Important Insights

-

Bitcoin is permitted in Australia and falls under the regulations of AUSTRAC and the Australian Taxation Office (ATO).

-

You can acquire Bitcoin through a variety of platforms, including centralized exchanges, decentralized exchanges (DEXs), peer-to-peer (P2P) networks, and Bitcoin ATMs.

-

There are multiple payment methods available, such as credit cards, debit cards, bank transfers, and cash deposits at ATMs.

-

It’s advisable to store your Bitcoin securely in cold wallets, which offer better protection than custodial wallets from exchanges.

The rate of Bitcoin adoption is on the rise. An increasing number of Australians are recognizing the cryptocurrency as a viable investment option, with ownership increasing from 23% in 2023 to 32.5% projected for 2025, reflecting an overall growth of 41.3%. With the availability of various platforms, purchasing Bitcoin has become both accessible and secure.

This piece explores different methods and provides guidance on how to invest in Bitcoin safely.

Is Bitcoin Legal in Australia?

Yes, Bitcoin is permitted in Australia, though it is not classified as legal tender. The government views cryptocurrencies like Bitcoin (BTC) as property. Any gains from Bitcoin transactions are liable to capital gains tax (CGT), and AUSTRAC ensures compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

There are also various regulatory requirements to consider. AUSTRAC mandates that cryptocurrency businesses adhere to AML and CTF protocols, designed to safeguard Australian investors and maintain the integrity of the crypto market.

A significant regulatory update in 2025 requires major crypto platforms to obtain an Australian Financial Services License (AFSL) to enhance consumer protections, as outlined in recent government proposals.

Fun Fact:Several Australian exchanges provide instant verification, enabling you to start trading Bitcoin in just minutes.

Steps to Purchase Bitcoin in Australia

Before you buy Bitcoin in Australia, proper preparation is crucial. Here are some key points to assist you:

-

Familiarize Yourself with the Legal Framework: While Bitcoin is regulated by AUSTRAC and is considered property, it is not legal tender. The government actively reduces risks, such as money laundering, making cryptocurrency transactions secure.

-

Choose Reliable Platforms for Acquisition: If you’re looking to buy Bitcoin or other cryptocurrencies in Australia, opt for trustworthy platforms. Consider using services like CoinSpot, Swyftx, or Binance, which adhere to local regulations for safe trading. Remember to complete KYC verification. Note that Binance is limited to spot trading as its derivatives license was revoked in 2023.

-

Establish a Non-Custodial Wallet for Self-Custody: Use a non-custodial wallet, like Trust Wallet or Exodus, to maintain control of your private keys. If you plan to store your coins long-term, prefer a cold wallet that keeps your assets offline.

-

Understand Payment Methods and Fees: The fastest and safest transactions are initiated with reliable payment options, including bank transfers, credit cards, or PayID. Always verify transaction fees to avoid unexpected charges.

-

Protect Your Investment: Make security a priority. Activate two-factor authentication (2FA) on your accounts and regularly back up your private keys. Ensure your platform features robust security, such as encryption and cold storage.

