The rise of one major cryptocurrency exchange as the predominant node operator on the Ethereum network is drawing attention to concerns about centralization, which could intensify with increasing institutional uptake, according to industry leaders.

On March 19, the exchange released a document indicating that it managed over 11% of the staked Ether (ETH), outpacing all other operators within the Ethereum ecosystem.

Karan Sirdesai, the CEO of a Web3 startup, pointed out that this trend underscores a fundamental flaw in Ethereum’s staking model.

“We are establishing a scenario where a small number of significant players disproportionately influence network security, which undermines the essential principle of decentralization,” Sirdesai remarked.

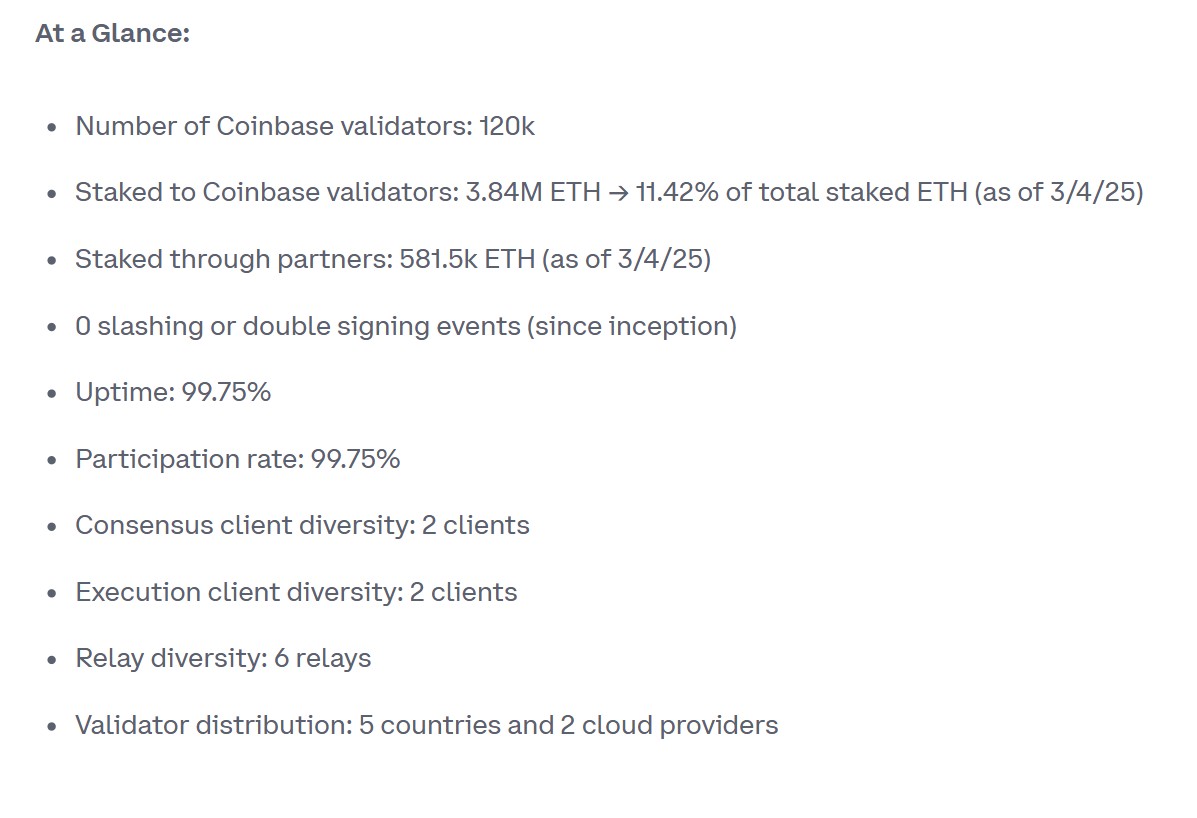

The findings revealed that the exchange controlled 3.84 million ETH across 120,000 validators, amounting to 11.42% of staked Ether as of March 4.

In contrast, a liquid staking protocol currently holds a larger total of staked Ether — around 9.4 million ETH, based on available information.

However, the staked Ether on this protocol is distributed among numerous independent node operators, as noted by an industry expert in a March 19 commentary.

To mitigate risks, the exchange distributes its staking operations across five countries and utilizes various cloud providers, Ethereum clients, and relays, as outlined in its document. “Ensuring diversification at the network level and maintaining the overall health of the network is a top priority for us, which is why we conduct regular checks on network distribution,” the company stated.

The exchange is the leading operator on the Ethereum network.

Related: Analysts predict significant growth for Ether ETFs in 2025

Centralization Challenges Ahead

The concentration within the Ethereum network may escalate if US exchange-traded funds (ETFs) are allowed to engage in staking, a priority for major asset managers.

As the foremost custodian for US crypto ETFs, the exchange manages ETH for eight out of nine US spot Ether funds, according to their January update.

“Such network consolidation comes with heightened risks of censorship and diminished network resilience,” stated Temujin Louie, CEO of a blockchain interoperability protocol.

For example, high levels of staking concentration can represent vulnerabilities under regulatory scrutiny. “These prominent staking entities will likely prioritize compliance over resistance to censorship when confronted with difficult decisions,” Sirdesai explained.

Additionally, new regulatory frameworks in the US permitting banks to act as validators for blockchain networks contribute to these centralization challenges, as indicated by several executives in the cryptocurrency sector.

“If excessive stake consolidates with regulated entities, the Ethereum network could resemble traditional financial systems,” Louie warned.

On a positive note, a rise in institutional validators might enhance diversification in staking. One major crypto exchange is particularly well-positioned to challenge the dominant player in this space, according to Sirdesai.

This exchange already possesses the necessary infrastructure, user base, and technical prowess to swiftly enter the staking sector. They could potentially outpace traditional banks in challenging the leading operator’s dominance,” Sirdesai asserted.

Magazine: Ethereum Layer 2 solutions expected to achieve interoperability ‘within months’ — Comprehensive overview