The current landscape of cryptocurrency is reminiscent of the “America Online” (AOL) phase of the internet during the late 1990s, characterized by a cumbersome user experience, technical complexity, limited functionality, and slow connection speeds, as noted by the co-founder of Polygon, Sandeep Nailwal.

In a recent discussion, Nailwal highlighted several critical areas needing advancement to enhance user experience, including smooth fiat on- and off-ramps, custody options with key recovery features, and the integration of hardware wallets into mobile devices.

“We are still in the dial-up phase of the internet, where even accessing the web felt like a challenging endeavor. You had to resemble a mini-engineer to get online—we find ourselves in a similar situation in crypto.” —Sandeep Nailwal

“We are likely still in 1998, and it may take an additional 10 to 15 years to realize the full potential of cryptocurrency,” the Polygon co-founder remarked.

Although seen as groundbreaking at the time, the AOL days on the internet had limited functionalities and a significant barrier to entry.

The internet journey took around 30-40 years to achieve widespread usage, having started with a handful of applications. During the late 90s, the AOL period mainly revolved around email and basic browsing, while today, the internet plays an integral role in the global economy.

Nailwal expressed that the situation in cryptocurrency mirrors this pattern, with financial use cases—especially market speculation—being the primary focus at this stage.

However, once the financial applications are thoroughly developed and gain adequate acceptance, the reach of cryptocurrency is expected to expand into other domains like decentralized social media, gaming, and various niche sectors, he mentioned.

Related:Concerns over security hinder global crypto payment acceptance — Survey

Participating in crypto today means getting in early

Nailwal emphasized that even the basic financial applications of cryptocurrencies haven’t reached full maturity.

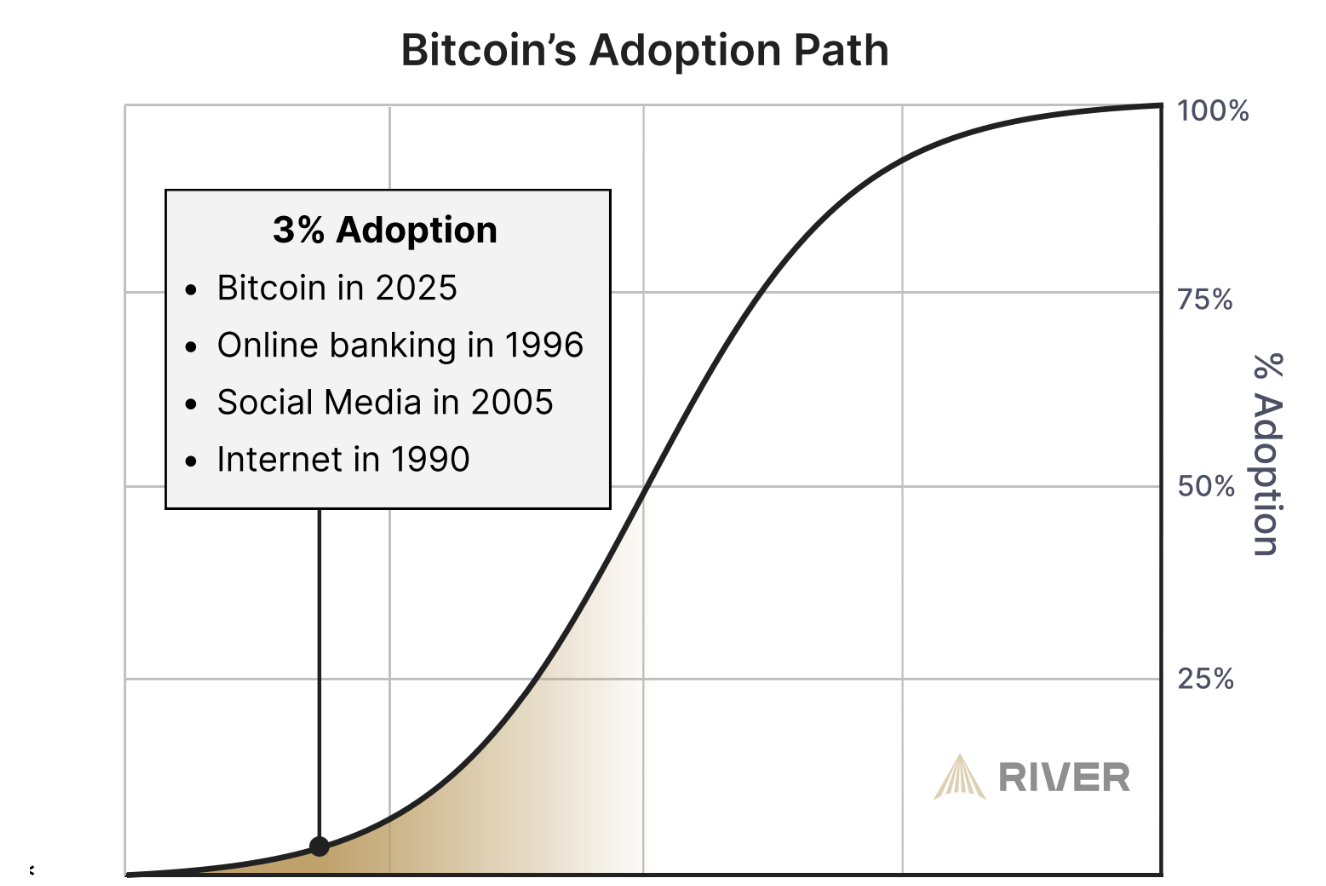

A report from a Bitcoin financial services company indicates that only 4% of the global population currently owns Bitcoin (BTC)—the original cryptocurrency, recognized for having the largest market share and mainstream appeal.

Pathway to Bitcoin’s adoption.

This report revealed that Bitcoin has only reached about 3% of its potential adoption trajectory when considering institutions and the overall addressable market along with appropriate portfolio allocations.

This limited number of Bitcoin holders signifies that widespread adoption of cryptocurrency remains years away, indicating that the entire industry is still in its early adoption phase.

Magazine:They addressed crypto’s challenging user experience — you’re just not aware yet