000, with the RSI indicator reflecting uncertainty among traders.

- Recent data indicates that BTC is trading within stable ranges, as the intensity of on-chain profit and loss-taking events decreases.

- US Senator Elizabeth Warren expresses her concerns that the stablecoin legislation might enable Donald Trump and Elon Musk to take control of individuals’ finances.

As of Thursday, the Bitcoin (BTC) price stands close to $87,000, while its Relative Strength Index (RSI) indicates that traders are experiencing uncertainty. Additionally, recent reports indicate that BTC is operating in a stable market, with on-chain profit-and-loss-taking occurrences becoming less pronounced, signaling reduced demand and diminished selling pressure.

In the US, Senator Elizabeth Warren has raised alarms regarding the approved stablecoin legislation, asserting that it could provide Trump and Elon Musk with undue influence over people’s financial resources, and she is urging Congress to make necessary amendments.

Bitcoin operates in a stable market

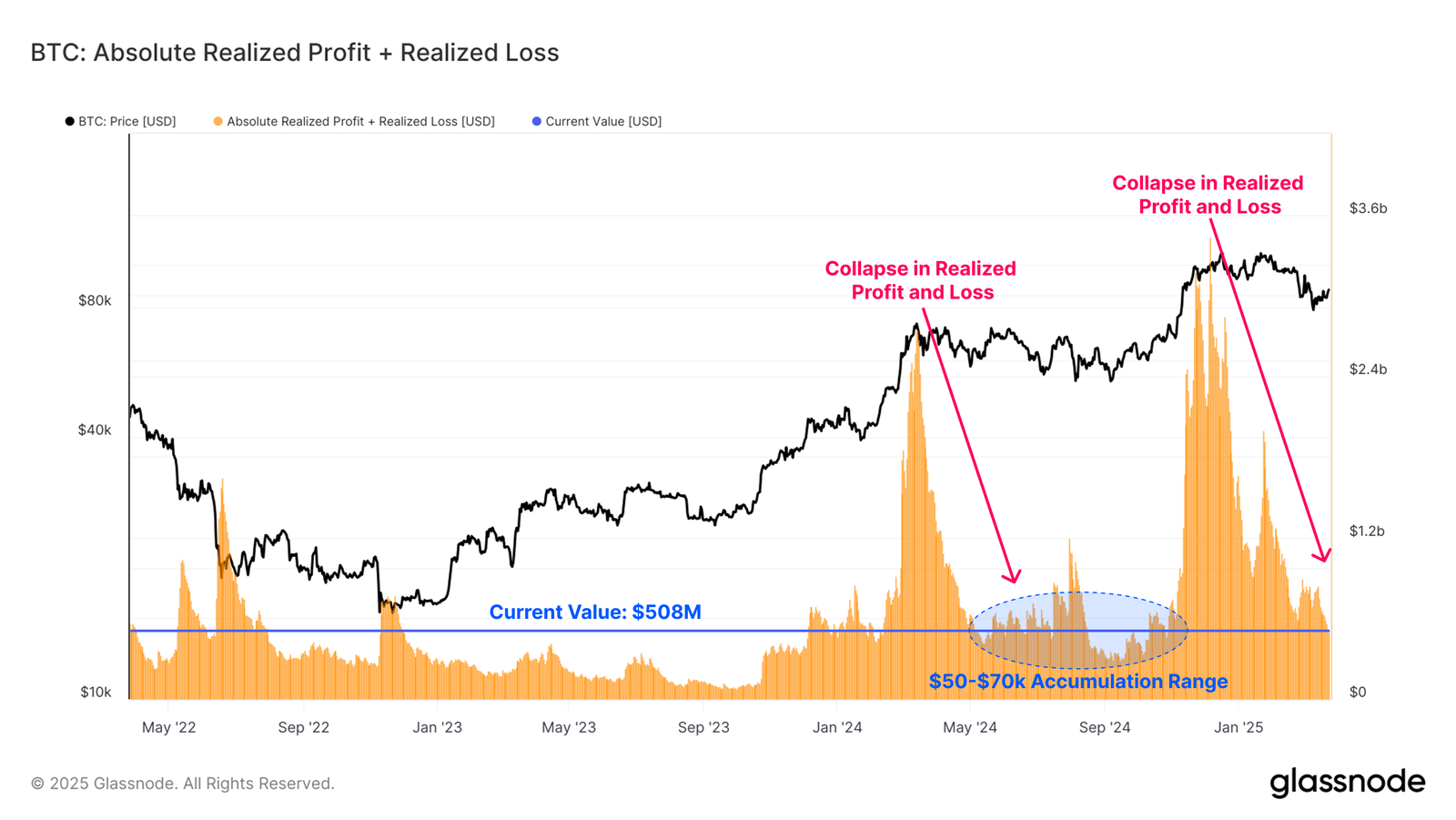

A recent report highlights that the Bitcoin market is stabilizing within a new range of $78,000 to $88,000. The decline in the scale of on-chain profit and loss events signifies weakening demand dynamics and reduced selling pressure.

