Recent years have been quite eventful for GameStop, the once-declining video game retailer that has transformed into a prominent meme stock. After narrowly avoiding bankruptcy in 2021 due to a dramatic rise in its stock price, the company has since made thoughtful business moves, including reducing its physical store presence and concentrating on higher-margin products.

Currently, GameStop is looking to enhance its sustainability by delving into Bitcoin investments. This strategy appears to have benefited Strategy, a business intelligence company turned Bitcoin advocate, which has successfully acquired over 500,000 BTC via ongoing purchases. Despite the considerable market volatility, Strategy’s stock has soared by more than 2,100% since its initial Bitcoin acquisition in 2020.

GameStop has managed to meme its way back into the spotlight—who’s to say it can’t secure at least the next ten years of operations by capitalizing on the Bitcoin trend?

This week’s Crypto Biz newsletter highlights GameStop’s Bitcoin investment, the allure of tokenization, and the resurgence of Bitcoin mining revenues.

GameStop: Adopting the Strategy Method

On March 25, GameStop announced that its board had approved plans to invest in Bitcoin and U.S.-dollar-pegged stablecoins. Given the company’s substantial cash reserves of nearly $4.8 billion, this initiative could create a significant impact. This marks a remarkable increase from approximately $922 million just a year before.

Moreover, it’s plausible that GameStop’s CEO, Ryan Cohen, may have been influenced by Michael Saylor following their meeting earlier in February. Cohen acknowledged the gathering by sharing an uncaptioned photo of himself with Saylor on February 8.

Image source: Ryan Cohen

Saylor, for his part, continues to aggressively grow his Bitcoin holdings. Earlier this week, he revealed that Strategy had added another 6,911 BTC to its collection, raising the total to 506,137 BTC.

Real Estate Tokenization on Polygon

DigiShares has debuted a real estate trading platform on Polygon, offering investors a liquid method to engage with commercial and residential properties.

The platform, known as RealEstate.Exchange (REX), launched with two high-end property listings in Miami, including a 520-unit tower and a 38-unit residential complex.

A Google street view of one of the listings, The Legacy Hotel & Residences in Miami, Florida. Source: Google Maps

The CEO of DigiShares, Claus Skaaning, shared that REX has plans for five or six additional properties, emphasizing that in the future, REX will cater to various types of commercial and residential real estate.

REX operates in the U.S. under a license agreement with Texture Capital, a broker-dealer registered with the Securities and Exchange Commission, and aims to secure registrations in the European Union, South Africa, and the United Arab Emirates as well.

CME Group Ventures into Tokenization

The CME Group, one of the largest exchanges for derivatives globally, has partnered with Google Cloud to introduce its asset tokenization initiative.

This program will utilize the Google Cloud Universal Ledger (GCUL) to tokenize traditional assets on the blockchain, which is expected to enhance the efficiency of capital markets and wholesale payments.

Tokenization could result in “substantial efficiencies for collateral, margin, settlement, and fee payments as the market moves towards 24/7 trading,” according to Terry Duffy, Chairman and CEO of CME Group.

While CME hasn’t disclosed specific assets targeted for the tokenization pilot, testing with market participants is slated to begin next year.