How to Purchase Bitcoin in Australia via a Centralized Exchange

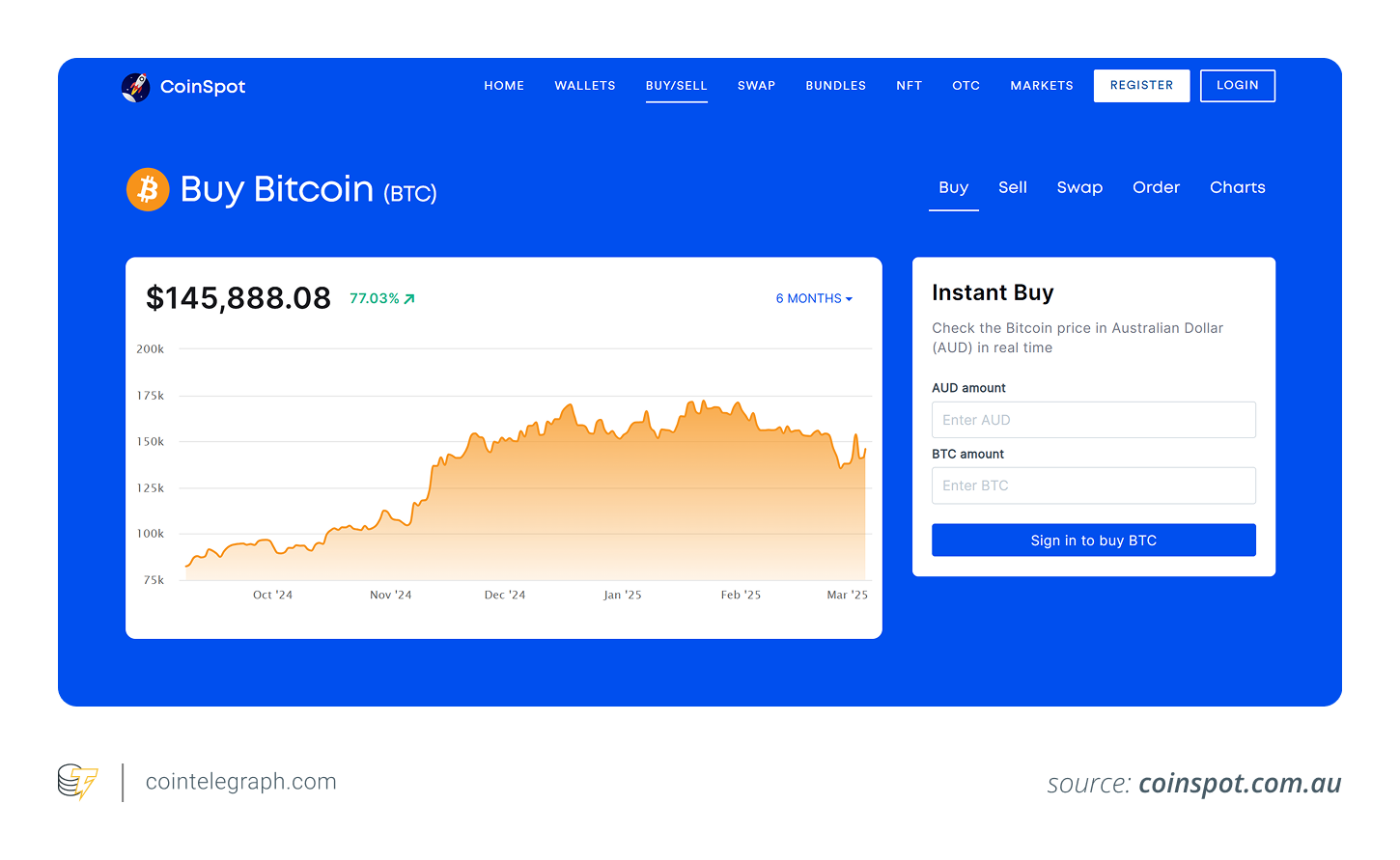

Want to buy Bitcoin through a centralized exchange like CoinSpot? The process is straightforward:

-

Step 1: Create an Account. Register on CoinSpot using your email and a strong password. Complete the KYC process through ID verification to get started. As of 2025, CoinSpot complies with AUSTRAC regulations and the new AFSL requirement, enhancing consumer protection.

-

Step 2: Add a Payment Method. Link a payment option such as bank transfer, debit card, or PayID. CoinSpot offers low-fee methods like bank transfers (free via POLi) and PayID, though credit/debit card payments may incur fees up to 2.58%. Make sure to check these costs in advance.

-

Step 3: Access the Bitcoin Purchase Section. Navigate to the “Buy/Sell” section on CoinSpot’s website or app, and choose Bitcoin from the list of over 350 supported cryptocurrencies.

