The price of Ether (ETH) experienced a decline of 9.3% from March 26 to March 28, testing the $1,860 level for the first time in a fortnight. This price correction resulted in over $114 million in liquidations of leveraged ETH futures and caused the premium compared to the standard spot market to fall to its lowest mark in over a year.

Some traders have interpreted the diminished ETH futures premium as a potential bottom signal, but let’s examine the data more closely to evaluate this viewpoint.

ETH 1-month futures premium relative to spot markets.

Typically, Ether’s monthly futures trade above the spot price, as sellers seek compensation for the extended settlement period. A premium ranging from 5% to 10% on an annualized basis generally indicates neutral market conditions, reflecting opportunity costs and exchange risk. However, on March 8, ETH futures fell below this threshold after a 24% price decline over the preceding two weeks.

The current 2% annualized premium for ETH futures indicates a lack of interest in leveraged buying. This measure is highly sensitive to recent price changes. For instance, on October 10, 2024, the ETH futures premium dropped to 2.6% following a 14% price correction in two weeks, but it rebounded to 7% as ETH recovered much of its losses. In essence, the futures premium rarely indicates shifts in spot price trends.

Whales are cautious about declining Ether prices

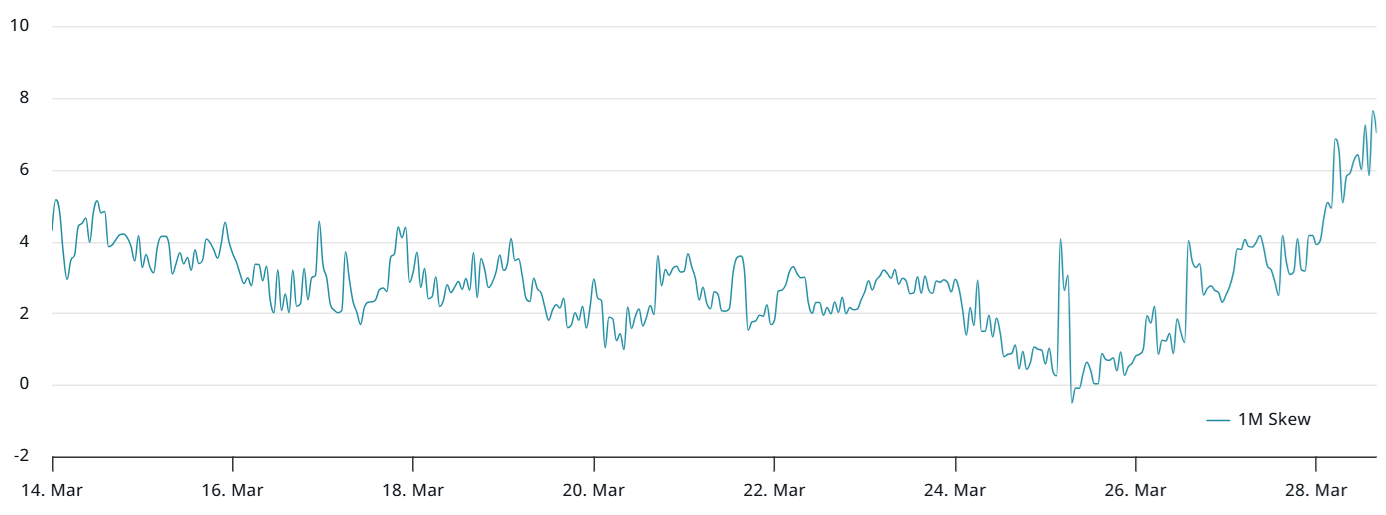

To assess whether larger investors are losing interest in Ether, it’s essential to analyze how the market is valuing put (sell) options compared to call (buy) options. A rise in the 25% delta skew above 6% suggests traders expect a price drop and are seeking hedging strategies. Conversely, bullish sentiments tend to push the skew below -6%.

Ether 1-month options 25% delta skew (put-call).

Currently, the ETH options’ 25% delta skew at 7% indicates hesitancy among professional traders, thereby increasing the possibility of continued bearish momentum.

From the perspective of the derivatives market, there are few signals suggesting that the recent price correction in ETH has hit a bottom. Essentially, investors lack confidence that the support at $1,800 will hold.

Some analysts point out that the sharp decrease in Ethereum network activity is a primary reason for the waning interest in ETH, while others believe that the progress toward layer-2 scalability has significantly reduced the potential for base chain fees. Given that compensating network validators requires additional ETH issuance, the lack of capital influx negatively impacts the returns on native staking.

The Ethereum network is facing significant competition

Trying to understand the motivations behind seller behavior is challenging, especially considering that Ethereum’s competition has broadened from blockchains like BNB Chain and Solana to networks designed to address specific challenges. For example, Hyperliquid specializes in synthetic assets and perpetual trading, while Berachain appears to be better suited for staked assets in cross-liquidity pools.

Related: Timeline: Jelly token declines following $6M exploit on Hyperliquid

The success of specific decentralized applications (DApps) could ultimately jeopardize Ether’s position. For instance, Ethena, the synthetic dollar protocol operating on Ethereum, is moving towards its own layer-1 blockchain. This project currently holds $5.3 billion in total value locked (TVL) and secured $100 million in December 2024 to facilitate this transition.

However, it might be premature to assert that ETH prices will continue to decline, particularly with a significant protocol update just weeks away. Investors should closely monitor the practical advantages stemming from Ethereum’s Pectra upgrade, especially concerning base layer fees and overall usability for everyday users. Until then, the likelihood of ETH outperforming the broader altcoin market remains low.

This content is for informational purposes only and should not be construed as legal or investment advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of any affiliated entity.