- The U.S. government transferred $10.23 million worth of Bitcoin and Ethereum on Friday, igniting discussions regarding possible liquidation.

- This transfer aligns with a crucial directive from President Trump’s executive order dated March 18, aimed at establishing the Strategic Bitcoin Reserve.

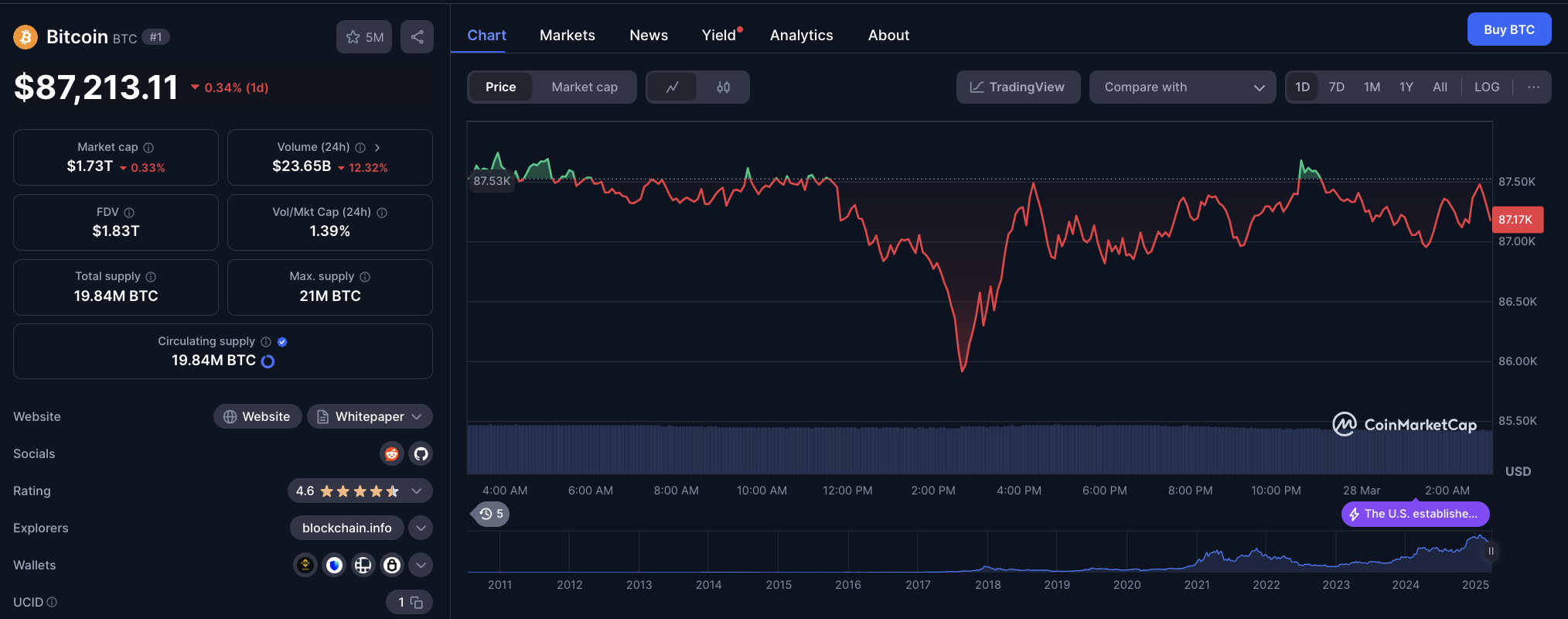

- Despite previous sell-offs associated with government transactions, Bitcoin has remained steady at $86,600, highlighting a neutral market sentiment.

The recent movement of $10.23 million in Bitcoin and Ethereum by the U.S. government has fueled speculation about whether it signals a liquidation or a strategic accumulation as part of new policies.

Government Transfers of 97 BTC and 884 ETH Generate Market Speculation

According to data from Arkham Intelligence, a cryptocurrency analytics platform, recent transactions linked to the U.S. government have been documented.

The report from Friday indicates the transfer of 97 Bitcoin (BTC) worth approximately $8.46 million and 884 Ethereum (ETH) valued at $1.77 million on March 28.

U.S. Government transfers $10.23 million on March 27, 2025 | Source: Arkham Intelligence

Conducted at 5:51 PM EST, this transaction has sparked renewed conversation regarding the strategies employed by the Trump administration to manage U.S. crypto assets, especially following a recent series of executive orders.

U.S. Government’s Crypto Holdings and Market Impact

Historically, significant government transactions have often put downward pressure on cryptocurrency prices.

For instance, a $1.9 billion Bitcoin transfer to Coinbase Prime in December 2024 resulted in a 5% decrease over three days, as recorded by OneSafe. Similar transfers in April, June, and August of the same year also led to short-term price drops, although Bitcoin has consistently recovered.

