The New York Stock Exchange has placed a Short Sale Restriction (SSR) on GameStop following a surge in its trading volume that echoed the company’s notable short squeeze in 2021.

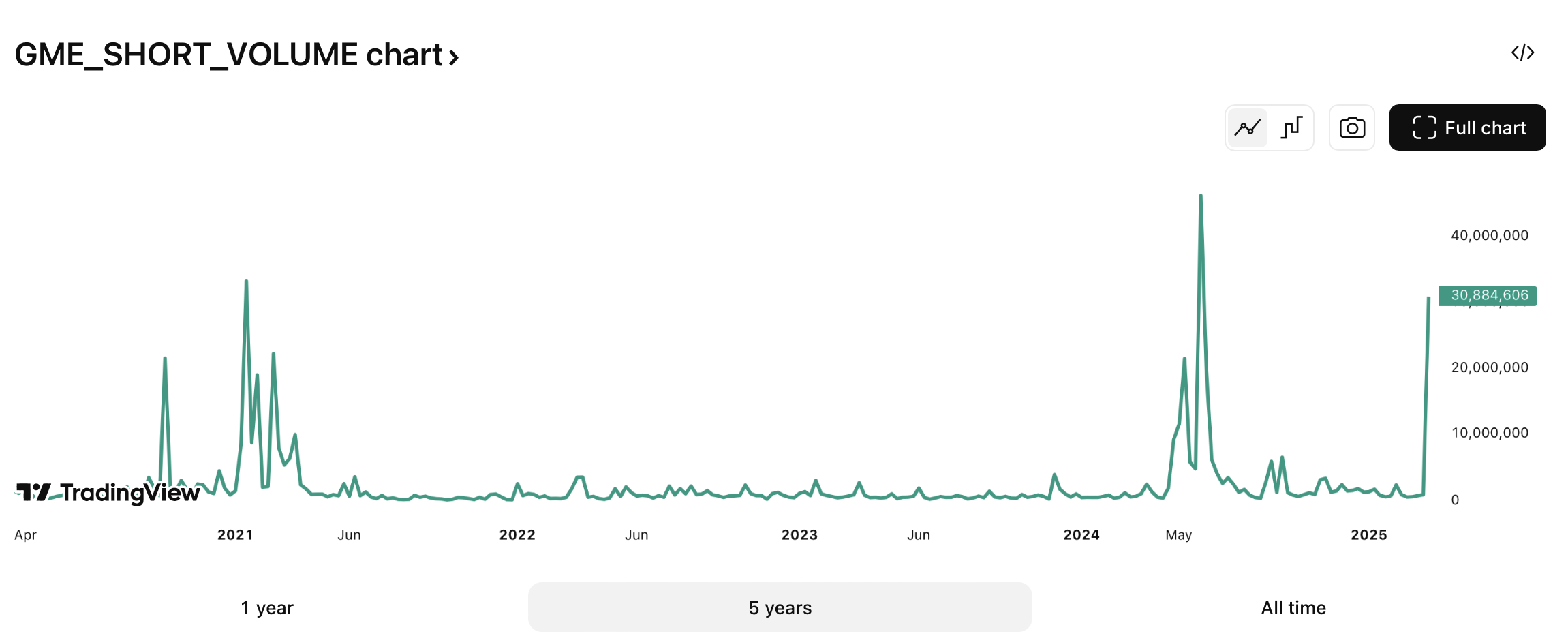

The short sales volume for GameStop climbed a staggering 234% within a 24-hour period, amounting to 30.85 million shares sold on March 27, based on data from TradingView.

This restriction activates when a stock’s price falls more than 10% from the previous day’s closing value. On the trading day in question, GameStop’s stock plummeted by 22%, erasing its earlier 12% gain attributed to a Bitcoin announcement, as outlined by Google Finance data.

At the time of this report, GameStop (GME) was priced at $22.09.

GameStop Short Volume Approaches 2021 Squeeze Highs

The SSR is enforced throughout the current trading day and the following one. Kevin Malone, president and CEO of Malone Wealth, noted on March 27 that GameStop transacted 50 times more shares that day compared to the previous Thursday, which he argues indicates a possibility of naked short-selling.

GameStop’s short sale volume reached 30.88 million on March 27.

This trading volume is approaching the historic highs seen in January 2021, when GameStop shares skyrocketed amid a short squeeze that inflicted substantial losses on hedge funds and allowed some retail investors to achieve notable profits. The peak during that month was 33.26 million shares on January 19.

GameStop’s Bitcoin Acquisition Plans Raise Eyebrows

While GameStop has not disclosed the exact quantity of Bitcoin it intends to purchase, the company revealed a $1.3 billion convertible notes offering after markets closed on March 26.

Yet, the decision to enter the Bitcoin market has drawn skepticism from various analysts and commentators. In a discussion with Yahoo Finance on March 27, Tastylive founder and CEO Tom Sosnoff expressed that GameStop’s intent to buy Bitcoin feels somewhat reminiscent of dot-com-era decisions.

Commentary on GameStop’s Bitcoin strategy.

Sosnoff remarked, “It seems a bit like adding a dot-com to a name or using excess cash to purchase Bitcoin due to an inability to find a more beneficial company to invest in.”

Similarly, Bret Kenwell, a U.S. investment analyst at eToro, noted to Reuters on March 27 that “investors may not be overly confident about the core business.”

Highest Short Sales Day Still Registering Keith Gill’s Comeback

The record for the highest short sales day remains June 3, 2024, with 46.20 million shares traded. This period coincided with Keith Gill, a trader recognized for his role in the GameStop short squeeze in 2021, disclosing that he had resumed trading GameStop stock with a capital of $180 million.

GameStop indicated that it intends to use the funds from the convertible senior notes—debt that can later be converted to equity—for various corporate purposes, including Bitcoin acquisitions.

Some believe the announcement regarding the convertible notes contributed to the stock’s decline. One analyst pointed out the resemblance to past situations where companies suffered stock dips after announcing similar financing strategies, which later became advantageous as the markets responded positively.

“It appears GME is – following a similar pattern … If either GME or Bitcoin sees significant upward movement, we could witness a compelling trading scenario given the potential for a squeeze,” the analyst added.

This article does not contain investment advice or recommendations. All investments and trading carry risks, and readers are encouraged to conduct their own research before making decisions.