- Bitcoin’s price has been stabilizing within the $85,000 to $88,000 range this week.

- A report from K33 highlights how the markets are relatively steady and gearing up for possible volatility as traders digest the tariff statements.

- PlanB’s S2F model indicates that Bitcoin appears significantly undervalued when compared to Gold and the housing market.

This week, Bitcoin (BTC) has been consolidating between $85,000 and $88,000, moving closer to the lower limit of this range as of Friday. A K33 Research report notes that market conditions are calm, setting the stage for increased volatility as investors respond to tariff news. According to PlanB’s Stock-to-Flow (S2F) model, Bitcoin seems quite undervalued relative to both Gold and the housing sector.

Bitcoin price remains steady ahead of impending tariff announcements

Bitcoin started the week on a positive note, peaking at $88,765 on Monday after a 4.25% recovery the week prior. This increase followed a Wall Street Journal article suggesting that the White House was refining its tariff strategy for the April 2 deadline, potentially avoiding specific industry tariffs while implementing reciprocal duties on key trading partners of the US. This news generated a sense of optimism within the cryptocurrency market, driving prices up and allowing Bitcoin to surpass the $88,000 threshold.

On Tuesday, K33’s “Ahead of the Curve” report observed that the current market situation is relatively stable but poised for volatility in light of the upcoming tariff announcements. The report suggests that the market’s calm demeanor could persist until President Donald Trump’s significant tariff announcement scheduled for April 2, which is anticipated to trigger a surge in activity across the cryptocurrency and broader financial markets, akin to the sharp shifts witnessed following Canadian and Mexican tariff news earlier this quarter.

If President Trump adopts a more lenient approach, the markets could rally. Conversely, unclear statements could result in turmoil for both long and short positions. A stringent stance, however, could lead to a steep decline reminiscent of previous tariff-induced drops.

BTCUSD vs tariff headlines chart.

“If there is back-and-forth maneuvering, we might see a market environment similar to February and early March, when tariffs were the primary focus. Although the US economy remains robust, many anticipate a slowdown due to tariffs — a risk already largely factored in by economists,” notes a K33 analyst.

Nevertheless, on Wednesday, President Trump declared a 25% tariff on automobile imports, effective from April 3, along with a long-expected set of reciprocal tariffs against America’s largest trading partners. “Any further retaliatory measures from these economies could introduce a fresh wave of uncertainty into an already unstable global trade framework,” adds an analyst from QCP Capital.

To better understand how these tariff policies might affect cryptocurrency markets, insights from various experts in the crypto realm were gathered in this report.

Corporate interest in BTC rises as GameStop joins the fold

Interest from corporate entities in Bitcoin is escalating. This week, GameStop (GME), the US video game retail giant, revealed that it has revised its investment strategy to include Bitcoin as a treasury reserve asset. The following day, the company announced its intent to issue $1.3 billion in senior convertible notes with a 0% interest rate via a private offering to investors.

GameStop follows in the path of MicroStrategy, which recently purchased 6,911 BTC for $584.1 million and currently holds a total of 506,137 BTC, acquired for $33.7 billion at an average cost of $66,608 per Bitcoin, positioning it as the largest corporate Bitcoin holder.

This move aligns with an overarching trend of corporate Bitcoin acceptance, partly triggered by a recent executive order from President Trump to create a strategic cryptocurrency reserve using government-held tokens. As of February 1, GME had $4.7 billion in cash and cash equivalents.

Bitcoin appears undervalued against Gold and the housing market

The creator of the Stock-to-Flow (S2F) model stated that Bitcoin is significantly undervalued compared to Gold and the housing market.

His analysis shows that Bitcoin’s market capitalization stands at $2 trillion, while Gold’s total market cap is at $20 trillion. The scarcity of Bitcoin (S2F ratio) is 120 years versus Gold at 60 years, suggesting substantial potential for growth in this current cycle.

Bitcoin looks extremely undervalued compared to gold and the housing market. Bitcoin market cap is $2T versus gold $20T. Bitcoin scarcity (S2F-ratio) is 120 versus gold 60 years. Let’s see what this halving cycle will bring. pic.twitter.com/7Xs6rFpaMB

