Concerns over irregular trading prompted decentralized exchange Hyperliquid to remove the Jelly-my-Jelly (JELLY) memecoin from its listings, as details of an exploit unfolded over several days.

The decentralized finance landscape has already experienced significant exploits in 2025, grappling with ongoing issues related to oversight and security. Notably, the Bybit hack saw hackers linked to North Korea make off with $1.4 billion in February alone.

The JELLY situation, where a whale took advantage of Hyperliquid exchange’s liquidation parameters and absconded with millions, marks yet another incident shaking the industry.

Critics have taken aim at Hyperliquid’s response to the short squeeze, with some drawing parallels to the troubled FTX. Here’s a recap of how events transpired.

Jelly token value plummets before Hyperliquid exploit

Launched by Venmo co-founder Iqram Magdon-Ismail as part of the JellyJelly Web3 social media initiative, the JELLY token saw its price tumble from $0.21 to a mere $0.01 within ten days following its January 30 debut.

The Jelly-my-Jelly token price lost the bulk of its value during its first two weeks of trading.

Initially boasting a market cap of nearly a quarter billion dollars, the value dwindled to approximately $25 million by March 26.

A JellyJelly short squeeze

The short squeeze concerning the JellyJelly token unfolded in just a few hours on March 26. As detailed in a report, here’s how it happened:

-

An exploiter funded three separate Hyperliquid accounts with $7 million, engaging in leveraged trades on the illiquid Jelly token.

-

Two accounts initiated long positions of $2.15 million and $1.9 million on JELLY, while the third took a $4.1 million short position to balance the trades.

-

As JELLYJELLY’s price rose, the short position faced liquidation, but it was too large to be processed in the usual manner.

-

The short was transferred to the Hyperliquidity Provider Vault (HLP).

-

Meanwhile, the exploiter accumulated a seven-figure profit from which to withdraw, as the JELLY price surged by 400%.

-

Upon attempting to withdraw their funds, Hyperliquid later restricted their accounts. Instead, they chose to liquidate their remaining JELLY holdings.

Hyperliquid halts Jelly trading

As the trader sought to sell off their remaining Jelly holdings, Hyperliquid put a stop to the token’s market. The exchange reportedly closed the market with JELLY priced at $0.0095, which was the point at which the third account had entered its short trades.

Hyperliquid announced on X that it would discontinue perpetual futures trading for the JELLY token, citing “evidence of dubious market activity.”

The exchange declared, “All users aside from flagged addresses will be compensated by the Hyper Foundation. This process will occur automatically in the upcoming days based on on-chain data.”

It also acknowledged the impact on the HLP due to the long positions but mentioned that the HLP achieved a positive net income of $700,000 in the past 24 hours: “Technical enhancements will be implemented, and the network will emerge stronger as a result of the lessons learned.”

Criticism aimed at Hyperliquid

Market analysts expressed disappointment over Hyperliquid’s handling of the incident. The CEO of Bitget, Gracy Chen, described the exchange’s approach to the JELLY event as immature, unethical, and unprofessional, warning that it could lead to user losses and raise serious questions regarding its reliability.

She suggested that the exchange “might be on the path to becoming FTX 2.0” and that deciding to close the Jelly market and settle positions at a favorable rate “establishes a troubling precedent.”

Alvin Kan, chief operating officer at Bitget Wallet, remarked that the Jelly debacle serves as a prime example of how unpredictable hype-driven price movements can be.

He stated, “The JELLY event reminds us that hype lacking fundamentals is unsustainable […] In the DeFi realm, momentum may attract short-term interest, but it doesn’t create long-lasting platforms,” arguing that the market will continue to reveal projects reliant on speculation rather than utility.

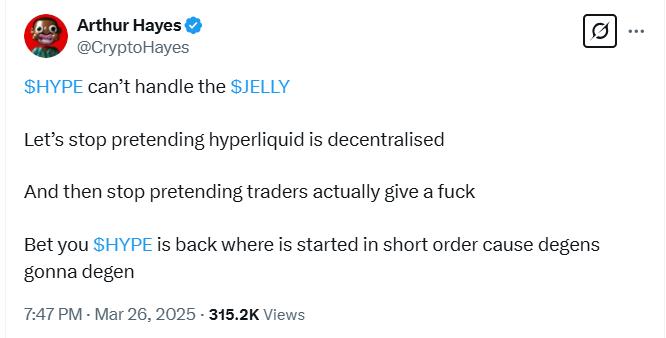

Arthur Hayes, founder of BitMEX, appeared to downplay the reactions to the JELLY episode, asserting on X, “Let’s stop pretending Hyperliquid is decentralized. And then let’s stop pretending traders actually care.”

Image source: Arthur Hayes

Earlier in March, the exchange had already adjusted its approach towards leveraged trading by increasing margin requirements after its HLP suffered significant losses during a major Ether liquidation.

Still, Hayes may have a point — “degen” traders accustomed to the risks in DeFi might simply absorb the losses and move on. Furthermore, a comprehensive legal framework for DeFi seems unlikely to materialize soon, particularly in the United States, leaving decentralized exchanges with minimal pressure or regulation to alter their practices beyond user reactions.

The irony of the exploit lies in the fact that it seems like a loss for everyone involved — the exchange, traders, and even the exploiter.

In total, the trader deposited $7.17 million into their accounts but managed to withdraw only $6.26 million, leaving around $900,000 still trapped in their Hyperliquid accounts. If they recover the remaining funds, the exploit will result in a loss of roughly $4,000; if not, they could potentially lose nearly $1 million.

Magazine: Arbitrum co-founder skeptical of move to based and native rollups: Steven Goldfeder