-

Step 4: Enter the Purchase Amount. Specify how much Bitcoin you wish to acquire in AUD. The platform will display the corresponding Bitcoin based on the current exchange rate.

-

Step 5: Review the Transaction. Go through the details, including fees, before confirming your purchase.

-

Step 6: Confirm and Finalize the Purchase. Click “Buy Now” to complete the transaction. The Bitcoin will immediately appear in your CoinSpot wallet. For added security, consider transferring your BTC to a non-custodial wallet like Exodus to retain complete control over your private keys.

This efficient process makes Bitcoin easily accessible to both beginners and seasoned users in a secure, regulated environment.

How to Purchase Bitcoin in Australia Using a Non-Custodial Wallet

Non-custodial wallets provide you with complete control over your Bitcoin. If you want to learn how to buy Bitcoin using your Trust Wallet, follow these steps:

-

Step 1: Set Up a Trust Wallet. Download Trust Wallet from the App Store or Google Play. Create a wallet, set a secure password, and write down the 12-word recovery phrase.

-

Step 2: Link a Payment Method. Connect a payment method, like a debit card or bank transfer, through MoonPay or Simplex. Make sure to select a service supporting Trust Wallet in Australia.

-

Step 3: Select Bitcoin to Purchase. Tap “Buy” in Trust Wallet, choose Bitcoin (BTC), and enter the amount in AUD. Review the transaction details before confirming your purchase.

-

Step 4: Confirm and Complete the Transaction. After verifying the payment details, tap “Confirm” to finalize the purchase. The Bitcoin will appear in your Trust Wallet as soon as the transaction is processed.

By using a non-custodial wallet, you ensure that your Bitcoin remains under your control, enhancing both privacy and security.

How to Buy Bitcoin in Australia on a Decentralized Exchange (DEX)

