The familiar four-year cycle in the crypto market that traders and investors have relied upon is becoming less noticeable, attributed to the growth of cryptocurrency as a legitimate asset class and the increasing involvement of institutional players, as stated by Polygon co-founder Sandeep Nailwal.

In a recent discussion, Nailwal observed that overall speculative activity has diminished due to elevated interest rates in the U.S. and conditions of low liquidity. He anticipates a resurgence in activity once interest rates decrease and the current administration settles into its role.

Though interest rates on 10-year Treasury bonds have notably decreased, they remain relatively high. Source: TradingView

Nailwal mentioned that he still predicts 30-40% drawdowns between cycles and expects the Bitcoin (BTC) halving to influence markets, but the traditional four-year cycle has become less distinct. He remarked:

“Historically, we’ve observed 90% drawdowns between cycles, which is typical for crypto. I believe these drawdowns will be less severe and appear more professional and mature, especially for the top crypto assets.”

The Polygon founder concluded that when the upward trend resumes and the crypto markets enter a significant bull run, capital is likely to shift from larger-cap assets to smaller-cap ones.

Related: BTC’s dominance has been rising since 2023; has altseason become a thing of the past?

Factors Influencing the Four-Year Cycle

One factor that analysts suggest is impacting the four-year market cycle is the executive order by U.S. President Donald Trump aimed at creating a Bitcoin strategic reserve.

The Trump administration’s pro-crypto initiatives have also helped legitimize cryptocurrency among institutional investors, potentially leading to increased capital inflows and reduced volatility for digital assets.

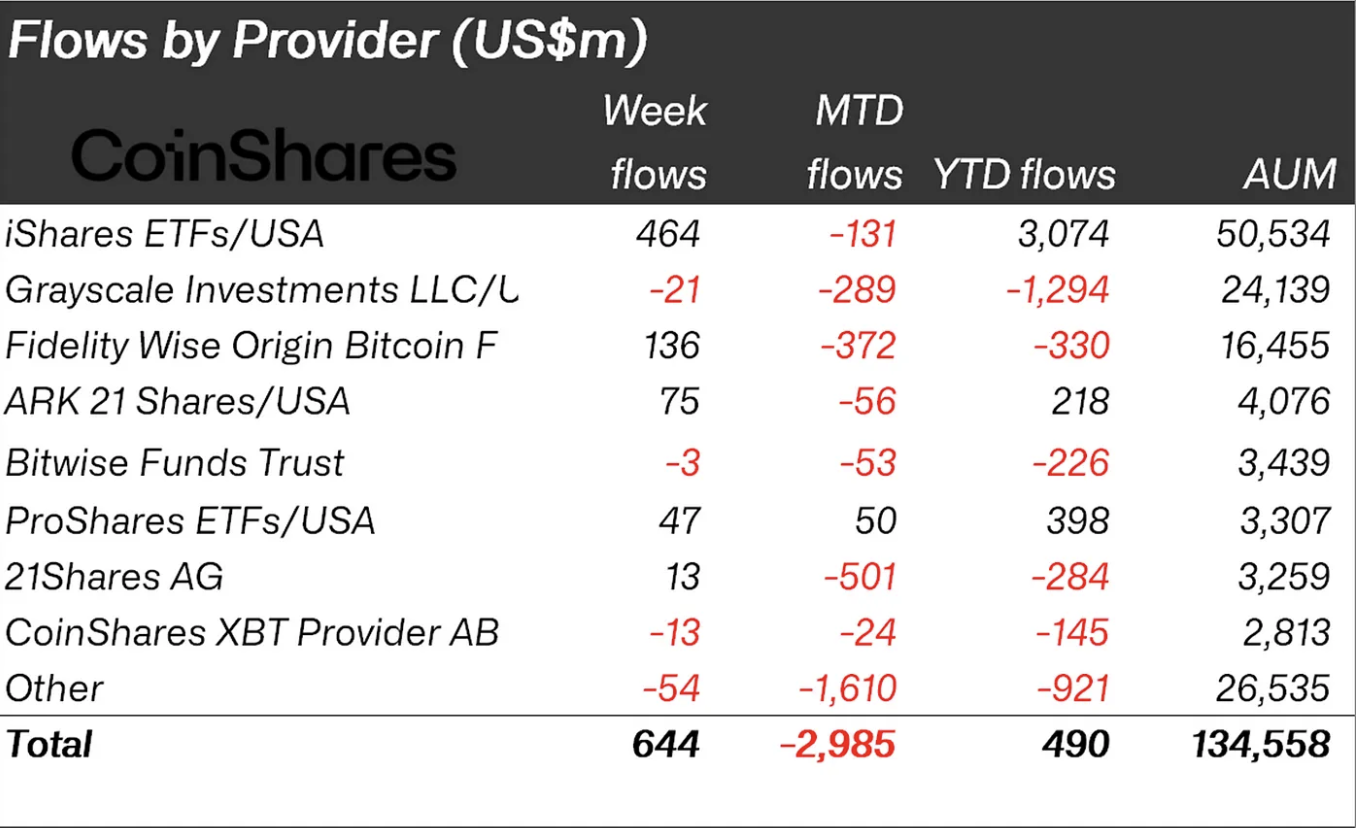

Capital flows into crypto ETFs for the week of March 21. Source: CoinShares

The emergence of exchange-traded funds (ETFs) has further disrupted the four-year cycle, bolstering the prices of digital assets associated with ETFs and locking up capital in these investment vehicles.

Since ETFs are traditional financial products that do not transfer actual digital assets to the holder, they restrict the flow of capital into other investments.

Macroeconomic conditions and geopolitical instability also play a disruptive role in market cycles, prompting investors to seek stability in cash and government securities rather than riskier assets.

Magazine: As Trump’s polling improves, Bitcoin may ‘start ripping’: Felix Hartmann, X Hall of Flame