Bitcoin is on track to reach $110,000 before revisiting the $76,500 level, as suggested by market expert Arthur Hayes. He attributes this potential surge to declining inflation concerns and a more accommodating monetary policy environment in the US, which is expected to support riskier assets like the leading cryptocurrency.

In contrast, the decentralized finance (DeFi) sector has faced another setback with an unidentified investor exploiting vulnerabilities in Hyperliquid’s algorithms to gain over $6 million through a short position in a memecoin.

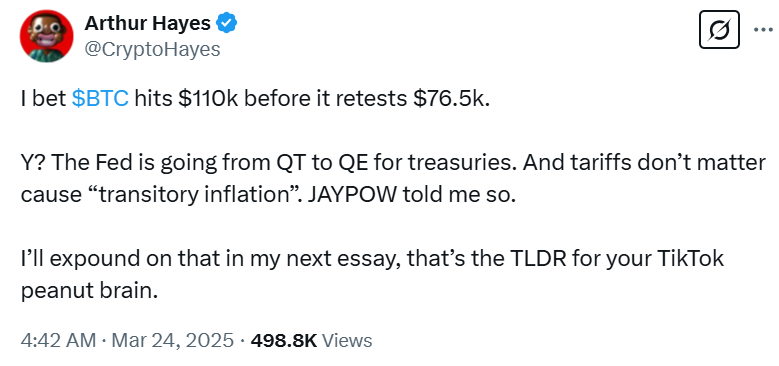

Bitcoin “more likely” to reach $110,000 before $76,500 — Arthur Hayes

Market analysts speculate that Bitcoin could establish a new peak at $110,000 prior to any notable pullback, citing easing inflation and increasing global liquidity as critical elements fueling this price increase.

Bitcoin (BTC) has achieved consecutive gains over the last two weeks, closing bullishly just above $86,000 on March 23, according to TradingView metrics.

With inflation fears subsiding, Arthur Hayes, co-founder of a major crypto exchange and head investment strategist at another company, sees this as a perfect opportunity for Bitcoin to chase a $110,000 all-time high.

BTC/USD, 1-week chart. Source: TradingView

In a post shared on March 24, Hayes asserted:

“I wager $BTC reaches $110k prior to any retracement at $76.5k. Why? The Federal Reserve is transitioning from quantitative tightening (QT) to quantitative easing (QE) for treasuries. Tariffs are irrelevant because of ‘transitory inflation.’ JAYPOW informed me.”

Source: Arthur Hayes

“What I’m suggesting is that the likelihood of reaching $110k is higher than that of hitting $76.5k next. If we hit $110k, then it’s celebration time, and we won’t be looking back until we see $250k,” he further elaborated.

Quantitative tightening occurs when the US Federal Reserve reduces its balance sheet by selling bonds or letting them mature without reinvesting proceeds, while quantitative easing involves the Fed purchasing bonds to inject money into the economy, thereby lowering interest rates and promoting spending during economic downturns.

Other experts pointed out that even though the Fed has slowed its QT process, it hasn’t entirely shifted to an easing stance.

“QT is not simply over as of April 1st. They still have $35 billion per month coming off from mortgage-backed securities. They’ve just reduced QT from $60 billion per month to $40 billion,” explained another market analyst, the founder of a research firm.

Continue reading

A whale exploits Hyperliquid, still holds 10% of JELLY memecoin after $6.2 million gain

A prominent crypto investor who reportedly manipulated the price of the Jelly my Jelly (JELLY) memecoin on a decentralized exchange known as Hyperliquid continues to hold nearly $2 million worth of the token, according to blockchain experts.

This unidentified whale profited at least $6.26 million by leveraging the platform’s liquidation settings.

A blockchain intelligence firm shared that the whale executed three significant trades in a matter of minutes: two long positions worth $2.15 million and $1.9 million, along with a short position of $4.1 million that counterbalanced the longs.