The analysis further indicates that Short-Term Holders are facing considerable financial distress, with a significant portion of their investments currently in a loss position compared to their initial investment, as depicted in the accompanying graph.

Bitcoin STH percentage supply in loss chart.

“While the Short-Term Holder group is largely incurring losses, Long-Term Holders appear to be entering a phase of accumulation, with expectations for their cumulative supply to increase in the upcoming weeks and months,” stated an analyst.

BTC: Absolute realized profit + realized loss chart.

QCP Capital noted that the uncertainty regarding US trade policy and the larger political environment is prominent. Trump announced further tariff plans impacting the automobile industry ahead of the April 2 deadline, yet the market remains unclear about the extent, timing, and potential impact of these actions. As such, QCP analysts foresee continued sideways volatility.

US Senator Elizabeth Warren criticizes the stablecoin bill

Senator Elizabeth Warren raised her concerns via social media on Wednesday regarding the current stablecoin legislation.

The senator from Massachusetts urged Congress to take action and resolve the issues before it allows figures like Trump and Elon Musk to exert control over finances.

Warren remarked, “This is Donald Trump’s latest scheme to benefit himself. Congress must act to amend the current stablecoin bill that could facilitate Trump – and Elon Musk – in taking control of your money.”

This is Donald Trump’s latest scheme to benefit himself.

Congress must act to amend the current stablecoin bill that could facilitate Trump – and Elon Musk – in taking control of your money.

— Elizabeth Warren (@SenWarren) March 25, 2025

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act), which has already passed the Senate Banking Committee, outlines the licensing and regulatory frameworks for stablecoin issuers, differing between federal oversight for larger entities and state regulation for smaller ones.

Ultimately, the approval of this legislation is anticipated to benefit Bitcoin prices over the long term by promoting wider adoption of cryptocurrencies without diminishing Bitcoin’s significance.

Bitcoin Price Outlook: RSI Flattens, Reflecting Trader Uncertainty

Bitcoin’s price surged past its 200-day Exponential Moving Average (EMA), registering approximately $85,570 on Sunday, and gained 4.45% by Monday. However, by Tuesday, BTC found stability around $87,000 and experienced a minor drop, re-evaluating the 200-day EMA on Wednesday. At the time of this writing on Thursday, it remains just above that level, approaching a descending trendline created by connecting various peaks since mid-January.

If the 200-day EMA serves as robust support and BTC surpasses the descending trendline, it may extend its recovery to test the key psychological threshold of $90,000. A successful breach of this level could propel the rally further towards its March 2 high of $95,000.

Currently, the RSI on the daily chart registers at 51, hovering near the neutral threshold of 50, indicating trader hesitancy. To maintain bullish momentum, the RSI must trend upward and exceed the neutral mark of 50.

BTC/USDT daily chart

Conversely, should BTC encounter resistance at the descending trendline and close below the 200-day EMA, it may descend further to test its next support level at $78,258.

Bitcoin, Altcoins, Stablecoins FAQs

Bitcoin is the leading cryptocurrency by market capitalization, designed to serve as a medium of exchange. This currency operates without being controlled by any single individual, group, or entity, thereby eliminating the need for third-party involvement in financial transactions.

Altcoins refer to all cryptocurrencies besides Bitcoin, although some experts consider Ethereum not to be an altcoin due to its significance in the cryptocurrency space. If one accepts this view, Litecoin is recognized as the first altcoin, having been forked from Bitcoin and thus seen as an enhanced version.

Stablecoins are cryptocurrencies meant to maintain a steady price, with their value often backed by reserves of the asset they represent. To achieve this, stablecoins are typically pegged to a commodity or financial instrument, like the US Dollar (USD), with their supply managed by an algorithm or market demand. The primary aim of stablecoins is to serve as a bridge for investors looking to trade and invest in cryptocurrencies, while also allowing for value storage, as cryptocurrencies in general are subject to high volatility.

Bitcoin dominance refers to the ratio of Bitcoin’s market capitalization compared to the total market capitalization of all cryptocurrencies. This metric provides insight into Bitcoin’s appeal among investors. A high BTC dominance is typically observed before and during a bullish trend, when investors prefer to allocate capital to stable, high market capitalization cryptocurrencies like Bitcoin. Conversely, a decrease in BTC dominance usually indicates that investors are reallocating funds to altcoins, seeking higher returns, which can lead to significant surges in altcoin prices.