The recent legal move by the New York State Attorney General against Galaxy Digital regarding its promotional connections to the now-defunct cryptocurrency Terra (LUNA) has been labeled as unjust and a misuse of the legal system by SkyBridge Capital and its founder, Anthony Scaramucci.

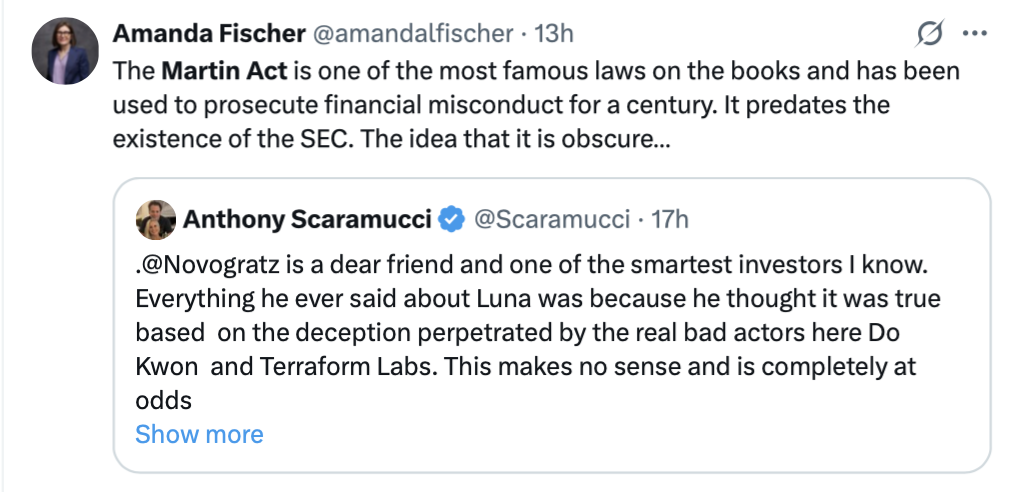

“This is nothing but LAWFARE, driven by an obscure yet dangerously potent New York law known as the Martin Act,” Scaramucci expressed in a post on March 28.

Martin Law creates potential for misuse

“This law doesn’t require proof of intent, establishing a low evidential threshold that can pave the way for exploitation like this. It should not be in existence,” he remarked.

New York’s Martin Act stands as one of the strictest anti-fraud and securities regulations in the U.S., granting prosecutors the authority to pursue financial fraud cases without the necessity of proving intent. The Attorney General accused Galaxy Digital of infringing upon the Martin Act through its alleged promotion of Terra, leading to a $200 million settlement agreed upon by Galaxy Digital.

Documents filed by the Attorney General on March 24 indicated that Galaxy Digital purchased 18.5 million LUNA tokens at a discounted price of 30% in October 2020 and promoted them before selling, without adhering to proper disclosure requirements.

Scaramucci reiterated that Galaxy CEO Michael Novogratz believed the information he shared about Luna was accurate, as he was misled by Terraform Labs and its former CEO, Do Kwon.

Source: Amanda Fischer

In a related note, Keith Grossman, the president of enterprise at MoonPay, mentioned that he had never come across the Martin Act before and needed to research it using an AI chatbot.

“Its scope is so extensive that it embodies the whole concept of lawfare,” Grossman stated. “Sorry you got caught in the crossfire of this, Mike,” he added.

The legal filing argued that Galaxy played a significant role in helping a “little-known” token, referring to LUNA, boost its market price from $0.31 in October 2020 to $119.18 in April 2022, all while allegedly profiting in the hundreds of millions of dollars.

Investor and asset manager Anthony Pompliano admitted he wasn’t well-versed in the lawsuit’s specifics but stood up for Novogratz, labeling him a “good man” who has invested considerable time and resources into assisting others.

The collapse of Terra is marked as one of the most notorious debacles in the cryptocurrency sector. In March 2024, SEC attorney Devon Staren described Terra as a “house of cards” that ultimately fell apart for investors in 2022.

Magazine: Arbitrum co-founder doubtful about the shift to based and native rollups: Steven Goldfeder