Solana’s native token, SOL, experienced a sudden decline of 8% after briefly reaching $147 on March 25. For the last three weeks, SOL has struggled to regain the $150 mark, prompting traders to question whether the initial bullish trend fueled by memecoin excitement and advancements in artificial intelligence has now fizzled out.

Some market analysts suggest that the approval of a Solana spot exchange-traded fund (ETF) in the United States could greatly benefit SOL’s price, along with the growth of tokenized real-world assets (RWA) on the Solana platform, which includes stablecoins and money market funds.

Others, such as a co-founder of a tech startup, argue that Solana possesses “the fundamental building blocks for a breakthrough in mobile technology.”

Image credits to original source

This individual emphasized the favorable regulatory framework from the current administration and the lasting effects of the memecoin craze, which has introduced “millions” of new users to Web3 wallets and decentralized applications (DApps). Essentially, they believe Solana is strategically positioned due to its seamless onboarding process for mobile users.

Bitcoin reserve news negatively impacted all cryptocurrencies

Despite the possibility of a thriving “consumer-grade” marketplace for DApps, many traders faced losses as the memecoin excitement waned and on-chain volumes declined. This downturn has raised doubts about SOL’s ability to surpass the $150 threshold. Additionally, Solana is contending with increased competition from other blockchain platforms.

Moreover, the announcement that the U.S. government would not be acquiring altcoins for its strategic reserves was a disappointment for many investors. On March 6, legislation was signed allowing budget-neutral strategies for the U.S. Treasury to obtain Bitcoin (BTC), while altcoins in government holdings could be sold off strategically. Notably, there was no reference to Solana or any other altcoin in the executive order regarding the Digital Asset Stockpile.

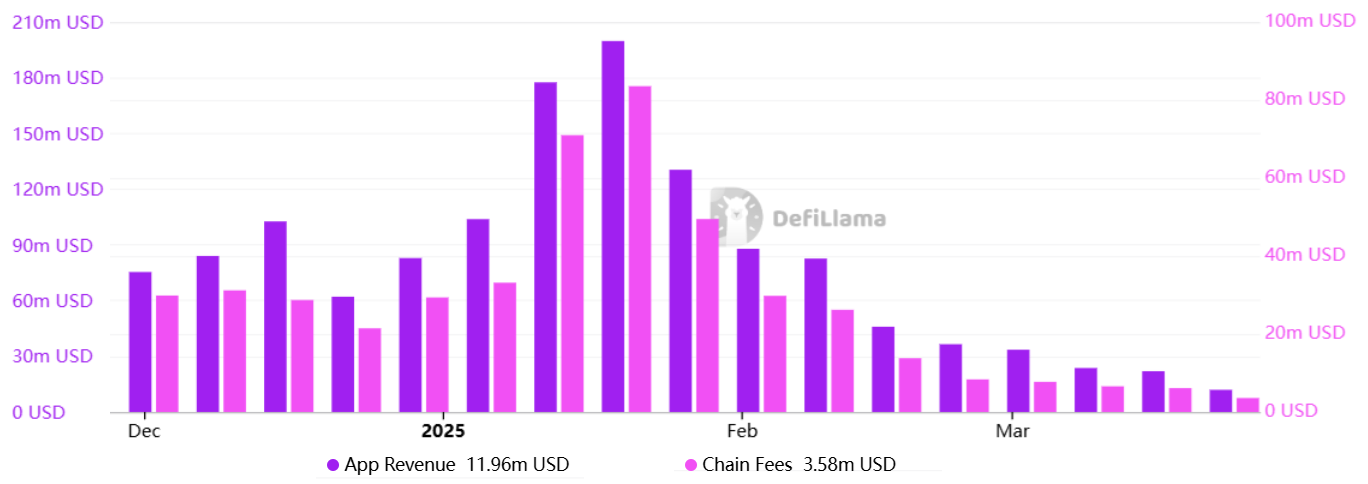

Some may contend that the Solana ecosystem encompasses more than just memecoin trading and token launches, as total value locked (TVL) has increased in areas like liquid staking, collateralized lending, synthetic assets, and yield farming. However, Solana’s fees and DApp revenues have consistently fallen. This decrease in on-chain activity diminishes SOL’s attractiveness to investors, thereby limiting its potential for growth.

Solana’s 7-day DApp revenues (left) and chain fees (right), USD.

In the week leading up to March 24, Solana’s DApp revenues reached $12 million, a decrease from $23.7 million just two weeks prior. Similarly, base layer fees fell to $3.6 million in this time frame, down from $6.6 million in the week ending March 10. Interestingly, this decline occurred while the total value locked remained stable at 53.2 million SOL.

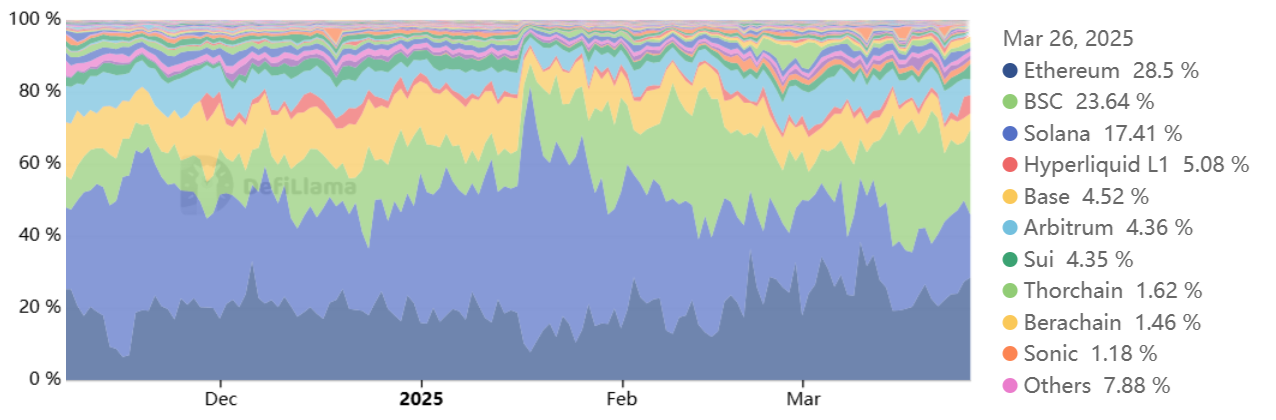

Solana’s dominance in DEX volumes has diminished

The decline in Solana’s on-chain activity is particularly alarming, especially since BNB Chain has ascended to the top spot in DEX volumes, despite having 34% less TVL than Solana, according to available data.

Market share for decentralized exchanges. Data from available sources.

Solana previously led the DEX sector in trading volume from October 2024 to February 2025 but has recently ceded ground to Ethereum and BNB Chain. Consequently, part of SOL’s price weakness is attributed to a decline in Solana’s on-chain activities compared to its rivals. For instance, trading volume on one competitor surged by 35% over the last week, while another saw a remarkable increase of 186% in activity.

While current fundamentals do not suggest an imminent surge above $150, the Solana network uniquely combines a user-friendly experience with a level of decentralization that has been successful. For example, although BNB Chain and Tron offer similar scalability, neither has had a wallet or DApp rank among the top 10 in the Apple App Store, unlike Solana’s Phantom Wallet, which achieved this distinction in November 2024.

This article serves general informational purposes and should not be construed as legal or investment advice. The views expressed in this article are solely those of the author and do not necessarily represent the views or opinions of any affiliated parties.