- The total market capitalization of cryptocurrencies surged by $14 billion on Thursday, reaching $2.83 trillion.

- Bitcoin ETFs attracted an additional $89.6 million, marking nine consecutive days of net inflows, based on recent data.

- A report from a crypto VC emphasizes yield opportunities as a major factor driving growth as the global stablecoin market cap exceeds $211 billion.

Bitcoin market updates:

- Bitcoin’s price increased by 4% in the early hours of Thursday, hitting a high of $88,000 on Binance before pulling back to around $87,000 at the time of writing.

- On Wednesday, Bitcoin ETFs recorded inflows of $89.6 million.

- BTC has maintained a position above $85,000 for the fourth straight day, while Ethereum is also showing solid support above $2,000. This suggests many traders are anticipating another push towards $90,000.

What drove the rise in Bitcoin’s price earlier today?

The early Thursday rally for Bitcoin stems from the announcement by U.S. President Donald Trump regarding the imposition of 25% tariffs on auto imports starting April 3. In light of this, investors hastily moved funds from U.S. stocks that may be affected by these tariffs.

S&P 500 performance March 26, 2025

S&P 500 performance March 26, 2025

In the 24-hour period following President Trump’s announcement, Tesla stock (TSLA) fell by 5%, while the S&P 500 dropped 65 points, reflecting a decline of 1.12%.

This reinforces the idea that the Thursday surge in BTC was influenced by traders reallocating their investments from U.S. stocks to cryptocurrencies, which are viewed as more insulated from the impacts of Trump’s trade policies.

Altcoin market updates: Toncoin, SUI, and PI coin rank among top gainers during market fluctuations

The total market capitalization of cryptocurrencies is stabilizing within a narrow 2% range near the $3 trillion threshold on Thursday, with trading volumes holding steady at $94 billion. However, the lack of significant directional change suggests that investors are reallocating funds rather than adding or withdrawing capital.

This trend is apparent in recent data showing considerable losses among high-cap layer-1 projects like XRP (-4.6%), Solana (-4.3%), and Cardano (-4.5%) over the past day, while capital is moving toward select mid-cap altcoins and networks associated with stablecoins.

Crypto Gainers Today

Tron (TRX) has seen its price grow by 2%, gaining traction after fresh discussions about stablecoin launches. The recent moves by Trump-backed World Liberty Financial (WLFI), the State of Wyoming, and Fidelity in the stablecoin space have driven more activity toward TRON’s efficient, low-cost network.

- Dogecoin (DOGE) has appreciated by 4.2%, outperforming most of the leading cryptocurrencies and posting a 12.8% gain over the past week as interest in memecoins rises.

- SUI has increased by 5%. Ethereum’s recent struggles alongside rising fees during peak activity have pushed investors toward layer-2 tokens like SUI. Additionally, growing speculation about a potential SUI Exchange Traded Fund (ETF) has contributed to its recent surge in value.

