Bitcoin (BTC) is at risk of entering a new bear market, as a significant range of BTC price indicators is showing a “bearish divergence.”

In a recent discussion on social media on March 27, observers pointed out concerning trends emerging from a Bitcoin Macro Index.

Decline in Bitcoin Macro Index “unfortunate,” says its creator

As BTC/USD finds it difficult to regain its former highs, onchain metrics are starting to lose their bullish momentum.

The Bitcoin Macro Index, introduced in 2022, employs machine learning to examine data drawn from various indicators that the creator claims “provide a strong indication of Bitcoin’s relative value throughout historical cycles.”

“The model focuses solely on on-chain and macro-market data. Notably, price data and technical analysis are not incorporated into this model,” he clarified when he first introduced the tool.

Since late 2023, the index has been printing lower highs while prices are making higher highs, resulting in a “bearish divergence.” Although this pattern has previously occurred in prior bull markets, it suggests that BTC/USD may have already reached a long-term peak.

“This is unfortunate,” Edwards commented while sharing an image of the Index posted by another user on X.

“However, when the Bitcoin Macro Index goes positive, I won’t oppose it.”

Capriole Bitcoin Macro Index. Source: @A_Trade_Academy/X

BTC price indicators face challenges

Several analytical platforms have determined that Bitcoin is grappling with macro challenges this year.

Related: Bitcoin price prediction markets forecast that BTC won’t exceed $138K by 2025

In one of its recent “Quicktake” analyses, an onchain analytics platform highlighted four key metrics that are currently fluctuating.

“These indicators all point to Bitcoin undergoing significant instability in the short to mid-term,” contributor Burak Kesmeci noted.

“However, none of these metrics suggest that Bitcoin has reached an overheated or high-cycle level.”

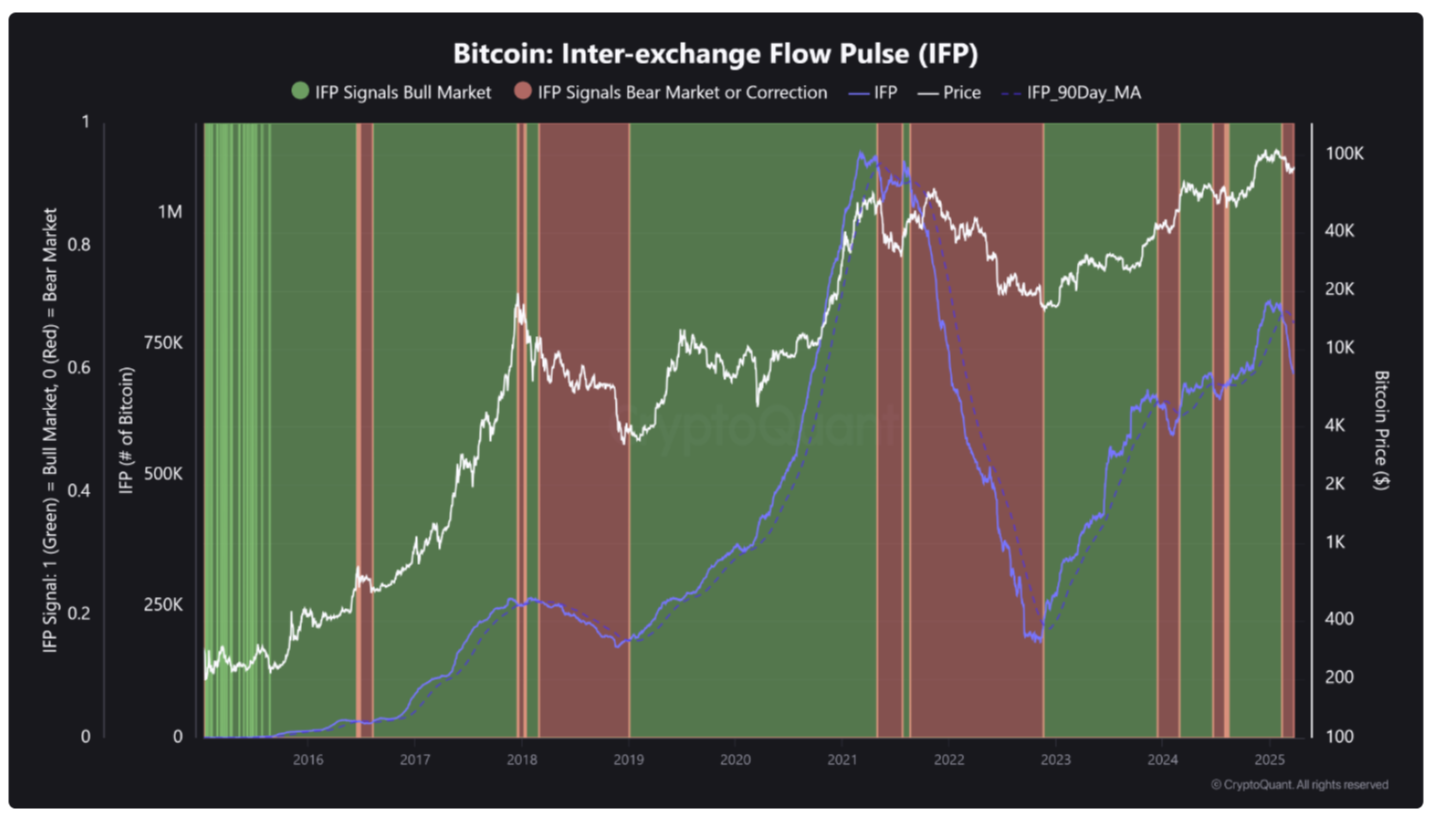

Bitcoin IFP chart (screenshot). Source: CryptoQuant

The mentioned metrics include the Market Value to Realized Value (MVRV) and Net Unspent Profit/Loss (NUPL), along with the Inter-Exchange Flow Pulse (IFP) indicator, which turned bearish in February.

For this situation to improve, Kesmeci concluded, the IFP needs to return above its 90-day simple moving average (SMA).

This article does not provide investment advice or recommendations. Every investment and trading decision comes with risks, and readers should conduct their own research before making any decisions.