Source: Blockchain intelligence analysis

When the value of JELLY skyrocketed by 400%, the $4 million short position was not immediately liquidated owing to its size. Instead, it was absorbed into the Hyperliquidity Provider Vault, which is structured to manage large positions.

The whale might still possess around $2 million worth of the token, as indicated by a blockchain investigator.

“Five addresses associated with the entity manipulating JELLY on Hyperliquid still control approximately 10% of the JELLY supply on Solana (worth over $1.9 million). All JELLY was acquired after March 22, 2025,” the investigator noted in a Telegram update.

Continue reading

Fidelity plans stablecoin launch following SOL ETF regulatory assessment

A major investment firm is reportedly nearing the launch of a US dollar-pegged stablecoin, representing its latest initiative in the digital assets space amidst a more accommodating regulatory environment for cryptocurrencies.

This $5.8 trillion asset management company aims to introduce the stablecoin via its cryptocurrency division, signaling a strong commitment to crypto-based services, as detailed in a report referencing anonymous insiders.

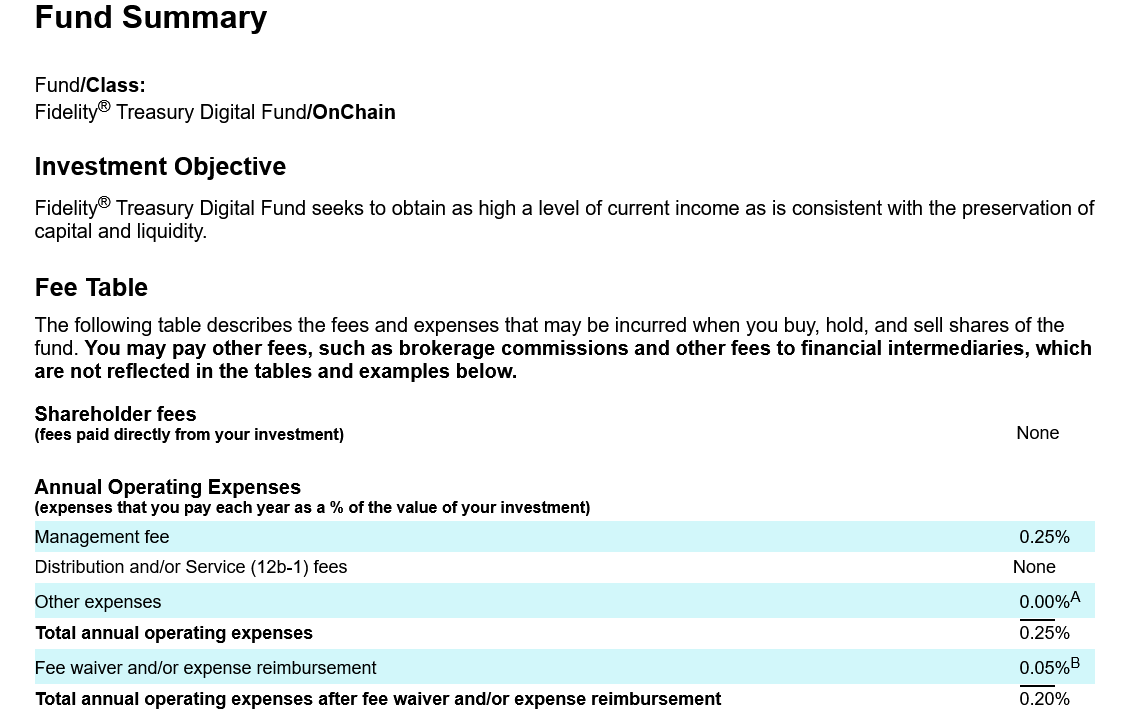

The stablecoin initiative is part of a broader strategy to enhance the firm’s offerings in crypto. They are also set to introduce an Ethereum-based “OnChain” share class for their US dollar money market fund.

