The insurance authority within the European Union has introduced a comprehensive rule that would require insurance companies to hold capital equivalent to the value of their cryptocurrency assets. This measure aims to safeguard policyholders against potential risks.

This new regulation, outlined in a Technical Advice report presented to the European Commission on March 27, would impose significantly stricter standards compared to other asset types, such as stocks and real estate, which have no obligation to be backed at even half their value.

The authority believes that applying a 100% capital requirement in the standard formula is both prudent and appropriate for these assets due to their inherent risks and considerable volatility.

This regulation aims to bridge a gap in the current regulatory framework between the Capital Requirements Regulation and the Markets in Crypto-Assets Regulation, addressing the absence of specific guidelines for crypto assets in the insurance sector.

In January, it was argued that applying a blanket 100% stress factor on crypto assets does not consider lower-risk stablecoins.

The authority proposed four options for the European Commission’s consideration: one — making no changes; two — enforcing an 80% “stress level” on crypto assets; three — implementing a 100% stress level; and the fourth option encourages a broader look at the risks associated with tokenized assets.

The percentages for the stress levels influence the amount of capital firms must maintain to ensure solvency. The third option is deemed the most suitable.

“Applying an 80% stress to the valuation of crypto-asset exposures fails to appear sufficiently cautious,” the authority stated, arguing that a 100% stress is more suitable. This recommendation aligns with one of the transitional handling strategies for crypto assets within the Capital Requirements Regulation.

A 100% stress signifies the assumption that crypto asset prices could drop to zero, and that diversification across various assets would not lessen this risk. The authority pointed out historical declines of up to 82% and 91% for Bitcoin and Ether, respectively.

Imposing a 100% capital charge for crypto assets is a notably stricter policy than that applied to stocks, which range from 39% to 49%, and real estate, which incurs a 25% capital requirement.

It was noted that a 100% capital charge for crypto-related (re)insurance entities should not be excessively burdensome and would not incur significant costs for policyholders. This requirement aims to fully address the risks presented by crypto assets, enhancing protection for policyholders in case of significant exposures in the future.

Despite the relatively small scale of crypto-related (re)insurance undertakings, which amount to 655 million euros or just 0.0068% of total entities in the region, the authority emphasized that these assets are high-risk investments that could lead to total value loss, explaining its recommendation for the third option.

Luxembourg and Sweden might be most impacted by the new rule

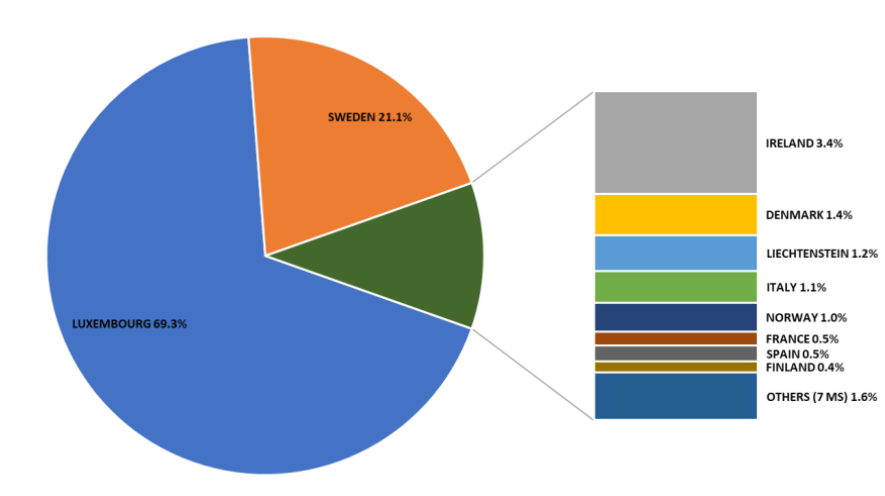

According to a report from late 2023, insurers in Luxembourg and Sweden are likely to be the most affected by this proposed regulation, as these two nations accounted for 69% and 21% respectively of all crypto asset-related exposures among (re)insurance firms.

Ireland, Denmark, and Liechtenstein also contributed minor percentages to the total exposure, standing at 3.4%, 1.4%, and 1.2% respectively. Most of these exposures are structured within funds, such as exchange-traded funds, managed on behalf of unit-linked policyholders.

Geographical distribution of crypto-asset exposure in Europe as of Q4 2023.

The authority also noted that as the adoption of crypto assets potentially grows in the future, there may be a need for a more nuanced approach to regulation.