The worldwide supply of stablecoins may reach $1 trillion by the close of 2025, potentially serving as a significant driver for the broader cryptocurrency market expansion, as noted by a managing partner in the crypto space.

“We’re experiencing a rising tide of stablecoin adoption that is likely to escalate significantly this year,” the expert stated during a live event on March 27. “We might see growth from $225 billion in stablecoins to $1 trillion within this calendar year.”

He pointed out that while this growth may seem modest compared to global financial markets, it would signal a “meaningfully significant” change for blockchain-based finance.

He also indicated that the influx of capital into on-chain activities, alongside heightened interest in exchange-traded funds, could bolster decentralized finance (DeFi) endeavors:

“If we encounter a scenario this year where ETFs are allowed to offer staking rewards or yield to their holders, it would unlock a substantial increase in DeFi activities, broadly speaking.”

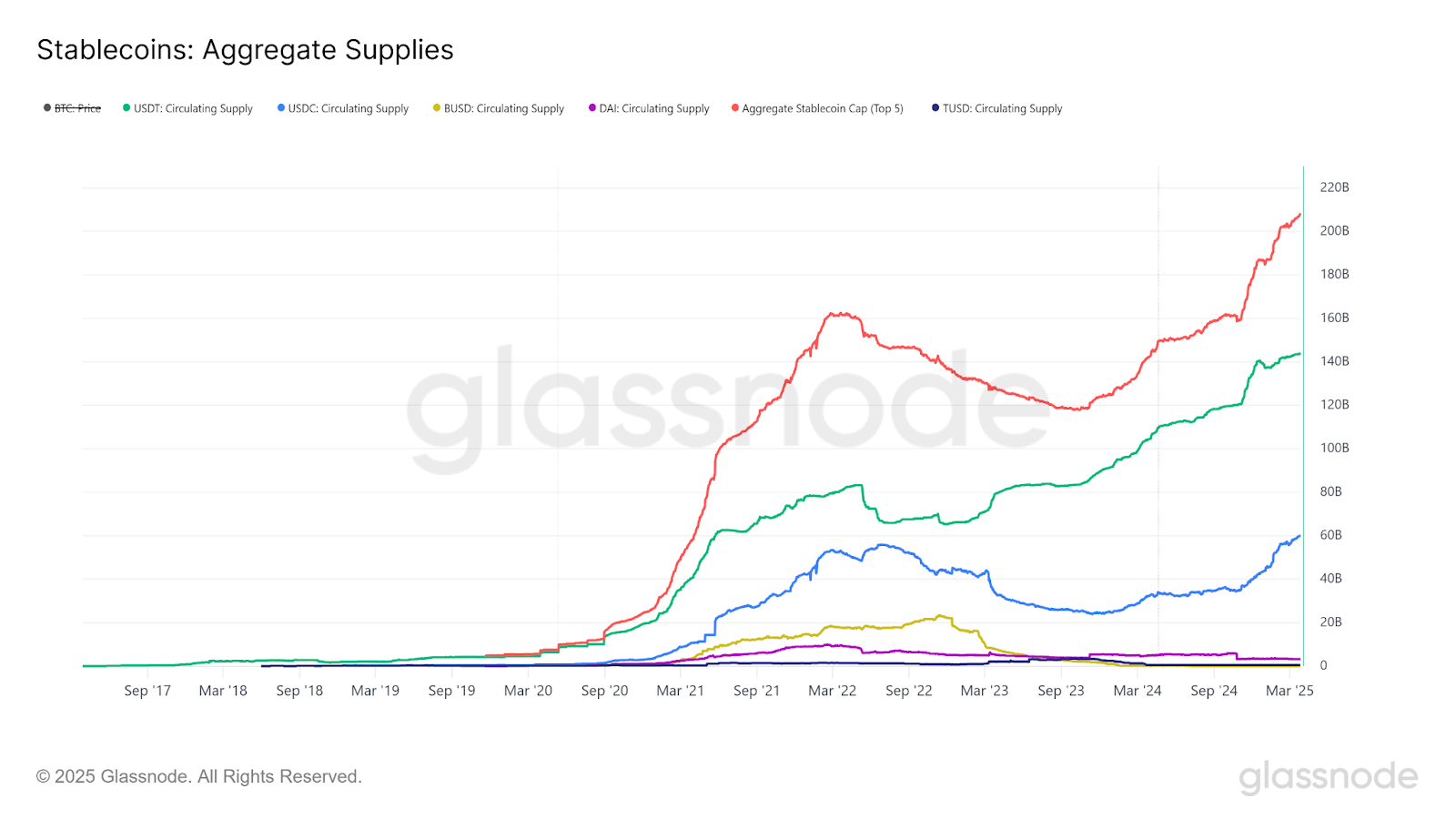

The total supply of stablecoins was reported to have reached an all-time high of over $208 billion across the five leading stablecoins as of March 28.

