The individual involved in the recent “questionable market activity” on Hyperliquid, which resulted in the suspension and removal of the Jelly my Jelly (JELLY) memecoin, may have incurred losses nearing $1 million as a result of their transactions.

A blockchain analytics company reported on March 26 that the trader seemed to engage in manipulative practices to capitalize on price fluctuations, withdrawing collateral before Hyperliquid’s liquidation process could respond.

Within a span of five minutes, the trader established three accounts, with two long positions of $2.15 million and $1.9 million, and a short position of $4.1 million to counteract the long positions, according to an analysis following the incident.

“This setup enabled him to increase leverage in his efforts to extract funds from Hyperliquid,” the analysts noted.

Image Credit: Unspecified

When the price of Jelly surged by over 400%, the $4 million short position faced liquidation; however, it did not immediately liquidate due to its size and instead was transferred to the Hyperliquidity Provider Vault (HLP), which is designed to liquidate such positions.

As this was happening, the trader withdrew collateral from the other two accounts while having a potential seven-figure profit to access, according to the analysis.

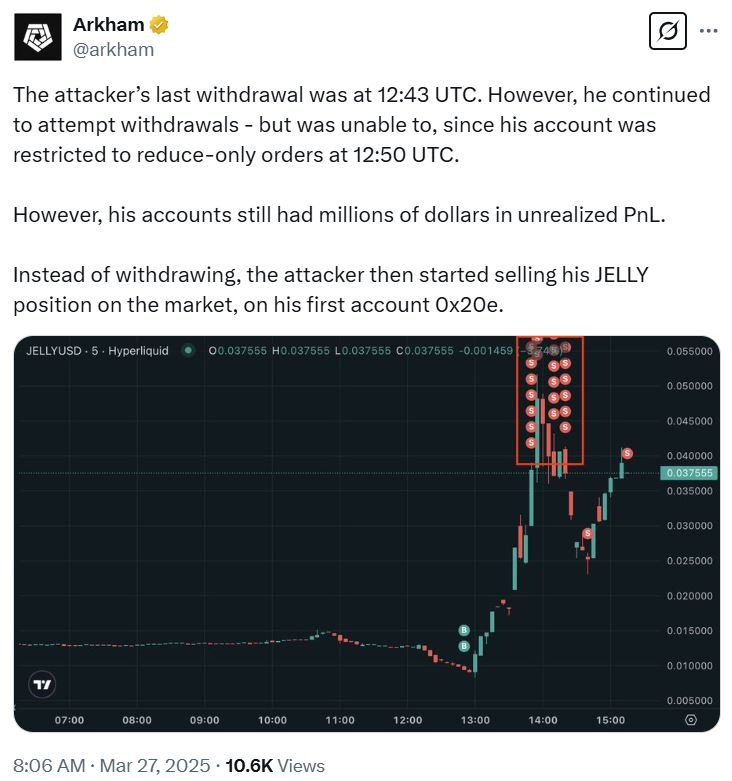

Nonetheless, the trader encountered significant restrictions as the accounts, still holding millions in unrealized profits and losses, were limited to reduce-only orders, compelling them to sell tokens from the first account on the market to recover some funds.

Image Credit: Unspecified

Ultimately, Hyperliquid closed the Jelly market at a price of 0.0095, which mirrored the price of the trader’s short position, effectively eliminating all floating profit and loss on the first two accounts affected.

According to estimates, the trader withdrew a total of $6.26 million, but at least $1 million is reportedly still left in the accounts.

“If he is able to withdraw these funds in the future, his actions on Hyperliquid would have cost him around $4,000. However, if withdrawal is not possible, he could be facing a near $1 million loss,” the blockchain analytics company remarked.

In light of these events, Hyperliquid has decided to remove perpetual futures associated with the JELLY token, citing evidence of suspicious market behavior.

Similar tactics have been seen among other traders

This isn’t the first instance of Hyperliquid encountering such issues. On March 14, the platform raised margin requirements for traders after its liquidity pool suffered significant losses during a large Ether (ETH) liquidation.

Related: Industry leader criticizes Hyperliquid’s management of “suspicious” incident involving JELLY token

A notable whale trader deliberately liquidated a $200 million Ether long position on March 12, resulting in a $4 million loss for the HLP while unwinding the trade.

Additionally, traders have started targeting whales on the platform, aiming to liquidate prominent leveraged positions in a collective effort.

Magazine: Explaining native rollups: A comprehensive guide to Ethereum’s newest innovation