Your investment firm’s recent filing with US securities regulators indicated that the OnChain share class would assist in tracking transactions related to a digital fund heavily concentrated in US Treasury bills.

Although regulatory approval for the OnChain share class is still pending, it is anticipated to be effective by May 30, as stated by the company.

Tokenized version of the Treasury Digital Fund. Source: SEC

More US financial institutions are venturing into cryptocurrency offerings after a recent shift in policy following a high-profile election.

Continue reading

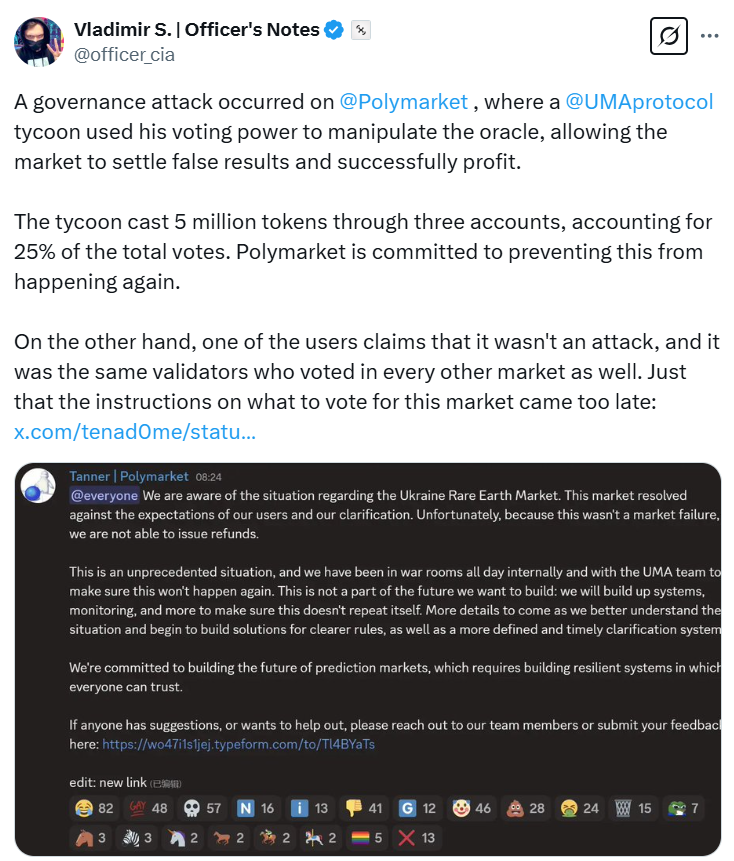

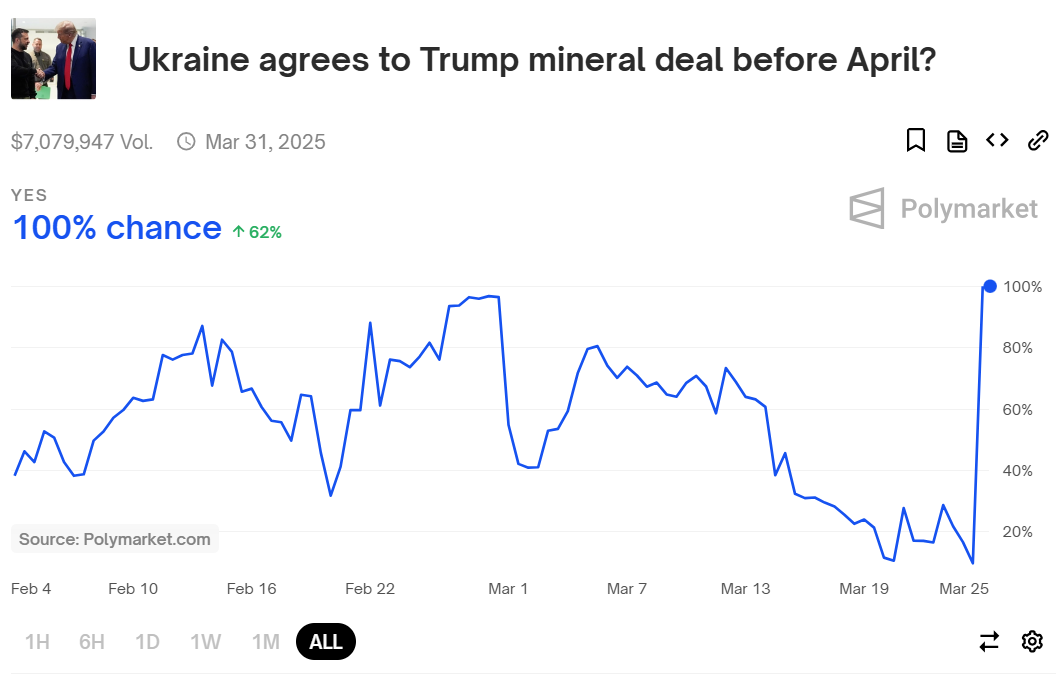

Polymarket faces backlash over $7 million Ukraine mineral deal bet

A leading decentralized prediction market is under scrutiny after a contentious outcome raised fears of possible governance manipulation linked to a high-stakes political wager.

A market on the platform asked whether the US President would accept a rare earth mineral agreement with Ukraine before April. Despite no such event taking place, the market was resolved as “Yes,” prompting criticism from users and industry experts.

Such reactions highlight the risk of a “governance attack,” wherein a major investor from a partnering protocol allegedly used voting leverage to influence the oracle, resulting in inaccurate market settlements.

“The investor cast 5 million tokens via three accounts, constituting 25% of the total votes. The prediction market is committed to preventing similar occurrences in the future,” an informed individual mentioned in a recent post.

Source: Crypto threat analysis

The prediction market utilizes blockchain oracles to secure external data for settling market results and validating real-world occurrences.