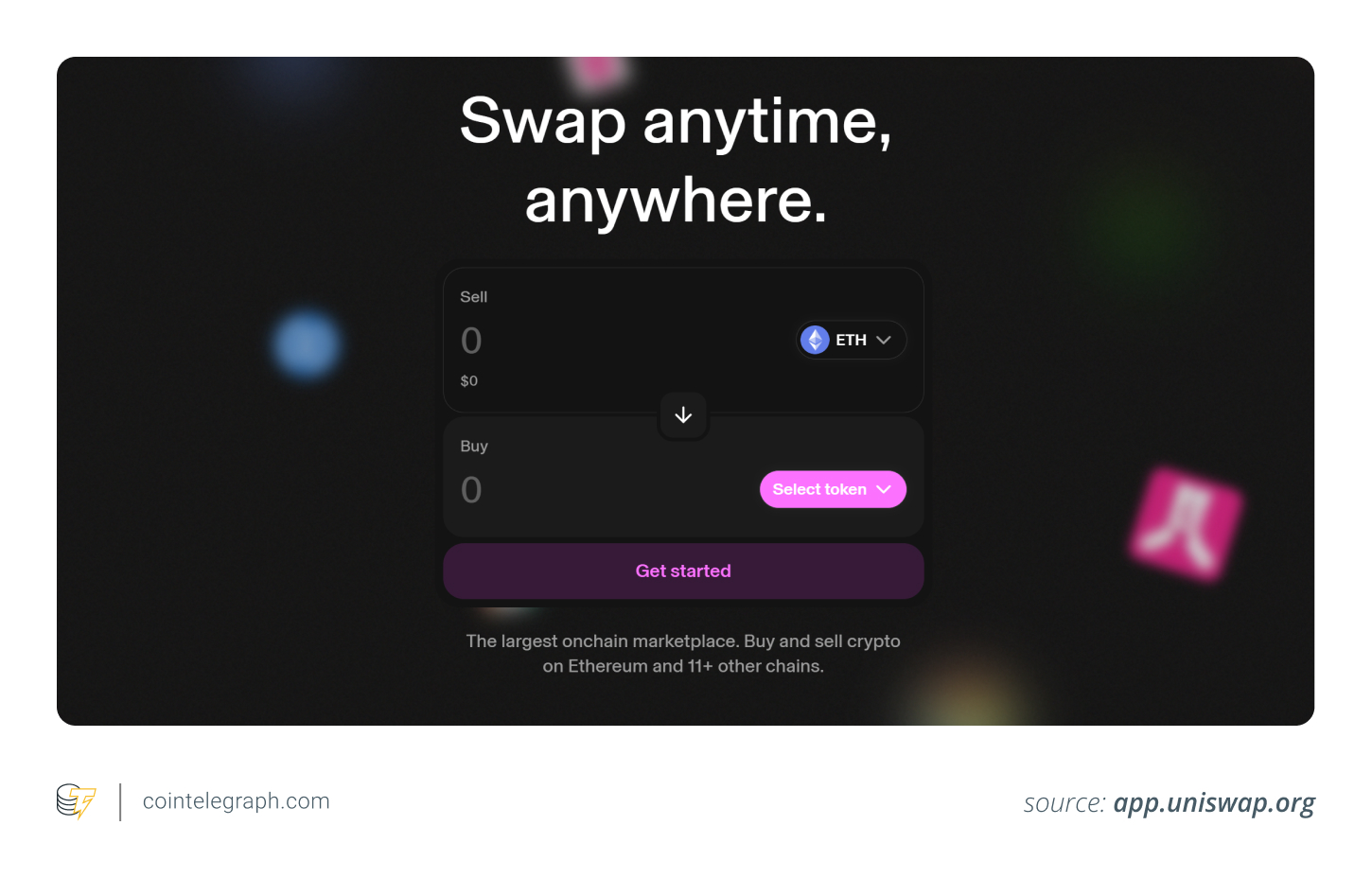

Purchasing Bitcoin on a DEX, like Uniswap, allows you full control over your assets. Here’s how to buy Bitcoin via a DEX:

-

Step 1: Set Up a Crypto Wallet. Download MetaMask and create a wallet. Save your 12-word recovery phrase, and ensure you have ETH in your wallet to cover transaction fees.

-

Step 2: Connect to the DEX (Uniswap). Go to the Uniswap website and click “Connect Wallet.” Choose MetaMask or WalletConnect for mobile access.

-

Step 3: Choose Bitcoin to Purchase. Select ETH as the token you want to exchange for Wrapped Bitcoin (WBTC).

-

Step 4: Verify and Approve the Transaction. Check the transaction details, including the amount of ETH you’re swapping and the amount of WBTC you will receive, and approve the transaction.

-

Step 5: Confirm and Complete the Purchase. Once everything is confirmed, the transaction will be processed on the Ethereum blockchain, and your WBTC will show up in your MetaMask wallet.

Fun Fact:Bitcoin’s popularity in Australia has been increasing, with many Australians incorporating cryptocurrency into their investment strategies.

Buying Bitcoin in Australia Through P2P Platforms

In Australia, P2P platforms like Binance P2P allow you to buy Bitcoin directly from other users, providing flexibility and confidentiality. Here’s how to buy Bitcoin on P2P platforms:

-

Step 1: Create an Account. Sign up and complete KYC verification. Ensure you have your ID ready and verify your contact details. Binance P2P is AUSTRAC-registered and adheres to AML/CTF regulations, making it a trustworthy option for Australians.

-

Step 2: Explore Bitcoin Offers. Browse through available offers, filtering by payment methods (like bank transfer or PayID), prices, or seller ratings. Prioritize sellers with high feedback ratings (e.g., 95%+ positive) and a track record of over 100 completed trades for reliability. Binance P2P features these metrics clearly. By 2025, Binance P2P supports over 31 fiat currencies with more than 700 payment options globally, catering to Australian users.

-

Step 3: Initiate a Trade. Select the amount of Bitcoin or fiat you wish to trade and click “Buy.”