Stablecoins, aggregate supplies. Source: Data Provider

“This significant shift has been long overdue: a notable transfer of wealth onto the blockchain that invites broader participation,” he added.

The increasing stablecoin supply has recently surpassed $219 billion and continues to grow, suggesting that the market is “likely still mid-cycle” rather than at the peak of a bullish trend, according to analysts.

Growing Adoption of Stablecoin Payments

Utilization of stablecoins for everyday transactions is on the rise, demonstrating the effectiveness of blockchain transactions.

“We’re observing a significant reduction in the size of individual stablecoin transactions, which indicates they are increasingly being used for payments rather than large transfers.”

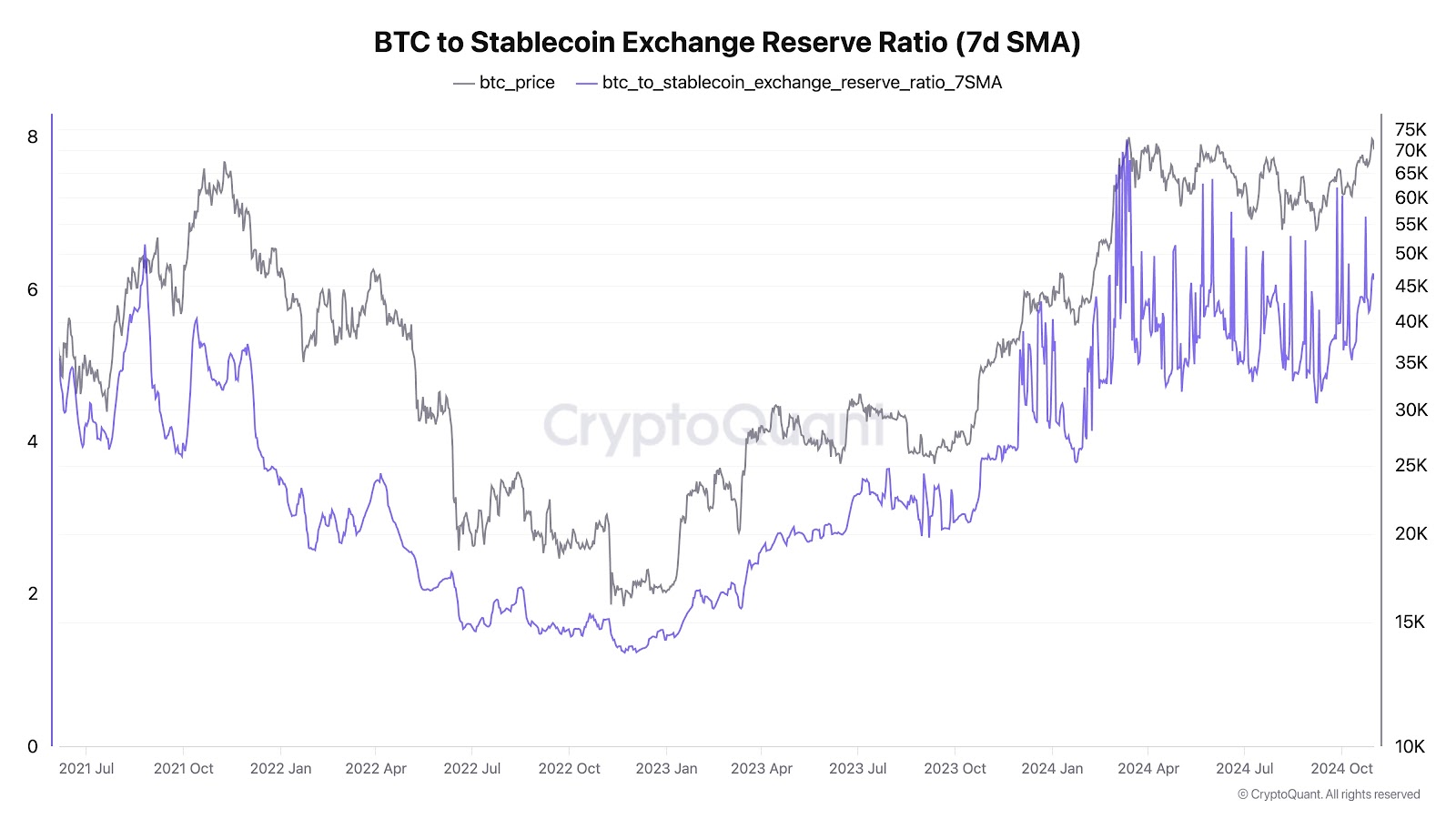

BTC-to-stablecoin ratio. Source: Data Provider

This aligns with the recent observations of a prominent figure in the crypto space, who noted that stablecoins are increasingly being utilized for remittance transactions and as a store of value. However, it was mentioned that simply increasing stablecoin supply won’t drive Bitcoin’s price up without additional catalysts.