The crosschain US-dollar stablecoin, USDT0, has been launched on Optimism’s Superchain, enhancing the availability of the most widely adopted stable asset within Ethereum’s layer-2 environment.

On March 27, it was announced that the dollar-backed USDT0 is now operational on the OP mainnet. The initial implementation of the crosschain stablecoin took place on Ink, the DeFi-oriented layer-2 developed by Kraken.

USDT0 functions as a bridged variant of Tether’s USDt (USDT), aimed at broadening the stablecoin’s usage across multiple blockchain platforms.

In January, USDT0 was introduced alongside the interoperability protocol LayerZero. A month later, Tether chose Arbitrum to serve as the primary infrastructure provider for the stablecoin.

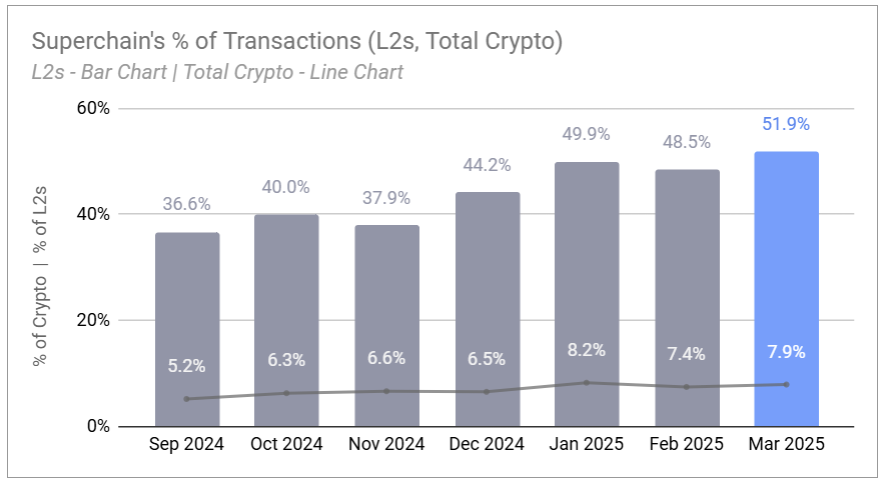

Superchain represents a network of layer-2 chains intended to enhance Ethereum’s scalability through Optimism’s OP Stack. The network currently supports 52% of all Ethereum layer-2 transactions, according to Superchain’s tracking data.

Since September, the dominance of Superchain’s layer-2 has increased from 36.6% of total transactions to 51.9%. Source: Superchain Health Dashboard

In February, the chief growth officer of Optimism stated that Superchain might account for 80% of Ethereum’s layer-2 transactions this year. At that time, Superchain held over $4 billion in total value—now increased to $4.2 billion.

Related: Celo, Chainlink, Hyperlane launch crosschain UDT on OP Superchain

Growing Adoption of Stablecoins

Superchain anticipates that the launch of USDT0 will attract “more top-tier assets, applications, and partners,” underscoring the influence of stablecoins in advancing DeFi adoption.

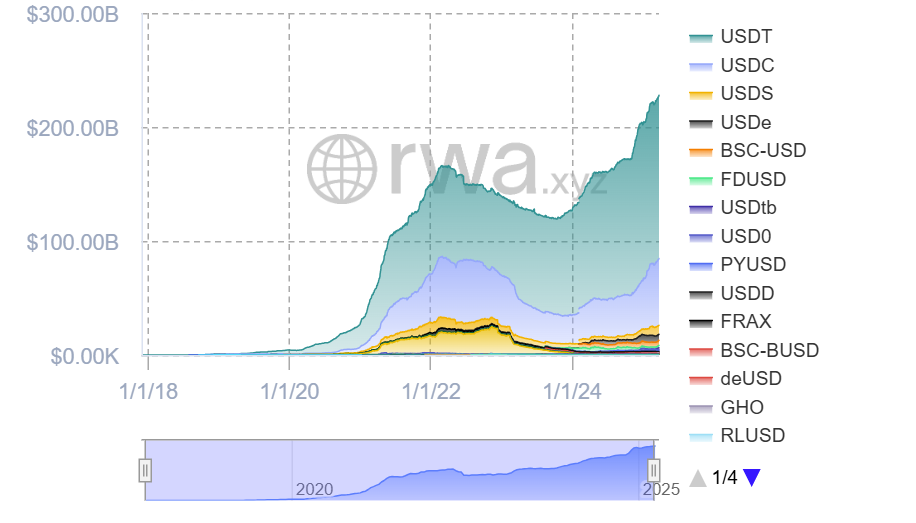

The overall market value of all stablecoins has nearly reached $228 billion, marking a 3.3% increase over the last month. As per RWA.xyz, there are over 155 million stablecoin holders globally.

Ethereum constitutes 58% of the entire stablecoin supply.

Ethereum is by far the largest network in terms of stablecoin market cap, with Tether’s USDt being the most widely utilized stable asset. Source: RWA.xyz

Tether has consistently maintained a first-mover advantage in the stablecoin sector. The company has become one of the world’s most significant holders of US Treasury assets, contributing to its record profits in recent years.

With the previous administration, dollar-pegged stablecoins emerged as a key element in US policy discussions.

The head of the council on digital assets under the former president recently indicated at a conference in New York that comprehensive regulations for stablecoins could potentially reach the presidential desk within two months.

Related: Tether’s US Treasury holdings exceed those of Canada and Taiwan, ranking 7th globally