— PlanB (@100trillionUSD) March 27, 2025

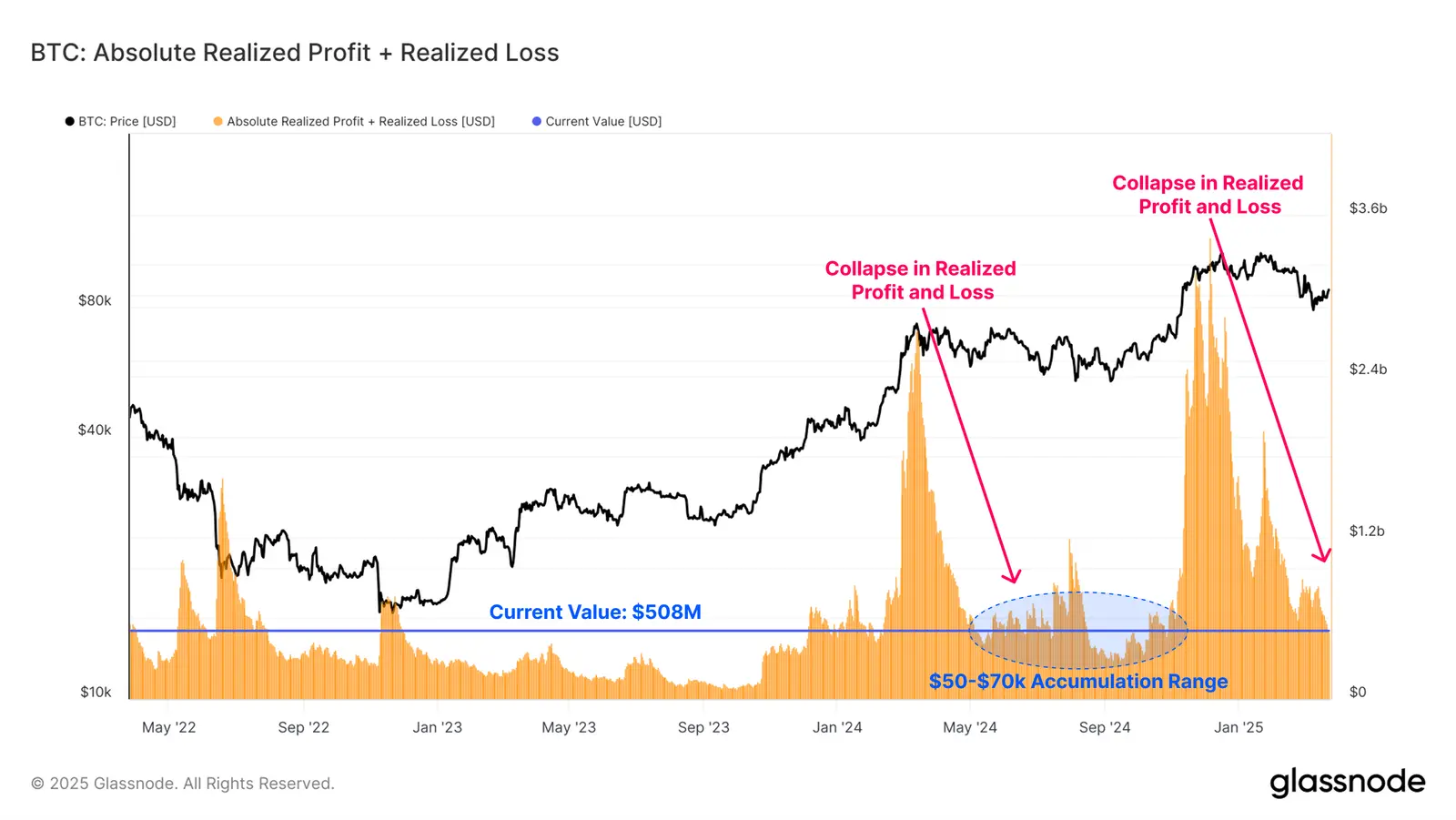

The recent report from Glassnode underlines the current Bitcoin market trading within a new band of $78,000 to $88,000. It notes that profit-taking and loss events on-chain are decreasing in intensity, indicating weakened demand and diminished sell-side pressure.

Additionally, the report highlights that short-term holders are facing notable financial strain, with a significant portion of their holdings now underwater compared to the original purchase price, as illustrated in the graph below.

-638787560387691904.webp.webp)

Bitcoin STH percentage supply in loss chart.

“While short-term holders are mostly incurring losses, long-term holders appear to be entering an accumulation phase once again, with expectations of their collective supply increasing in the weeks and months to come,” remarks a Glassnode analyst.

BTC: Absolute realized profit + realized loss chart.

Technical analysis reveals a range-bound market for Bitcoin

After exceeding and closing above the 200-day Exponential Moving Average (EMA) on Sunday, Bitcoin’s price has been consolidating between $85,000 and $88,000 throughout the week. As of Friday, BTC is slightly down, nearing the lower edge of this range.

Should BTC fall below this range — roughly aligning with the 200-day EMA at $85,500 — it could extend its decline to test the next support level around $78,258.

The Relative Strength Index (RSI) on the daily chart is hovering around the neutral level of 50, indicating a lack of momentum.

BTC/USDT daily chart

However, if the 200-day EMA serves as support and BTC manages to surpass the descending trendline (which connects several highs since mid-January) — aligning with the upper boundary of the recent range — this could result in an upward movement toward the psychological level of $90,000 and the prior peak of $95,000 on March 2.

FAQs on Bitcoin, altcoins, and stablecoins

Bitcoin stands as the leading cryptocurrency by market capitalization, designed to function as a form of money. This type of payment is not controlled by any individual, group, or entity, eliminating the requirement for third-party involvement in financial transactions.

Altcoins refer to any cryptocurrency other than Bitcoin, although some consider Ethereum to be outside this category since these two coins are the primary sources of forks. If this viewpoint holds, then Litecoin is considered the first altcoin, created from the Bitcoin protocol and thus an “enhanced” version of it.

Stablecoins are cryptocurrencies crafted to maintain a consistent price, with their value supported by reserves of the respective assets. To maintain stability, each stablecoin’s value is pegged to a commodity or financial asset, like the US Dollar (USD), with supply controlled by an algorithm or demand. The primary goal of stablecoins is to provide an accessible entry and exit point for investors involved in cryptocurrency trading and investment, while also serving as a means to store value amid the inherent volatility of cryptocurrencies.

Bitcoin dominance refers to the ratio of Bitcoin’s market capitalization compared to the total market cap of all cryptocurrencies combined. It offers insight into Bitcoin’s popularity among investors. Generally, a high BTC dominance is noted prior to and during a bull market, where investors tend to favor more stable, high-cap cryptocurrencies like Bitcoin. A decline in BTC dominance often signifies that investors are reallocating capital or profits towards altcoins in pursuit of higher returns, leading to altcoin rallies.