By Francisco Rodrigues (All times ET unless stated otherwise)

President Donald Trump intensified his rhetoric surrounding the trade war, warning of increased import tariffs on both the EU and Canada should they continue efforts that “inflict economic harm” on the U.S., following his announcement of a 25% tariff on vehicles and foreign-manufactured auto parts.

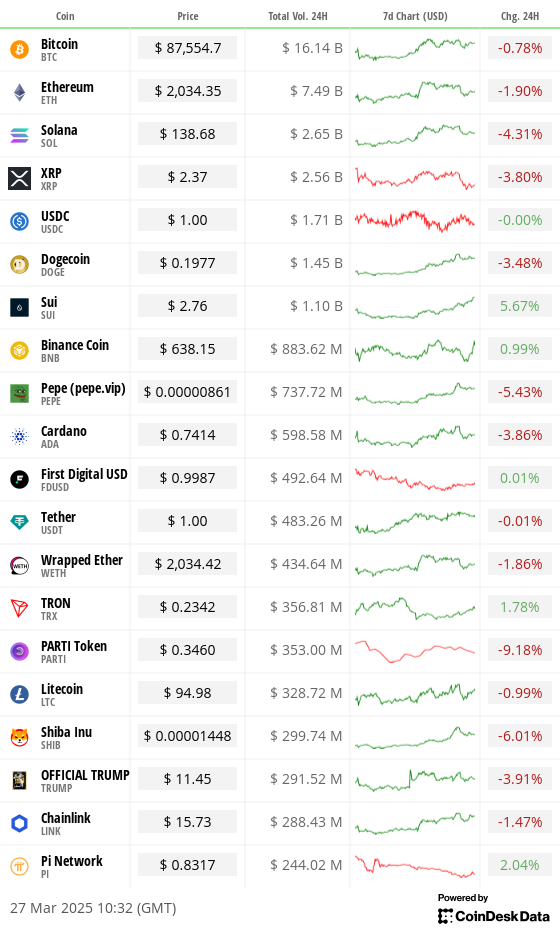

In spite of the threats, cryptocurrency markets showed resilience, with bitcoin holding steady around $87,500. Over the past 24 hours, the leading cryptocurrency has seen a decline of approximately 0.6%, while the broader CoinDesk 20 Index is down around 2%.

The escalating threats not only spark worries about economic growth but also widen the divide between the United States and Europe, whose leaders are convening today with Ukraine’s President Volodymyr Zelensky to discuss long-term security assurances. This meeting follows the U.S.’s successful negotiations that led to a Black Sea ceasefire agreement between Ukraine and Russia.

Cryptocurrency prices are being swayed by macroeconomic variables and the impending expiration of about $15 billion in BTC and ETH options contracts this Friday. This uncertainty has hindered BTC’s price rally, despite video game retailer GameStop’s efforts to raise $1.3 billion to invest in cryptocurrencies.

In other developments, the U.S. House of Representatives has unveiled a bill aimed at addressing systemic risks linked to stablecoin usage. Meanwhile, blockchain advancements are continuing smoothly, with the final Pectra test of Ethereum launching on the Hoodi network.

Looking forward, the U.S. Senate Banking Committee is set to hold a hearing today on the nomination of Paul Atkins, who has between $4 million and $6 million in crypto-related holdings, for the position of Chair of the Securities and Exchange Commission. Stay vigilant!

What to Monitor

Crypto:

March 27: Walrus (WAL) mainnet goes live.

April 1: Metaplanet (3350) will execute a 10-for-1 stock split.

Macro

March 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis will release (Final) Q4 GDP statistics.

GDP Growth Rate QoQ Estimate: 2.3%, Previous: 3.1%

Core PCE Prices QoQ Estimate: 2.7%, Previous: 2.2%

PCE Prices QoQ Estimate: 2.4%, Previous: 1.5%

Real Consumer Spending QoQ Estimate: 4.2%, Previous: 3.7%

March 27, 8:30 a.m.: The U.S. Department of Labor will publish unemployment insurance figures for the week ending March 22.

Initial Jobless Claims Estimate: 225K, Previous: 223K

March 27, 10:00 a.m.: The U.S. Senate Banking Committee will conduct a hearing regarding Paul Atkins’ nomination for the SEC chair. Livestream link.