Data indicates that the market drew over $7 million in trading volume before formally resolving on March 25.

Betting pool on the Ukraine/US mineral deal. Source: Polymarket

However, not everyone subscribes to the notion that it was a coordinated effort. A pseudonymous user on the platform argued that the outcome was simply due to a lack of oversight.

Continue reading

DWF Labs launches $250 million fund to promote mainstream crypto adoption

A market-making and investment firm based in Dubai has unveiled a $250 million Liquid Fund aimed at propelling the advancement of mid- and large-cap blockchain initiatives and facilitating the real-world adoption of Web3 technologies.

The company is poised to finalize two investment agreements worth $25 million and $10 million as part of the fund’s strategy.

This initiative seeks to enrich the crypto ecosystem by providing strategic investments ranging from $10 million to $50 million for projects that can foster genuine adoption, as detailed in a recent announcement.

Source: DWF Labs

The fund will concentrate on blockchain projects that demonstrate high levels of “usability and discoverability,” according to a managing partner at DWF Labs.

“We are channeling our support toward mid-to-large-cap initiatives, the tokens and platforms that typically serve as entry points for everyday users,” he stated, further noting:

“Nevertheless, strong technology and utility alone aren’t enough. Users need to first discover these projects, grasp their value, and build trust.”

“We believe that coupling strategic investment with proactive ecosystem development is crucial for unlocking the next phase of growth in the industry,” he commented.