-

Step 4: Make the Payment. Pay using accepted methods like bank transfer or PayID. The platform will hold the Bitcoin in escrow until payment confirmation is complete. PayID transactions are typically instant and free on Binance P2P, while bank transfers may take 1-2 hours. Confirm receipt with the seller through the platform’s messaging system to avoid delays.

-

Step 5: Access Your Bitcoin. Once the seller verifies your payment, the Bitcoin held in escrow will be released to your P2P wallet (e.g., Binance wallet). This often occurs within minutes for instant payment methods like PayID.

For added security, immediately transfer your BTC to a non-custodial wallet such as Trust Wallet or to a hardware wallet like Ledger, as P2P platforms are not ideal for long-term storage.

This P2P approach provides a direct and adaptable method to purchase Bitcoin, with Binance P2P recognized in 2025 for its robust escrow services and extensive payment alternatives. Always verify seller reputation and refrain from making off-platform payments to mitigate risks in line with best P2P trading practices.

Buying Bitcoin Using Bitcoin ATMs in Australia

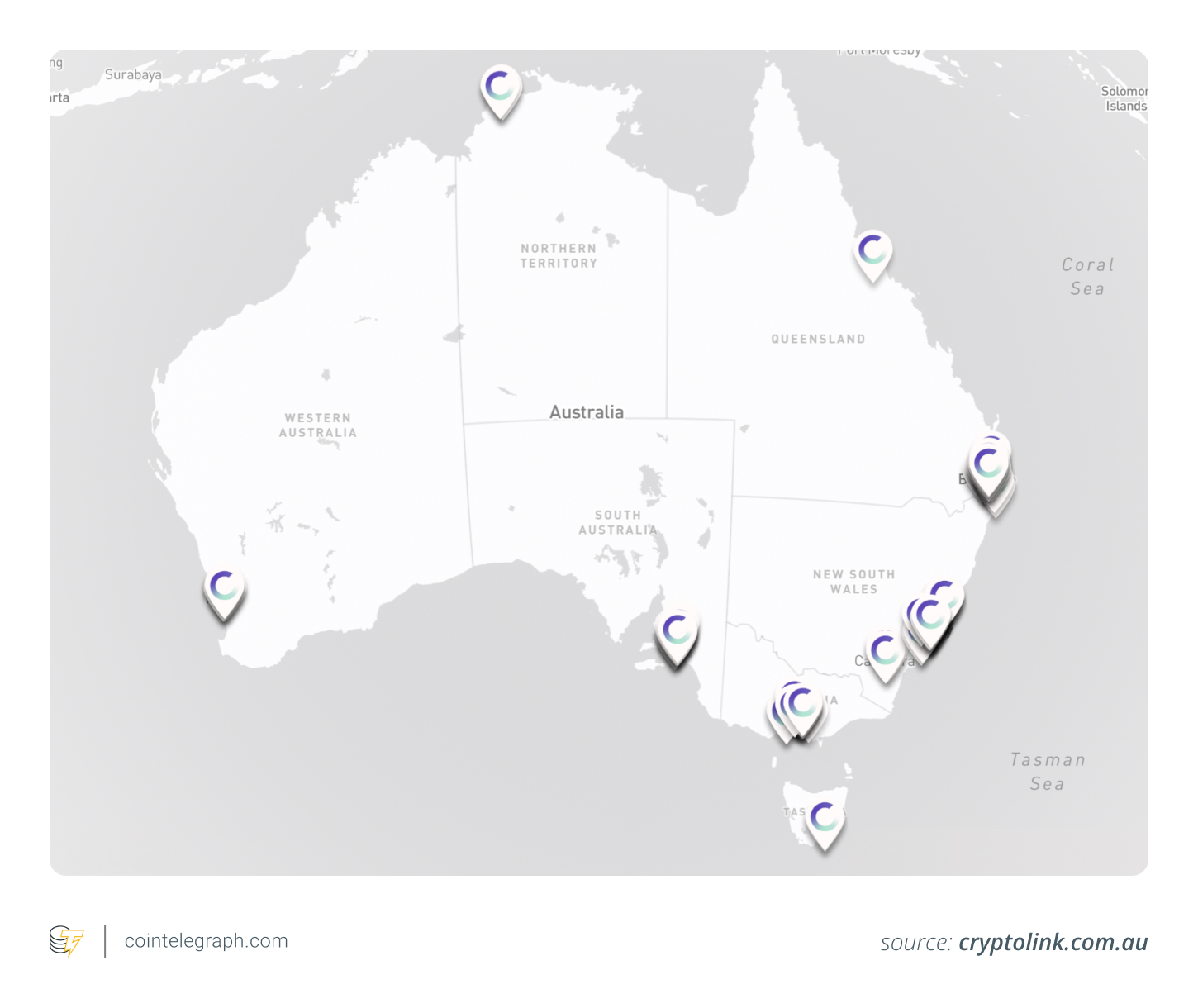

Utilizing a Bitcoin ATM allows for a fast and simple way to purchase Bitcoin. Here’s how it’s done:

-

Step 1: Locate a Bitcoin ATM. Use CoinATMRadar to find Bitcoin ATMs. These machines are typically situated in shopping centers in major Australian cities.

-

Step 2: Verify Your Identity. Most ATMs require a government-issued ID, such as a driver’s license or passport.

-

Step 3: Initiate the Transaction. Select “Buy Bitcoin” and enter the desired purchase amount in AUD or Bitcoin.

-

Step 4: Enter Your Wallet Address. Scan your Bitcoin wallet’s QR code to input the address for receiving Bitcoin.

-

Step 5: Deposit Your Funds. Insert cash into the ATM to finalize the transaction.

-

Step 6: Confirm and Complete the Process. Review the transaction and confirm your purchase. Your Bitcoin will be sent to your wallet after processing.

Quick Tips for Using Bitcoin ATMs in Australia

-

Locate a verified ATM using CoinATMRadar.

-

