The pace of institutional adoption of Bitcoin within the European Union is still slow, even as the United States advances with significant regulations aimed at recognizing BTC as a reserve asset.

More than three weeks have passed since an executive order outlined intentions to utilize cryptocurrency seized in criminal investigations to establish a federal Bitcoin reserve, yet European firms have largely not responded on this front.

This stagnation may be attributed to Europe’s intricate regulatory framework, as noted by a legal expert at a European tokenization platform for real-world assets.

“The uptake by European corporations is still quite limited,” the expert stated, further emphasizing:

“This reluctance highlights a more profound structural divide rooted in regulations, institutional signals, and market maturity. Europe has not yet decisively positioned Bitcoin as a reserve asset.”

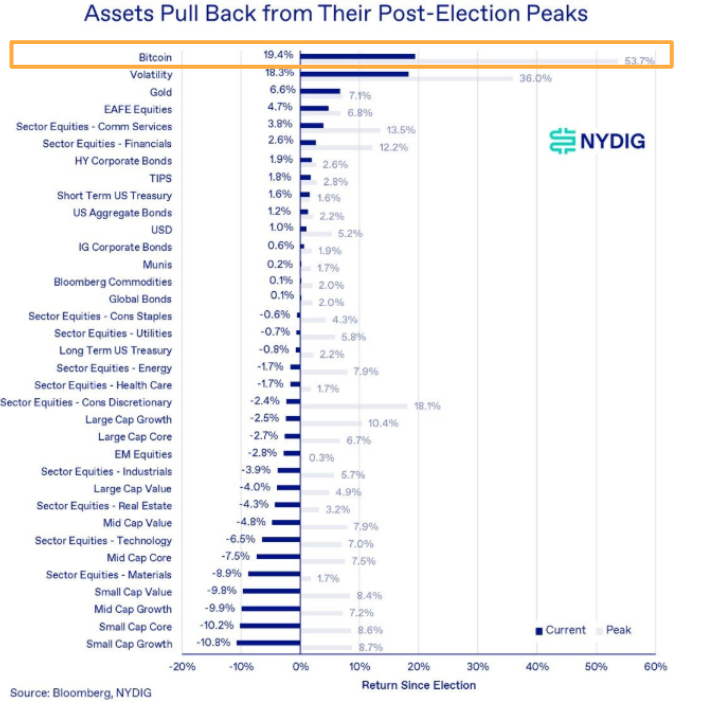

Bitcoin’s economic structure tends to benefit early adopters, potentially prompting more investment firms to contemplate exposure to BTC. The cryptocurrency has outperformed most major global assets since the election, despite a recent downturn.

Performance of assets since the election victory.

In light of the executive order, only a few European firms have openly acknowledged their Bitcoin holdings or crypto services, including notable entities like a prominent French bank, a Swiss investment firm, an Austrian fintech company, and others.

A recent survey suggests that European financial institutions might be misjudging the demand from cryptocurrency investors by as much as 30%.

Related: Friday’s US inflation report could spark an April Bitcoin rally

The uncertain regulatory environment in Europe

The slower rate of adoption in the EU appears related to its fragmented regulatory environment and more conservative investment strategies, according to analysts. “The institutional landscape in Europe is more segmented, with regulatory obstacles and conservative mandates restraining Bitcoin investments,” they observed.

“Furthermore, large asset managers and pension funds in Europe have been more cautious regarding Bitcoin exposure due to vague guidelines and a tendency toward risk aversion,” they added.

Related: Bitcoin ‘more likely’ to reach $110K before hitting $76.5K — an industry expert

Moreover, the appetite for cryptocurrencies among retail investors in Europe and their participation levels are generally lower than in the US, according to a dispatch analyst at a digital asset investment platform.

Europe is often seen as “more conservative when it comes to adopting new financial instruments,” the analyst remarked, stating:

“This contrasts sharply with the deeper, more liquid, and comparatively cohesive US capital market, where the introduction of a spot Bitcoin ETF was supported by robust retail demand and a clear regulatory approval.”

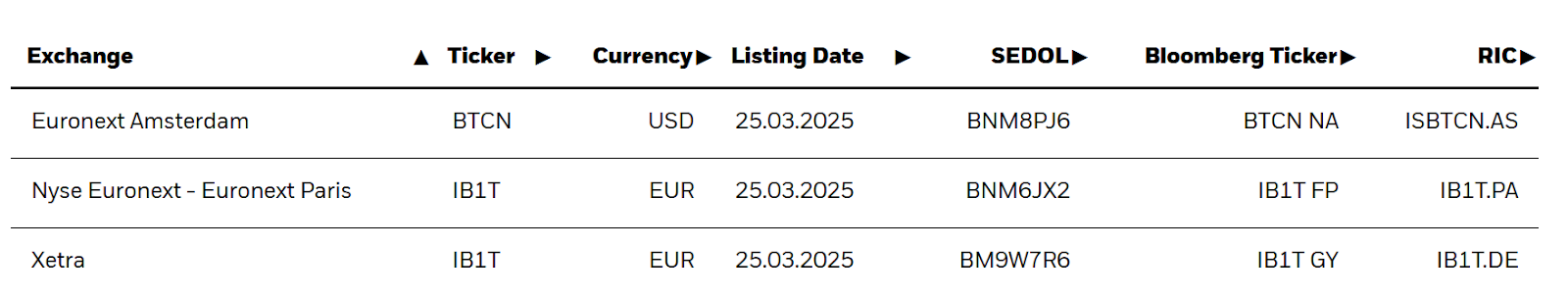

iShares Bitcoin ETP listings.

Recently, the world’s largest asset management firm introduced a Bitcoin exchange-traded product (ETP) in Europe, a move that could help enhance institutional confidence among investors in the region.

Magazine: Discussion of Bitcoin-related legal issues and market trends: Asia Express