Bitcoin Mining Revenue Stabilizes Post-Halving

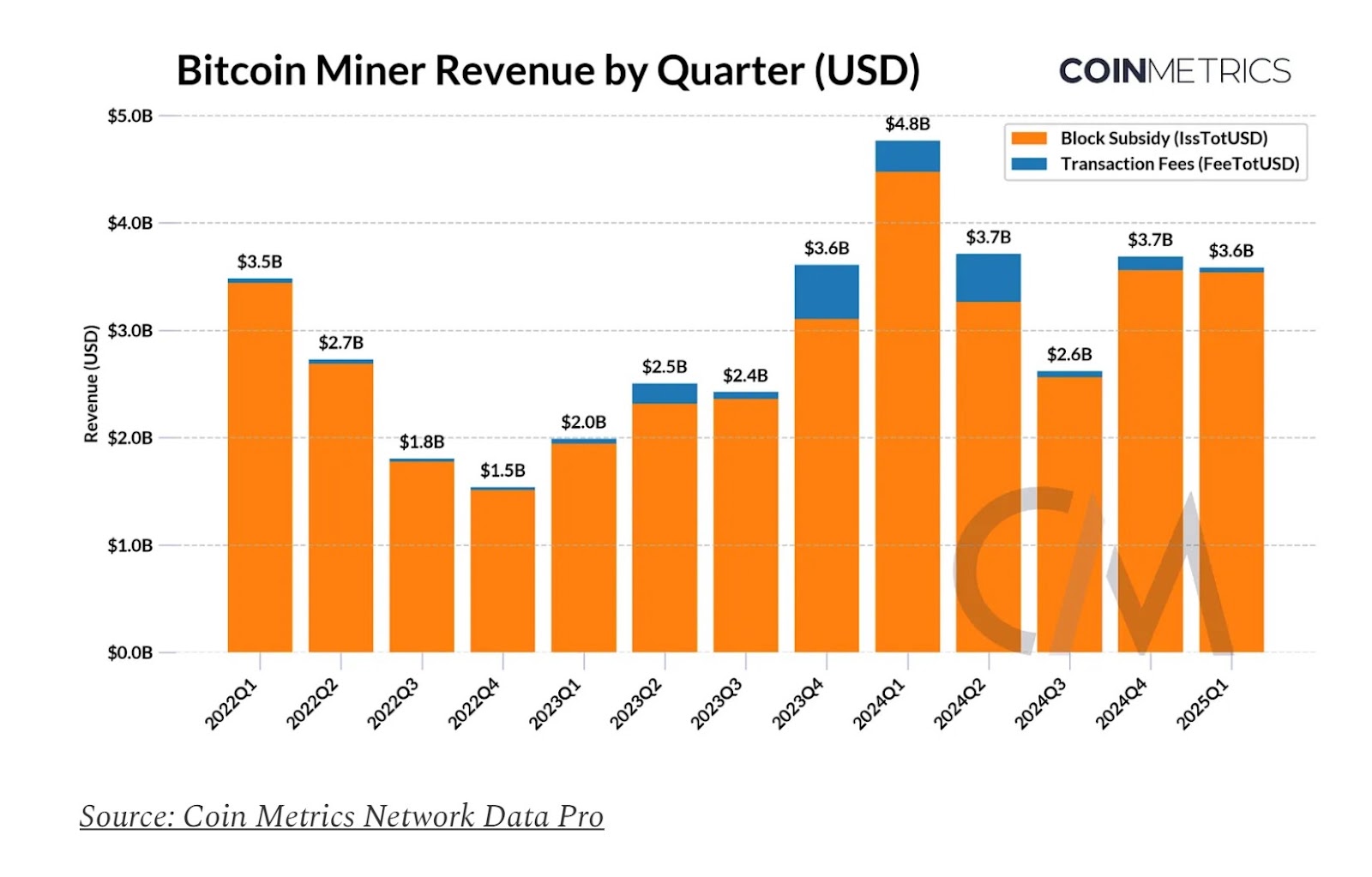

Bitcoin miners are on a path to recovery following the halving event in April 2024, which halved mining revenues from 6.25 BTC to 3.125 BTC.

Data from Coin Metrics indicates that miner revenues approached $3.6 billion in the first quarter, closely aligning with the previous quarter’s $3.7 billion. This represents a significant rebound compared to the $2.6 billion recorded in the third quarter of 2024.

Miners have quickly adapted to the latest quadrennial halving, although revenues are still trailing behind the pre-halving peak from the first quarter of 2024. Source: Coin Metrics

“With nearly a year gone since Bitcoin’s fourth halving, miners have entered a stabilization phase, adapting to decreased block rewards, tighter profit margins, and evolving operational dynamics,” states Coin Metrics.

In spite of challenging market conditions post-halving, some miners are committing to a Bitcoin hodl strategy. The CFO of Hive Digital told reporters that the firm aims to “retain a significant portion of its mined Bitcoin to benefit from potential price appreciation.”

Crypto Biz is your weekly overview of the business aspects of blockchain and cryptocurrency, delivered to your inbox every Thursday.