Current Ethereum Price: $1,930

- Ethereum’s development team has tentatively set April 30 as the date for the Pectra mainnet upgrade during their latest ACDC discussion.

- Whale investors are increasing their accumulation of ETH, anticipating a price increase following the Pectra upgrade on the mainnet.

- ETH may encounter significant bearish pressure if its technical indicators signal a breakdown.

On Thursday, Ethereum (ETH) experienced substantial buying activity from whale investors after the core development team tentatively earmarked April 30 for the Pectra upgrade initiation on the mainnet.

Whales Boost ETH Accumulation Ahead of Pectra Upgrade

During the recent All Core Developers Consensus (ACDC) meeting, developers provisionally scheduled the Pectra upgrade for April 30.

The Pectra upgrade successfully launched on the new Hoodi testnet on Wednesday. Nevertheless, developers are monitoring for potential issues in light of challenges experienced on the Holesky and Sepolia testnets following similar upgrades.

If April 30 is confirmed in next week’s ACDC meeting, we may see increased market volatility as investors start to position themselves for possible price changes following the upgrade.

Summary highlights from ACD:

– Pectra upgrade provisionally set for April 30

– EOF still in Fusaka, full scope expected by April 10. Priority: expedite PeerDAS deployment

– Historical data pre-merge will be removed from Sepolia on May 1st, and mainnet approximately one month post-Pectra

– Upcoming Protocol Research Call #001 next week— timbeiko.eth (@TimBeiko) March 27, 2025

While the Pectra upgrade doesn’t directly alter ETH’s valuation metrics, its new features could enhance network activity and draw more investment into the Ethereum Layer 1, as indicated by the recent behaviors of ETH whale investors.

In a surge of activity within just a few hours, whales have ramped up their purchasing of ETH, with some staking their assets in protocols and others leveraging their holdings through decentralized finance lending platforms, according to Lookonchain data.

Notably, one whale purchased 51,209 ETH for about $103 million on the Coinbase exchange.

The significant reduction in ETH’s exchange reserves aligns with the recent whale activity. Reserves have decreased by nearly 1 million ETH since March 3, showcasing strong buying pressure.

ETH exchange reserve. Source: CryptoQuant

However, prices have remained relatively stagnant, burdened by macroeconomic factors and the sentiment of traditional investors, as indicated by ongoing outflows from Ethereum exchange-traded funds (ETFs) since February, based on Farside Investors’ analysis.

Additionally, the US government transferred 884 ETH valued at $1.77 million to an undisclosed wallet recently, according to Arkham data. This has attracted attention from the cryptocurrency community following the signing of an executive order by President Donald Trump earlier this month to establish a Strategic Bitcoin Reserve and a digital asset stockpile.

Ethereum Price Outlook: Technical Signals Near a Breakdown

In the past 24 hours, Ethereum experienced $29.38 million in futures liquidations, as per Coinglass data. This includes total liquidations of $22.36 million for long positions and $6.02 million for shorts.

