Dogecoin surged nearly 10% this week, showing resilience despite the ongoing tariff dispute instigated by U.S. President Donald Trump and recent macroeconomic trends. While many altcoins have reacted negatively to Trump’s announcements, DOGE has managed to rise, reclaiming a position above $0.2058 for the first time in almost two weeks.

Dogecoin’s double-digit rise: what’s next for DOGE’s value?

On Wednesday, March 26, Dogecoin (DOGE) reached a peak of $0.20585, its highest level in nearly two weeks. Over the past week, DOGE has increased by almost 10%, even as various altcoins have struggled to recover amidst the prevailing macroeconomic issues in the U.S.

The leading meme coin in the cryptocurrency market could maintain its upward trajectory, potentially achieving gains of nearly 11% as it tests resistance around the lower boundary of the range between $0.24040 and $0.21465.

The upper limit of this range, at $0.24040, represents the next significant resistance level for DOGE, approximately 24% higher than its current price.

Two important momentum indicators, the RSI and MACD, support a bullish outlook for Dogecoin. With an RSI of 52, it sits above the neutral threshold. The MACD indicates positive momentum, as evidenced by green histogram bars appearing above the neutral line in the Dogecoin price trend.

On-chain analysis of Dogecoin

The on-chain analysis of the top meme cryptocurrency reveals a growing number of DOGE holders. Should the count of holders continue to rise or stabilize over the next week, the meme coin could maintain its appeal among traders.

The network’s realized profit/loss metric indicates that DOGE holders have seen modest profit realizations. Generally, large-scale profit-taking can elevate selling pressure on the meme coin, possibly affecting its price negatively.

This metric supports a positive outlook for DOGE in the upcoming week. Additionally, the number of active addresses has remained consistent since mid-March, further highlighting the meme coin’s stability.

Analysis of DOGE derivatives and price outlook

The review of Dogecoin derivatives across various exchanges suggests that open interest is bouncing back from its low on March 12. Currently, open interest stands at $1.98 billion, aligning with DOGE’s trading price around $0.19. Data indicates a steady rise in open interest over the recent period.

On March 27, data revealed that $4.29 million worth of long positions were liquidated. Therefore, prospective buyers should closely monitor liquidation data and market prices before augmenting their derivatives positions.

The long/short ratio on leading exchanges like Binance and OKX exceeds 1, suggesting that traders in the derivatives market are anticipating an increase in DOGE’s price.

Combining technical analysis with derivatives data suggests that Dogecoin’s price could potentially test resistance at $0.21465 next week, if spot prices align with the strategies of derivatives traders.

Future expectations for DOGE

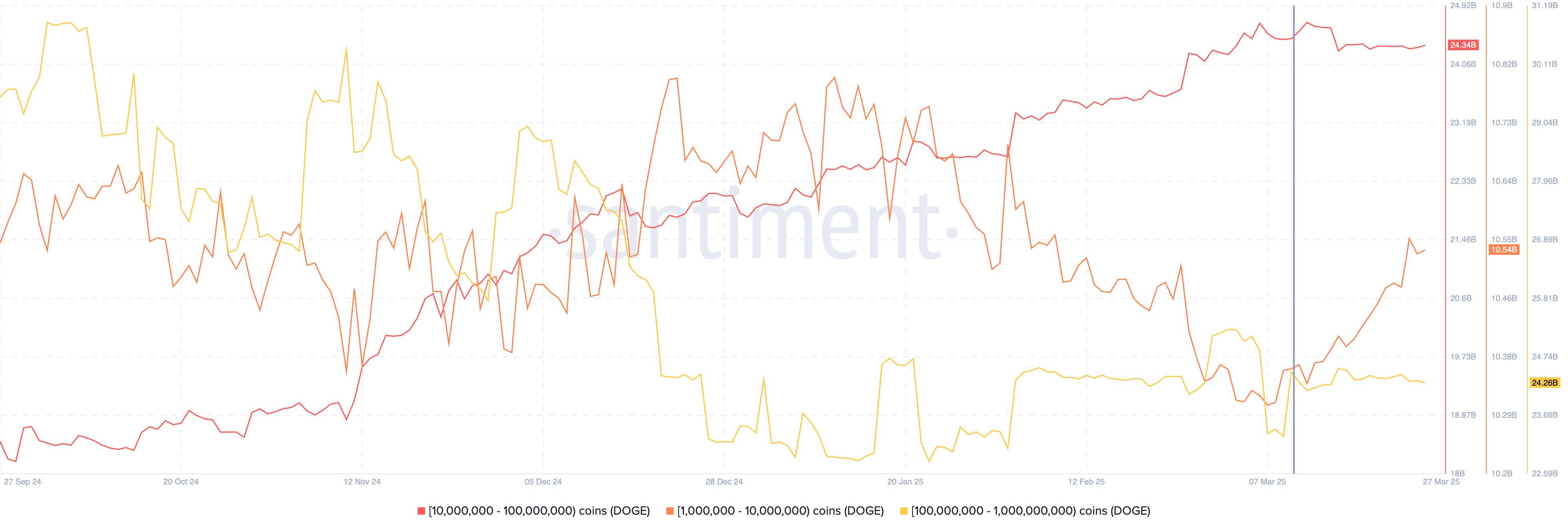

Wallets holding between 1 million and 10 million DOGE tokens have been consistently adding to their holdings from March 10 to 27, while larger holder categories, those with 10 million to 100 million and 100 million to 1 billion DOGE tokens, have remained relatively stable during this period.

Data indicates that traders with 1 million to 10 million DOGE tokens are actively accumulating, even as the price of the token rises. This trend supports demand for DOGE and reinforces a positive outlook for the meme coin.

Potential catalysts for DOGE and ETF news

Holders of DOGE are keenly observing developments related to Bitwise’s Dogecoin ETF application with the SEC. This ETF filing aims to establish the meme coin as a viable investment option for institutional investors, especially as DOGE retains its value while many altcoins experience rapid declines.

Despite minor drops linked to Bitcoin’s flash crashes, Dogecoin has managed to bounce back each time, with consistent gains potentially marking the end of its prolonged downward trend.

Other significant factors influencing Dogecoin include positive regulatory updates in the crypto space, the approval of the stablecoin bill in Congress, and increasing demand for DOGE from whales and investors holding large amounts.

Disclosure: This document is not intended as investment advice. The content provided here is for educational purposes only.