March 27, 3:00 p.m.: Mexico’s central bank will disclose its interest rate decision.

Target Rate Estimate: 9%, Previous: 9.5%

March 28, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) will issue February unemployment rate data.

Unemployment Rate Estimate: 6.8%, Previous: 6.5%

March 28, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography will provide February unemployment rate data.

Unemployment Rate Estimate: 2.6%, Previous: 2.7%

March 28, 8:30 a.m.: Statistics Canada will release January GDP figures.

GDP MoM Estimate: 0.3%, Previous: 0.2%

March 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis will disclose February consumer income and spending data.

Core PCE Price Index MoM Estimate: 0.3%, Previous: 0.3%

Core PCE Price Index YoY Estimate: 2.7%, Previous: 2.6%

PCE Price Index MoM Estimate: 0.3%, Previous: 0.3%

PCE Price Index YoY Estimate: 2.5%, Previous: 2.5%

Personal Income MoM Estimate: 0.4%, Previous: 0.9%

Personal Spending MoM Estimate: 0.5%, Previous: -0.2%

April 2, 12:01 a.m.: The reciprocal tariff plan initiated by the Trump administration will take effect, alongside a 25% tariff on imported vehicles and certain components.

Earnings (Estimates based on FactSet data)

March 27: KULR Technology Group, post-market, $-0.02

March 28: Galaxy Digital Holdings, pre-market, C$0.38

Token Events

Governance votes & calls

DYdX DAO is currently engaging in discussions about allocating $10 million to incentivize the most profitable traders on the platform in an effort to attract talent. The DAO is also voting on the creation of a new liquidity tier aimed at markets introduced through the Instant Market Listings feature.

Venus DAO is reviewing the potential acquisition of a 33% stake in Thena.fi for $4.5 million, positioning Venus to establish a comprehensive DeFi SuperApp on the BNB Chain.

Balancer DAO is contemplating the establishment of a Balancer Alliance Program, allocating a portion of the revenue generated by the protocol to key partners in the form of USDC as veBAL.

CoW DAO is discussing an update to the score definition for buy orders following an incident on the Base network that unveiled potential misallocation of solver rewards.

March 27, 9 a.m.: PancakeSwap and EOS Network Foundation will host an Ask Me Anything (AMA) session.

March 27, 12 p.m.: Cardano Foundation will livestream with its CTO discussing the project’s roadmap.

March 27, 12 p.m.: Header will conduct a Community Call focused on Post-Quantum Cryptographic Algorithm support, sponsored tools, and AI tools.

March 27, 1 p.m.: Alchemy Pay will host a Community AMA session.

March 28, 3 a.m: Ontology will conduct a Weekly Community Update via X Spaces.

Unlocks

March 31: Optimism (OP) will unlock 1.93% of its circulating supply valued at $28.67 million.

April 1: Sui (SUI) will unlock 2.03% of its circulating supply valued at $178.46 million.

April 1: ZetaChain (ZETA) will unlock 6.05% of its circulating supply valued at $17.66 million.

April 2: Ethena (ENA) will unlock 0.77% of its circulating supply valued at $17.63 million.

April 3: Wormhole (W) will unlock 47.64% of its circulating supply valued at $144.79 million.

April 7: Kaspa (KAS) will unlock 0.59% of its circulating supply valued at $11.74 million.

April 9: Movement (MOVE) will unlock 2.04% of its circulating supply valued at $24.92 million.

Token Listings

March 27: Walrus (WAL) will be listed on Gate.io, KuCoin, Bluefin, MEXC, Bitget, and Bybit.

March 28: Binance will delist Aergo (AERGO).

March 31: Binance will delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

A notable gathering in the cryptocurrency space, taking place in Toronto on May 14-16. Use code DAYBOOK for a 15% discount on passes.

Day 2 of 3: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: Web3 Banking Symposium 2.0 (Lugano, Switzerland)

March 27: WIKI Finance EXPO Hong Kong 2025

Day 1 of 2: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

April 2-3: Southeast Asia Blockchain Week 2025 Main Conference (Bangkok)

April 2-5: ETH Bucharest Conference & Hackathon (Bucharest, Romania)

April 3-6: BitBlockBoom (Dallas)

Token Insights

An AI art movement sparked by OpenAI’s recent model release has led to a surge in memecoins themed around Studio Ghibli, merging nostalgia with cryptocurrency speculation as fans generate Ghibli-inspired images while traders capitalize on the growing excitement.