Continue reading

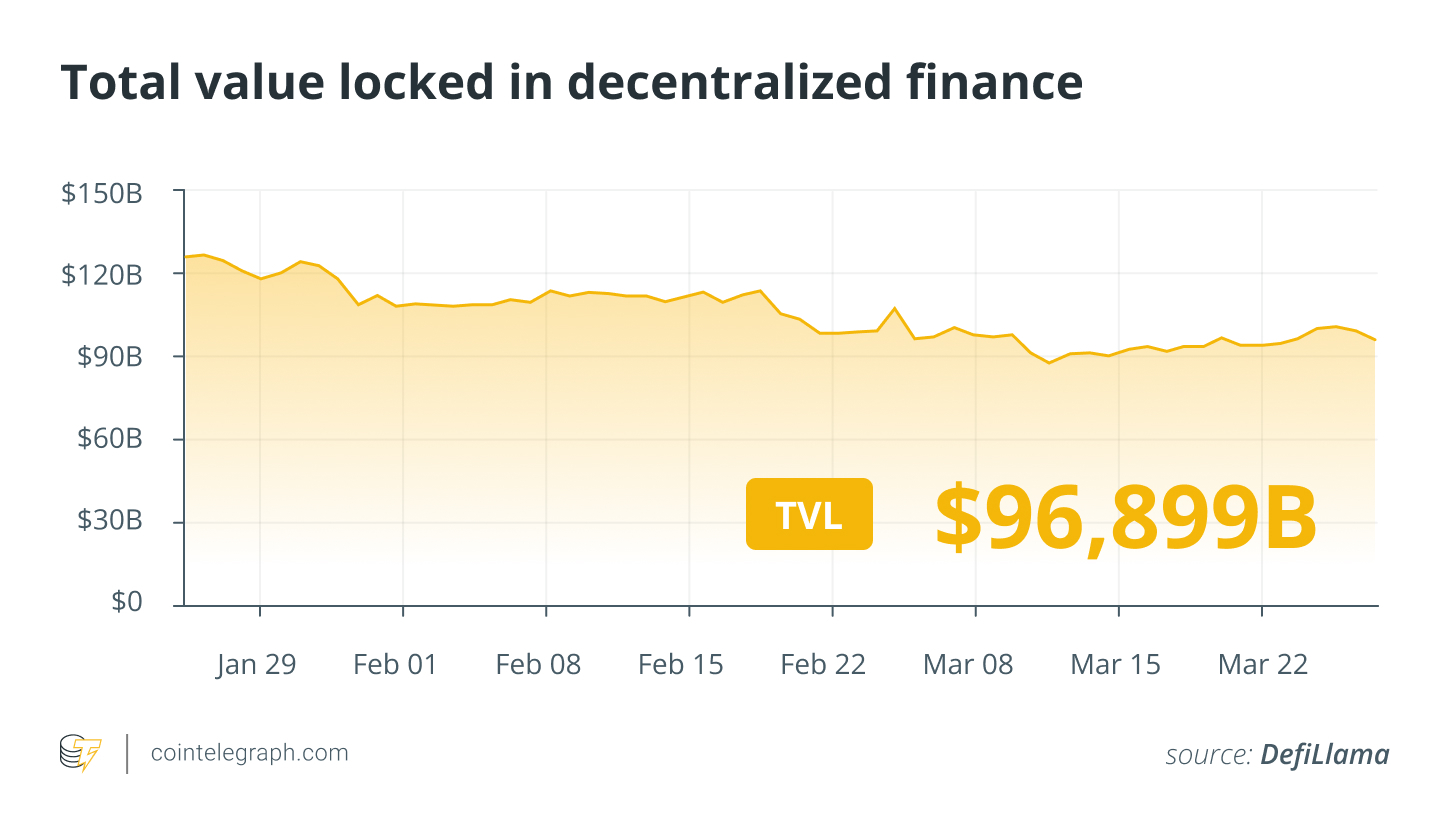

DeFi market overview

Data from market trackers indicates that most of the top 100 cryptocurrencies by market capitalization finished the week on a positive note.

Among these, the BNB Chain-native Four (FORM) token surged over 40% to become the week’s biggest winner, followed by the Cronos (CRO) token, which rose by over 37% despite accusations against a major exchange for allegedly manipulating the CRO token supply after reissuing 70 billion tokens that were claimed to have been permanently burned in 2021.

Total value locked in DeFi. Source: DefiLlama

Thank you for reading our recap of this week’s significant DeFi developments. Join us next Friday for more updates, insights, and educational content on this rapidly evolving sector.