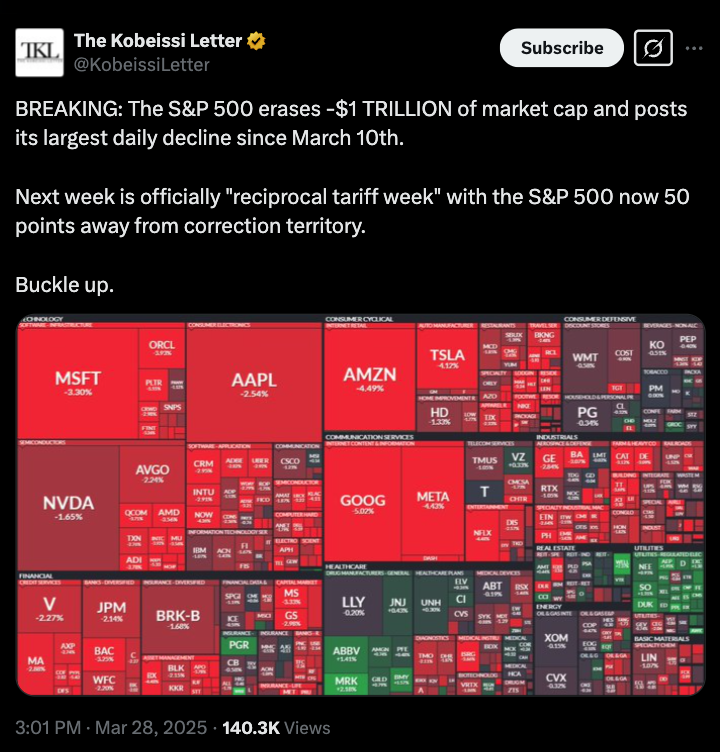

On March 28, the price of Bitcoin continued to slide, marking its fourth straight day of decline and reaching an intra-day low of $83,387. This downturn in Bitcoin’s value reflected the tumultuous trading on Wall Street, where the DOW suffered a drop of 700 points, while the S&P 500 index fell by 112 points.

The equity sell-off is largely seen as a reaction to growing concerns about inflation, especially after the core Personal Consumption Expenditures index data from February rose to 2.8%—a monthly increase of 0.4%—which exceeded analysts’ expectations.

S&P 500 loses $1 trillion in market capitalization. Source: X / The Kobeissi Letter

The situation worsened as the markets reacted to the recent imposition of “reciprocal tariffs” by the President, which include a 25% tax on vehicles not manufactured in the U.S.

The likelihood of a Bitcoin rebound or oversold recovery appears to be decreasing, as traders remain watchful for April 2, a date referred to as “Liberation Day” by the President, when further tariffs—including on pharmaceuticals—are expected to be announced.

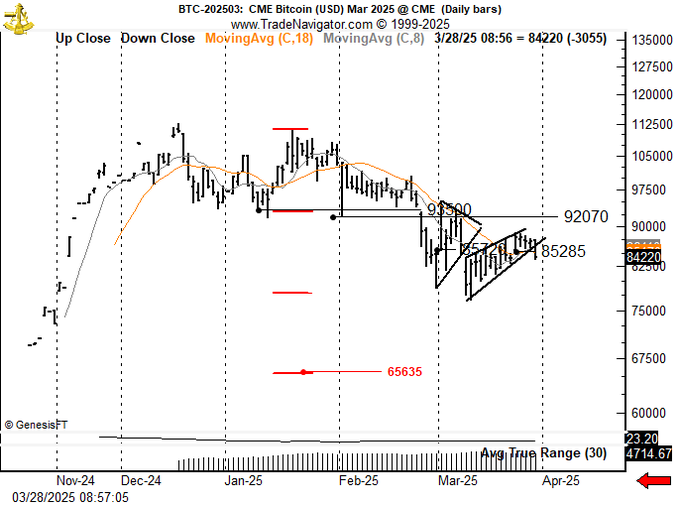

Could Bitcoin drop to $65K?

BTC/USD 1-day chart. Source: X / Peter Brandt

In a recent post on social media, Brandt noted the completion of a “bear wedge” pattern and stated,

“Don’t blame the messenger. Just reporting on the chart’s indications until it suggests otherwise. The bear wedge has been completed, with a double top target at $65,635.”

Another trader, known as ‘HTL-NL’, supported Brandt’s view, indicating that Bitcoin’s inability to break through a long-term descending trendline and the confirmation of the bear wedge suggest that a revisit to lower price levels is imminent.

BTC/USD 1-day chart. Source: X / HTL-NL

Analyzing the situation technically, it seems challenging to predict a rapid turnaround in Bitcoin’s price, as many indicators on the daily time frame do not show oversold conditions. Despite a lack of robust demand in the current price range, crypto trader Cole Garner pointed out that “whales are very active at the moment.”

BTC/USD 1-day chart. Source: X / Cole Garner

Garner also noted that the Bitfinex margin long-to-short ratio has sent a strong signal indicating historical returns of over 50% within 50 days.

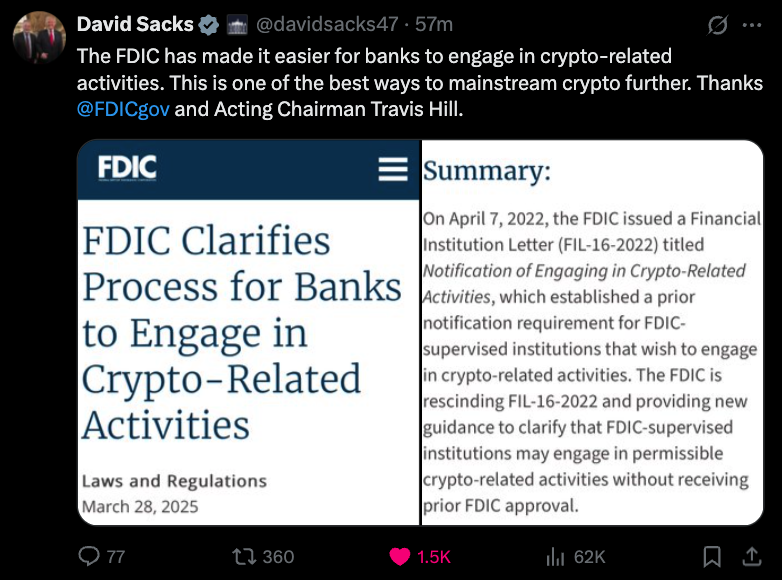

Related: U.S. regulators FDIC and CFTC relax crypto restrictions for banking and derivatives

Meanwhile, despite the fluctuations in daily prices, positive news continues to emerge from the crypto regulatory landscape.

On March 28, the AI and Crypto Advisor to the White House, David Sacks, praised the FDIC and its Acting Chairman, Travis Hill, for clarifying the procedures for banks wishing to engage in crypto-related activities.

Source: X / David Sacks

Essentially, the guidance issued by the Federal Deposit Insurance Corporation to its regulated institutions clarified that they could offer crypto-related products and services without prior notification to the FDIC.

This article does not provide investment advice or recommendations. All investments and trading carry risks, and readers are advised to perform their own research before making decisions.