The ghiblification (GHIBLI) token, the most significant among these, saw a market capitalization of $21 million and $70 million in trading volume within just 24 hours, driven by over 250,000 transactions on the Ethereum and Solana networks.

This phenomenon, underpinned by the #GhibliAI hashtag, has amassed millions of views across X and Instagram, highlighting the internet’s penchant for humor and absurdity, thereby drawing in speculators interested in low-cost, high-volatility tokens.

Smaller Ghibli-themed tokens such as Ghilbi Doge, NoFace, and Yutaro are trailing behind GHIBLI in terms of trading interest, with GHIBLI holding a liquidity pool of just over $330,000 in Solana’s SOL.

Market Positioning

While BTC and ETH CME futures yields have stabilized early this month, there has been a distinct lack of upward momentum, particularly amidst continued corporate integration of bitcoin. This divergence indicates that sophisticated market players are remaining cautious.

BTC and ETH perpetual funding rates on offshore exchanges are barely in the positive territory, further underscoring this cautious sentiment.

TRX, XMR, TON, and SUI stand as the only top 25 coins with positive net cumulative volume deltas for the previous 24 hours, indicating net buying activity within the perpetual futures market.

BTC and ETH short-end options’ implied volatility indexes are steadily declining, as investors continue to anticipate larger price shifts in ETH relative to bitcoin.

Deribit-listed options suggest a preference for short-duration puts in BTC, ETH, SOL, and XRP.

Market Updates:

BTC is up 0.22% from Wednesday at 4 p.m., priced at $87,494.70 (last 24 hours: -0.86%)

ETH is up 0.69% at $2,025.47 (last 24 hours: -1.90%)

CoinDesk 20 is up 0.48% at 2,757.13 (last 24 hours: -2.19%)

Ether CESR Composite Staking Rate has increased by 2 bps, reaching 2.97%

BTC funding rate sits at 0.0087% (3.1744% annualized) on Binance

DXY remains stable at 104.47

Gold has risen by 0.82% to $3,045.80/oz

Silver is up 1% at $34.37/oz

Nikkei 225 closed down 0.6% at 37,799.97

Hang Seng closed up 0.41% at 23,578.80

FTSE dropped 0.66% to 8,632.24

Euro Stoxx 50 is down 0.7% at 5,373.68

DJIA finished down 0.31% at 42,454.79 on Wednesday

S&P 500 closed down 1.12% at 5,712.20

Nasdaq decreased by 2.04% to 17,899.02

S&P/TSX Composite Index ended down 0.7% at 25,161.10

S&P 40 Latin America closed down 0.83% at 2,460.26

The U.S. 10-year Treasury yield increased by 4 bps to 4.4%

E-mini S&P 500 futures remained unchanged at 5,763.25

E-mini Nasdaq-100 futures were steady at 20,112.25

E-mini Dow Jones Industrial Average Index futures rose by 0.16% to 42,815.00

Bitcoin Insights:

BTC Dominance: 61.69 (-0.14%)

Ethereum to bitcoin ratio: 0.02317 (0.17%)

Hashrate (seven-day moving average): 838 EH/s

Hashprice (spot): $49.19

Total Fees: 9.67 BTC / $846,444x

CME Futures Open Interest: 144,470 BTC

BTC priced in gold: 28.8 oz

BTC vs gold market cap: 8.17%

Technical Overview

The share price of bitcoin-investment firm Strategy (MSTR) has climbed past $320, indicating a bullish double-bottom breakout. This pattern suggests a potential rally in the Nasdaq-listed shares toward resistance at $410.

Crypto Equities

Strategy (MSTR): closed Wednesday at $329.31 (-3.66%), up 0.48% pre-market at $330.89.

Coinbase Global (COIN): closed at $193.95 (-5.03%), currently up 0.81% at $195.52.

Galaxy Digital Holdings (GLXY): closed at C$18.08 (-3.06%).

MARA Holdings (MARA): closed at $13.79 (-3.23%), up 0.51% at $13.86.

