Shibtoshi, the creator of the SilentSwap platform focused on privacy-centric trading, highlighted several factors that deter institutions from embracing decentralized finance (DeFi) solutions, including concerns about privacy, the absence of standardized compliance regulations, and questions of legal accountability.

In a conversation, the DeFi innovator remarked that the significant transparency of onchain transactions poses challenges for businesses that need to protect confidential details, such as trading strategies, payroll data, and B2B agreements. Shibtoshi stated:

"The primary issues—regulatory ambiguity, limitations on privacy, and complicated user experiences—are genuine, but they can be addressed. Advances in privacy-preserving technologies are making DeFi more aligned with the needs of enterprises. Solutions like SilentSwap represent progress in this area."

Regulatory ambiguity remains a major obstacle for DeFi, exacerbated by disparate legal frameworks across jurisdictions, making it difficult for institutions to adopt these solutions, Shibtoshi explained.

"Are DeFi tokens considered securities? What if a decentralized autonomous organization (DAO) falters — who bears the responsibility? It’s still quite unclear," the founder remarked.

Shibtoshi advocated for sensible regulations that foster innovation while maintaining the core advantages of decentralized finance, including self-custody, efficiency, and affordable transactions.

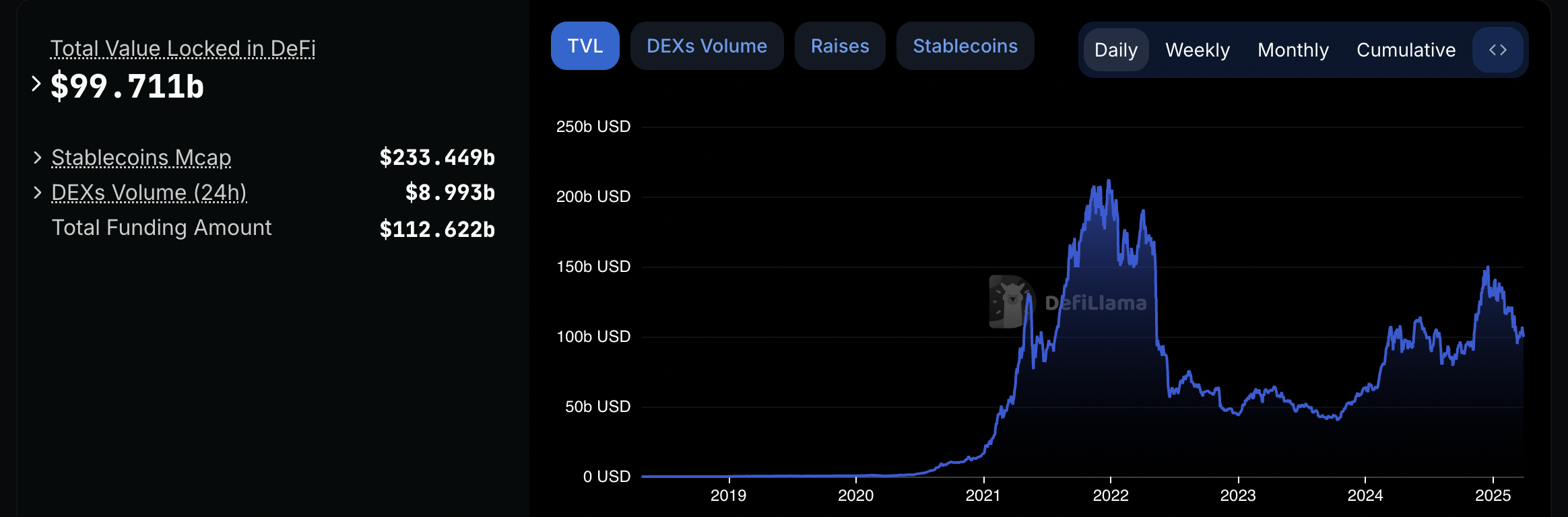

The total value locked in the DeFi ecosystem has not yet returned to the peak levels seen in 2021 and 2022.

Related: Specialized purpose DEXs poised for growth in 2025 — Curve founder

US Congress Repeals Outdated DeFi Regulation, Yet Challenges Persist

Recently, both houses of the United States Congress voted to dismantle the widely criticized DeFi broker rule that mandated decentralized finance protocols and platforms to report user transactions to the Internal Revenue Service (IRS).

On March 4, the Senate repealed the IRS broker rule with a vote of 70 to 27, followed by the House of Representatives voting for its repeal on March 11.

Although this outdated regulation has been overturned, fears remain that excessive regulation could stifle a sector that emerged as a decentralized, more accessible, and pseudonymous alternative to traditional finance.

According to entrepreneur and investor Artem Tolkachev, the push for regulatory compliance threatens the core decentralization of DeFi and undermines the value that this budding sector offers.

Tolkachev noted that a heightened focus on regulatory compliance could lead to increased censorship and transfer control from users to third-party intermediaries and larger institutions.