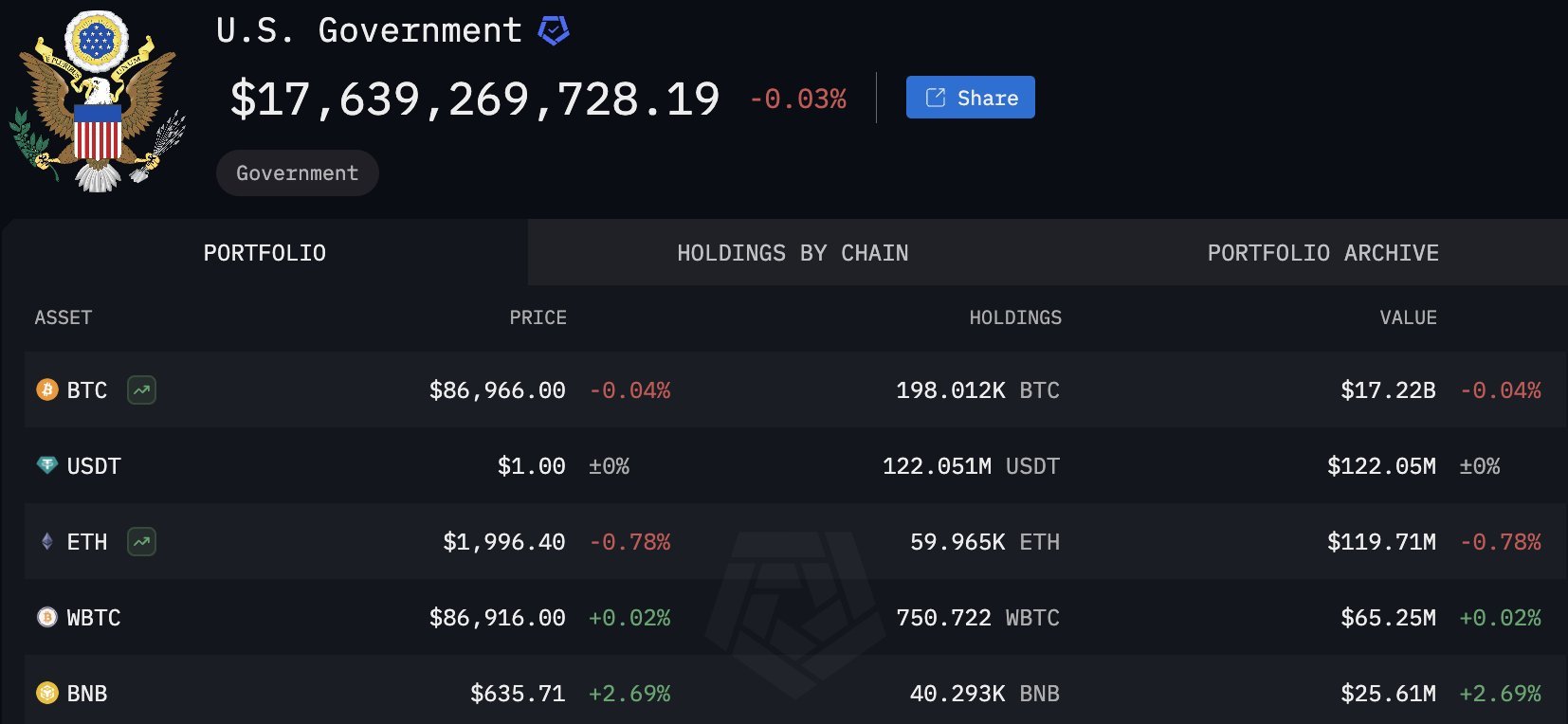

Currently, the U.S. government holds 198,012 BTC valued at $17.22 billion and 59,965 ETH, which is worth $119.7 million, making it one of the largest institutional holders of cryptocurrency.

U.S. Government’s Crypto Holdings as of March 27 | Source: Arkham

U.S. Government’s Crypto Holdings as of March 27 | Source: Arkham

A significant portion of these reserves comes from assets acquired through criminal investigations, including the infamous 2016 Bitfinex hack, during which authorities seized 94,000 BTC—now valued at over $8 billion.

Bitcoin price action (BTCUSD) after U.S. Government’s transfers on March 27, 2025 | Source: CoinmarketCap

As of March 28, Bitcoin was trading around $87,200, while Ethereum hovered near $2,000, indicating that overall market sentiment remained neutral following the transaction.

Sell-off Unlikely Due to Recent Executive Orders

Historical trends suggest that transactions involving U.S. government Bitcoin frequently introduce short-term volatility, as market participants prepare for possible sell-offs.

However, Bitcoin’s price has sustained itself around the $86,600 level as of press time on Friday, with current developments suggesting that a sell-off is improbable.

Noteworthy is the executive order issued by Donald Trump on March 18, which established a Strategic Bitcoin Reserve.

A pivotal requirement within this order demands that federal agencies report their cryptocurrency holdings to the Secretary of the Treasury within 30 days.

This indicates that the $10.3 million transactions involving BTC and ETH may be part of a larger strategy to consolidate crypto assets, consistent with the administration’s recent directives, rather than being indicative of another major sell-off.