The diminishing attractiveness of Ether (ETH) as an investment is attributed to layer-2 solutions extracting value from the main blockchain and a lack of community resistance against the rampant creation of new tokens, according to a crypto venture capital expert.

“The primary reason for this is selfish layer-2 solutions draining value from Layer 1, along with a general consensus that excessive token issuance is acceptable,” a partner at Castle Island Ventures commented in a post on March 28.

Ether “self-destructed”

“ETH was overwhelmed by its own tokens. It effectively self-destructed,” he remarked, responding to a statement from Lekker Capital’s founder who claimed that Ether is “completely dead” as an investment.

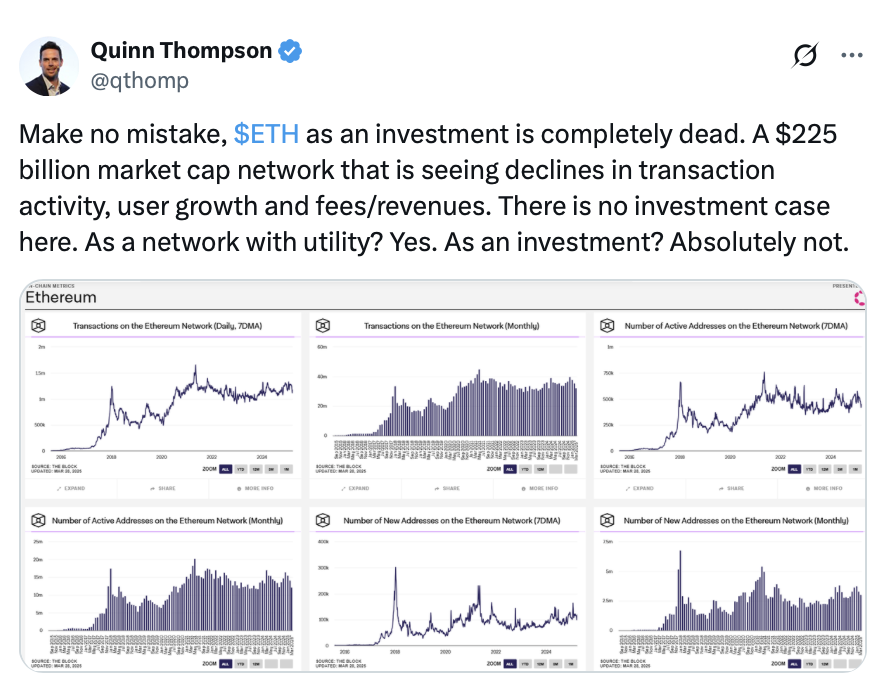

Source: Quinn Thompson

“With a market capitalization of $225 billion, this network is experiencing decreases in transaction volume, user growth, and revenue from fees. There is no case for investment here. It has utility as a network, but as an investment? Certainly not,” the founder stated in a post on the same day.

The ETH/BTC ratio, reflecting Ether’s strength against Bitcoin, stands at 0.02260, its lowest point in nearly five years, according to data from a trading platform.

Currently, Ether is priced at $1,894, representing a 5.34% drop over the last week, according to market analysis.

Ether has fallen 17.94% over the past month. Source: CoinMarketCap

Furthermore, a recent report indicated that Ethereum’s fee revenue had plummeted by 99% over the prior six months, as “extractive layer-2s” captured all users, transactions, and fee income without adding value to the base layer.

During the same period, a partner at Cinneamhain Ventures suggested that Based Rollups could address the issue of layer-2 networks draining liquidity and revenue from Ethereum’s fundamental layer.

He noted that Based Rollups could significantly alter the incentive structures impacting Ethereum’s monetization.

Related: Ethereum futures premium reaches 1+ year low — Is it time to consider buying the ETH dip?

After some positive sentiment late last year predicting Ether could hit $10,000 by 2025—particularly following its $4,000 peak in December, the same month Bitcoin first climbed to $100,000—Ether has faced a steep decline alongside the broader downturn in the cryptocurrency market.

A large financial institution further contributed to the pessimistic outlook in a letter to clients on March 17, revising its end-of-2025 price prediction for ETH from $10,000 down to $4,000, a staggering 60% cut.

However, some crypto traders, including those sharing insights anonymously, remain “incredibly bullish,” contending that Ether might be the “best opportunity in the market.”

Source: Merlijn The Trader

Magazine: Co-founder of Arbitrum questions the shift to based and native rollups: Steven Goldfeder