Riot Platforms (RIOT): closed at $7.9 (-7.17%), currently up 1.01% at $7.98.

Core Scientific (CORZ): closed at $7.63 (-11.89%), now up 1.97% at $7.78.

CleanSpark (CLSK): finished at $8.12 (-6.99%), now trading up 0.62% at $8.17.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.32 (-8.5%).

Semler Scientific (SMLR): closed at $39.57 (-6.63%).

Exodus Movement (EXOD): closed at $50 (-10.78%), currently up 0.6% at $50.30.

ETF Flows

Spot BTC ETFs:

Daily net flow: $89.6 million

Cumulative net flows: $36.33 billion

Total BTC holdings ~ 1,115 million.

Spot ETH ETFs:

Daily net flow: -$5.9 million

Cumulative net flows: $2.43 billion

Total ETH holdings ~ 3.406 million.

Overnight Flows

Chart of the Day

The AI sector within the cryptocurrency market has recorded the worst performance over the past 24 hours. This weak performance mirrors losses in AI-related equities on Wall Street, seemingly triggered by Microsoft backing out of data center projects expected to require 2 gigawatts of electricity in the U.S. and Europe.

While You Were Asleep

Dogecoin Rises, XRP Declines as Trump Signals ‘Even Bigger’ Tariffs: President Donald Trump threatened increased tariffs on Canada and the EU should they work against U.S. economic interests, leading to a drop in early bullish sentiment within crypto markets.

Rattled by Tariffs, U.S. Allies Shift into Defensive Mode: Trump’s 25% auto tariff has raised alarms among allies like Canada, Japan, and Germany, who perceive it as a violation of longstanding economic and security alliances.

BlackRock Expands Digital Asset Division with New High-Level Positions: The asset management firm is seeking to fill roles including director of digital assets, regulatory affairs director, and legal counsel for digital assets and ETFs.

Robinhood, Beyond Meme Stocks, Aims to Become a Bank: This year, U.S. Robinhood Gold subscribers will have access to high-yield savings and checking accounts, with features including instant cash delivery and estate planning services.

Concerns Raised Over U.S. Economic Data Quality Due to Trump’s Cuts: Economists warn that the Department of Government Efficiency’s cuts could compromise the reliability of U.S. economic data, impacting key indicators such as inflation and employment reports.

Studio Ghibli Phenomenon Fuels Memecoins on Ethereum and Solana Following OpenAI’s Model Release: AI-generated art mimicking Studio Ghibli films has gone viral, leading to the emergence of Ghibli-themed cryptocurrencies, with ghiblification (GHIBLI) attaining a market cap of $21 million.

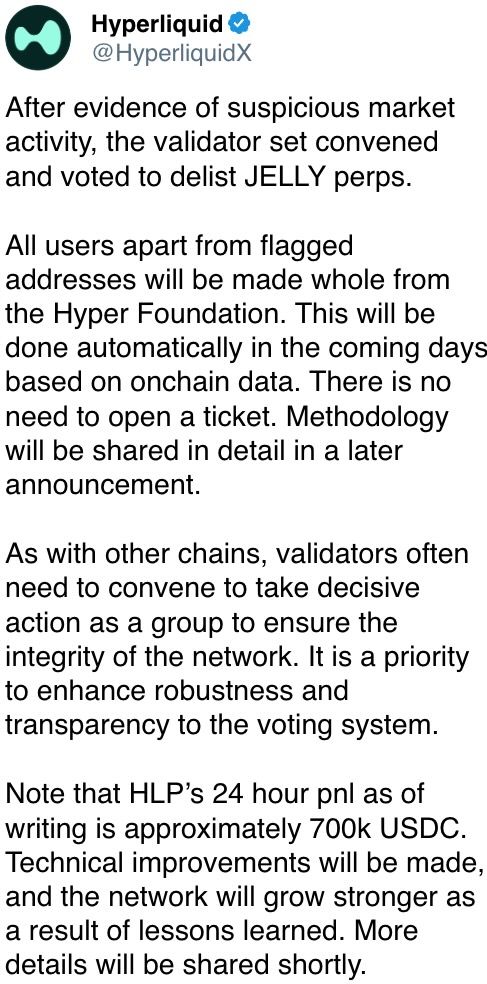

In the Ether