Bring a pre-set wallet QR code and your ID with you.

-

Compare fees/rates with online alternatives.

-

Use the ATM in a safe, public place.

-

Confirm receipt and keep track of the transaction.

-

Steer clear of unofficial QR codes or support contacts.

-

Start with a small transaction to test the process.

How to Buy Bitcoin ETFs in Australia

Purchasing Bitcoin ETFs in Australia is simple. Just follow these steps:

-

Step 1: Select a Brokerage Platform. Create an account on a brokerage that offers Bitcoin ETFs available on the ASX, ensuring it complies with local financial regulations.

-

Step 2: Complete KYC Verification. Submit proof of identity and address for verification.

-

Step 3: Fund Your Account. Deposit money into your account using secure options like bank transfers.

-

Step 4: Search for Bitcoin ETFs. Utilize the platform’s search tool to find Bitcoin ETFs, such as the VanEck Bitcoin ETF (VBTC) or Global X 21Shares Bitcoin ETF (EBTC).

-

Step 5: Place Your Order. Decide how many units you wish to purchase and choose between a market or limit order.

-

Step 6: Confirm Your Transaction. Review and confirm your purchase. The ETF units will be added to your portfolio once the transaction is finalized.

Fun Fact:Bitcoin ETFs in Australia are closely monitored by regulatory bodies to ensure transparency and protect investors’ interests.

Best Practices for Buying Bitcoin in Australia

After acquiring Bitcoin, store it securely through a reputable platform that adheres to regulations. Ensure your internet connection is safe and enable two-factor authentication (2FA) for enhanced security.

Select cost-effective payment options like bank transfers rather than credit cards. Once you purchase Bitcoin, transfer it to a non-custodial wallet to maintain full control over your private keys.

Consider using a cold wallet for optimum security. Stay updated on market trends, tax responsibilities, and regulatory changes to effectively safeguard your investments, as the cryptocurrency landscape evolves quickly, and keeping informed will aid in making informed investment choices while complying with Australian laws.