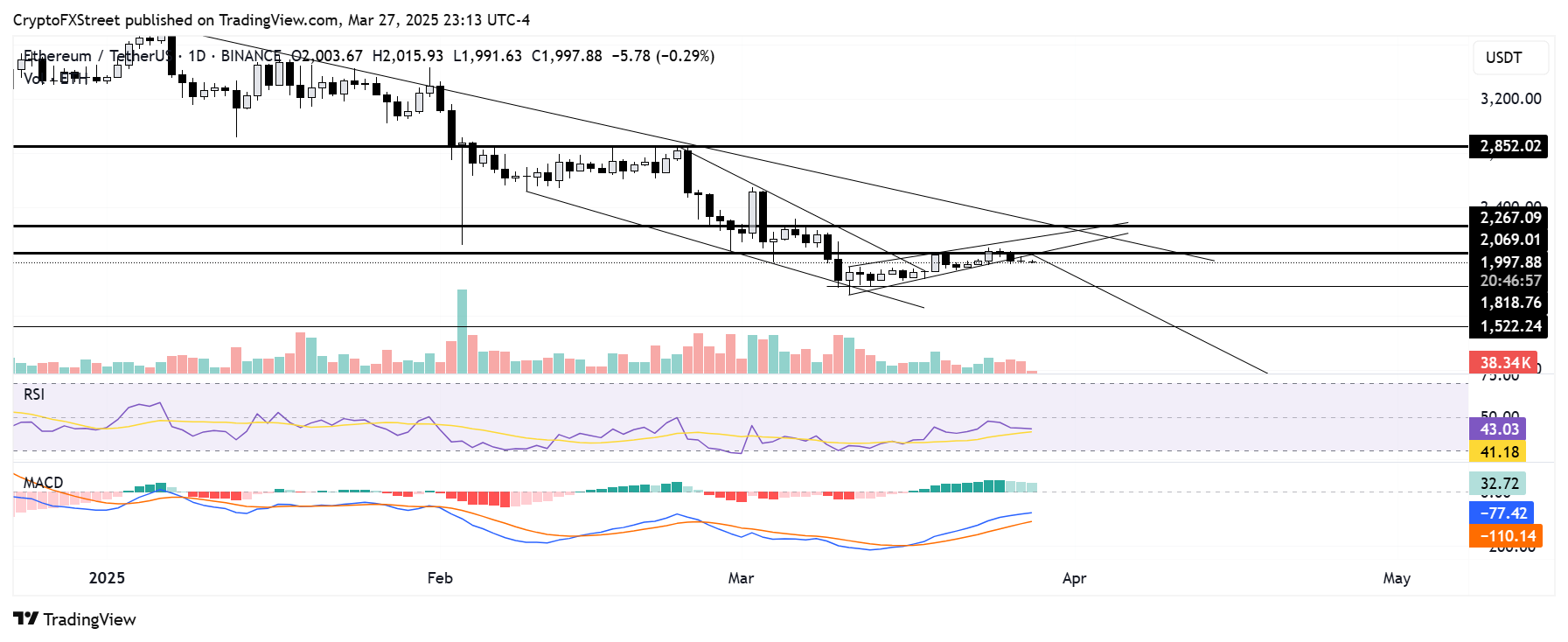

ETH has dropped below a critical support channel after facing resistance around $2,069. A consistent decline beneath this trendline could lead ETH to test support near $1,800.

ETH/USDT daily chart

A decisive move below $1,800 would confirm a bearish flag pattern, potentially pushing ETH down toward $1,500 and possibly $1,200 — a target derived from the height of the flag pole projected downward from the breakdown point.

Conversely, a rebound above the lower boundary of this essential channel and the $2,069 resistance may trigger a short-term rally for ETH.

The Relative Strength Index (RSI) is dipping below its mid-line and could approach its yellow moving average. Additionally, the Moving Average Convergence Divergence (MACD) has shown consecutive diminishing green bars.

The bearish momentum could intensify if the RSI falls below its moving average line and the MACD histogram shifts to red.

Ethereum Development FAQs

Following the Dencun upgrade in March 2024, Ethereum users are now looking ahead to the Pectra upgrade planned for early 2025. This upgrade will be executed in two phases, enhancing features such as wallet experience, upgrading the Ethereum Virtual Machine (EVM), and introducing PeerDAS for Layer 2 scaling, along with increasing blob capacity, etc.

Forks represent updates or alterations to a blockchain network’s codebase or structure. In the absence of central governance, forks occur solely after consensus is reached among developers and validators. Hard forks represent significant and lasting changes in blockchain protocols that create two parallel chains: one adhering to the old rules and a new one implementing changes. Developers can choose to upgrade software to the new chain or remain on the old chain, functioning as separate networks. Users receive an equivalent amount of their tokens on the new blockchain during a hard fork. Soft forks, however, are subtle modifications that are backward-compatible, allowing the network to function as a single entity even when some developers do not adopt the new changes.

Ethereum improvement proposal EIP-7702, which was famously drafted in just 22 minutes by co-founder Vitalik Buterin, aims to integrate EIP-3074 and ERC-4337 to facilitate substantial adoption of Ethereum’s smart wallet features. Set to be implemented in the upcoming Pectra upgrade, EIP-7702 will introduce an advanced account abstraction version enabling features such as batching, allowing users to pay a single transaction fee for multiple actions, sponsorship enabling one account to cover gas fees for others, and wallet recovery options in case users misplace their seed phrases.

Layer 2 refers to a group of protocols designed to scale Ethereum by processing transactions in batches off the Mainnet. After verifying their validity through mathematical computations, these Layer 2 solutions return a compressed transaction summary to the Mainnet for final processing. This approach helps reduce transaction fees and enhances the Mainnet’s speed while leveraging its security. Picture them as personal assistants who aid their boss in managing a multitude of paperwork, sending a summarized version for the boss to approve and sign.

Layer 3 solutions are blockchains tailored for specific applications, built on top of existing Layer 2 networks to maximize scalability and interoperability. For instance, a Layer 3 could focus on addressing privacy issues, amplifying scalability, enhancing gaming experiences, or tackling other complex functionalities while still benefiting from the security of the Layer 1.