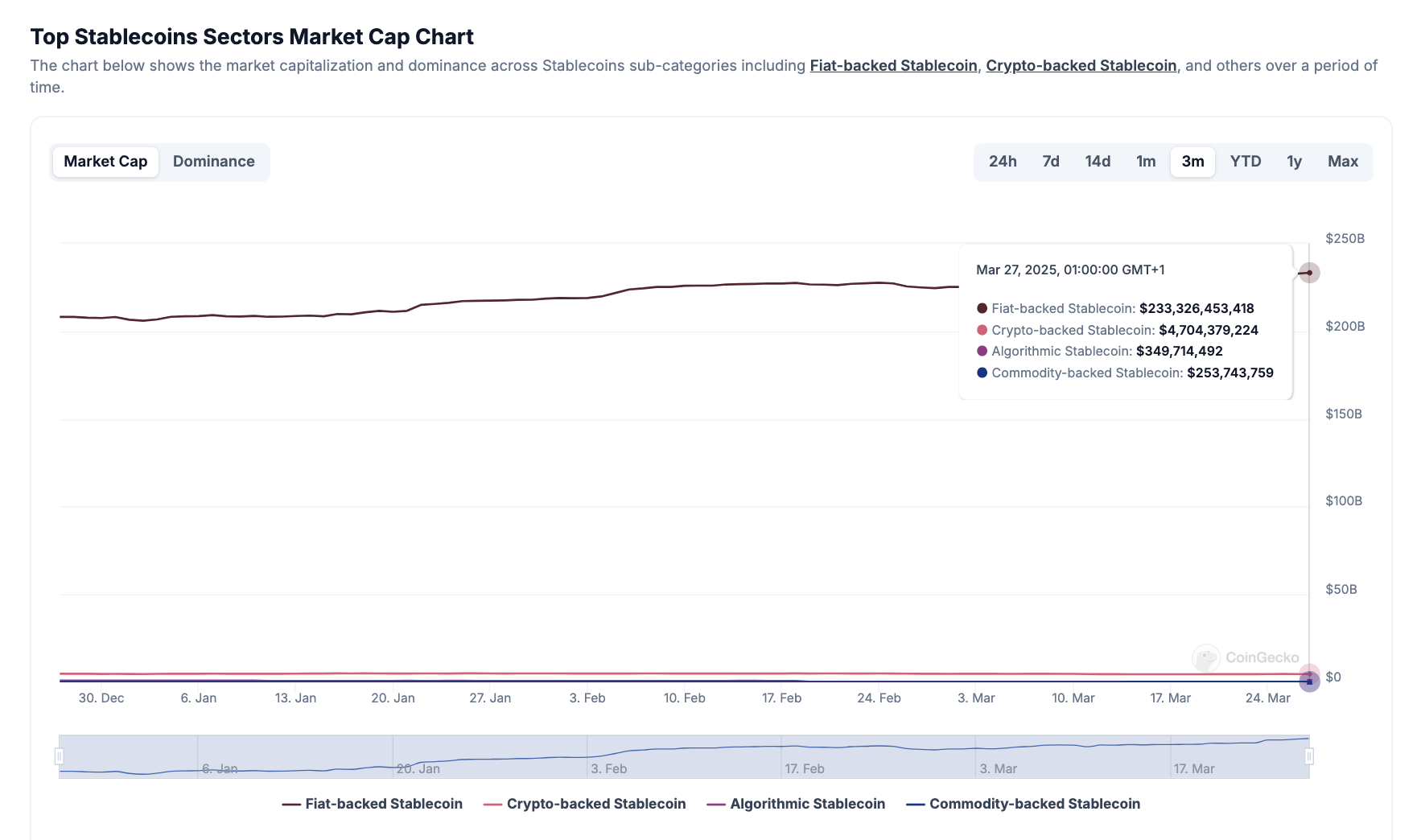

Chart of the day: Yield opportunities emerge as stablecoin market cap surpasses $211 billion

This week, stablecoins have taken center stage in crypto discussions, with various U.S.-based companies announcing initiatives to launch USD-backed tokens.

As a result of shifting regulatory attitudes following President Trump’s administration, the U.S. Securities and Exchange Commission (SEC) has recently discontinued charges against several leading crypto firms, leading to greater corporate adoption of cryptocurrencies.

In just this week, WLFI, the State of Wyoming, and Fidelity have all made significant announcements regarding stablecoin issuance.

Stablecoin market capitalization as of March 27, 2025

Stablecoin market capitalization as of March 27, 2025

The total market cap for stablecoins has exceeded $211 billion, increasing by $8 billion this March alone.

However, the report from a crypto VC indicates that the uptick in stablecoin participation extends beyond regulatory improvements.

“The potential to earn yield on digital dollars is a compelling aspect of stablecoins, which traditional finance has largely overlooked,” the report suggests.

“Historically, achieving DeFi yields required technical know-how, self-custody, and engagement with complex protocols. Now, regulated platforms are simplifying these processes, providing user-friendly interfaces that allow holders to earn yields on their stablecoin assets without needing extensive crypto expertise.”

“Unlike conventional stablecoins that serve merely as mediums of exchange, Mountain’s USDM distributes daily yields to its token holders by default. The current 4.70% APY is derived from low-risk, short-term U.S. Treasuries, positioning it as an appealing alternative to traditional bank deposits and DeFi staking options.”

– Crypto VC Report, March 2025

Crypto news updates:

- ICE collaborates with Circle to investigate new digital asset opportunities

The Intercontinental Exchange (ICE) has entered a memorandum of understanding with Circle, a technology company focused on peer-to-peer payments, to explore new financial products involving Circle’s USDC stablecoin and US Yield Coin (USYC). This partnership aims to incorporate these digital assets into ICE’s market framework, including derivatives exchanges, clearinghouses, and data services, with the goal of enhancing the adoption of tokenized assets in the capital markets.

- GameStop plans to raise $1.3 billion for Bitcoin treasury initiative via note offering

GameStop has announced its intention to conduct a private offering of convertible senior notes totaling $1.3 billion, maturing in 2030, which will be aimed at institutional investors. Proceeds will be allocated for the acquisition of Bitcoin as a part of the company’s newly outlined treasury asset strategy. This decision aligns with the company’s updated investment policy shared in its fourth-quarter earnings reveal, where GameStop reported a net income of $131.3 million and $4.75 billion in cash reserves, setting the stage for a strategic pivot toward digital assets.

- Senate votes to overturn IRS crypto reporting regulation enacted by Biden administration

The U.S. Senate has voted to rescind an Internal Revenue Service (IRS) rule that mandated decentralized finance (DeFi) platforms to operate like traditional securities brokers. This regulation required DeFi participants to gather user trading data, provide tax forms, and report transactions to the IRS. Lawmakers argued that these stipulations imposed excessive burdens on the industry and raised privacy concerns for users.

With bipartisan backing for the measure, President Donald Trump is anticipated to endorse the repeal, officially annulling the rule enacted in the closing days of the previous administration.