- The valuation of the cryptocurrency market fell by 4%, bringing it down to $2.7 trillion on Friday.

- Lawmakers in South Carolina unveiled a plan to invest up to 1 million BTC.

- Cronos is the sole asset among the top 40 to report gains after the SEC dismissed charges against the crypto sector.

Bitcoin market updates:

- The price of Bitcoin dropped below the $85,000 support level on Friday, hitting a low of $84,200 at the time of reporting.

Crypto market liquidations | March 28

This downturn triggered over $449 million in liquidations across crypto derivatives markets.

- The US government transferred 97 BTC and 884 ETH on Thursday, raising mild concerns regarding possible sell-offs.

Altcoin market updates: Trump tariffs cause market-wide decline

- Ethereum (ETH), the second-largest cryptocurrency by market cap, has slipped below $1,900, reflecting a significant drop from its recent highs.

- Ripple’s XRP and Solana (SOL) also experienced declines of around 5%, making them some of the worst-performing altcoins for the day, alongside Cardano (ADA).

The recent sell-off appears to be largely triggered by new tariffs announced by US President Donald Trump, amidst rising geopolitical tensions in Europe, further contributing to economic uncertainty.

Chart of the day: Solana, ETH, XRP among the biggest losers

The recent 7% decline in Solana raises concerns about its capacity to maintain momentum in an environment wary of risk.

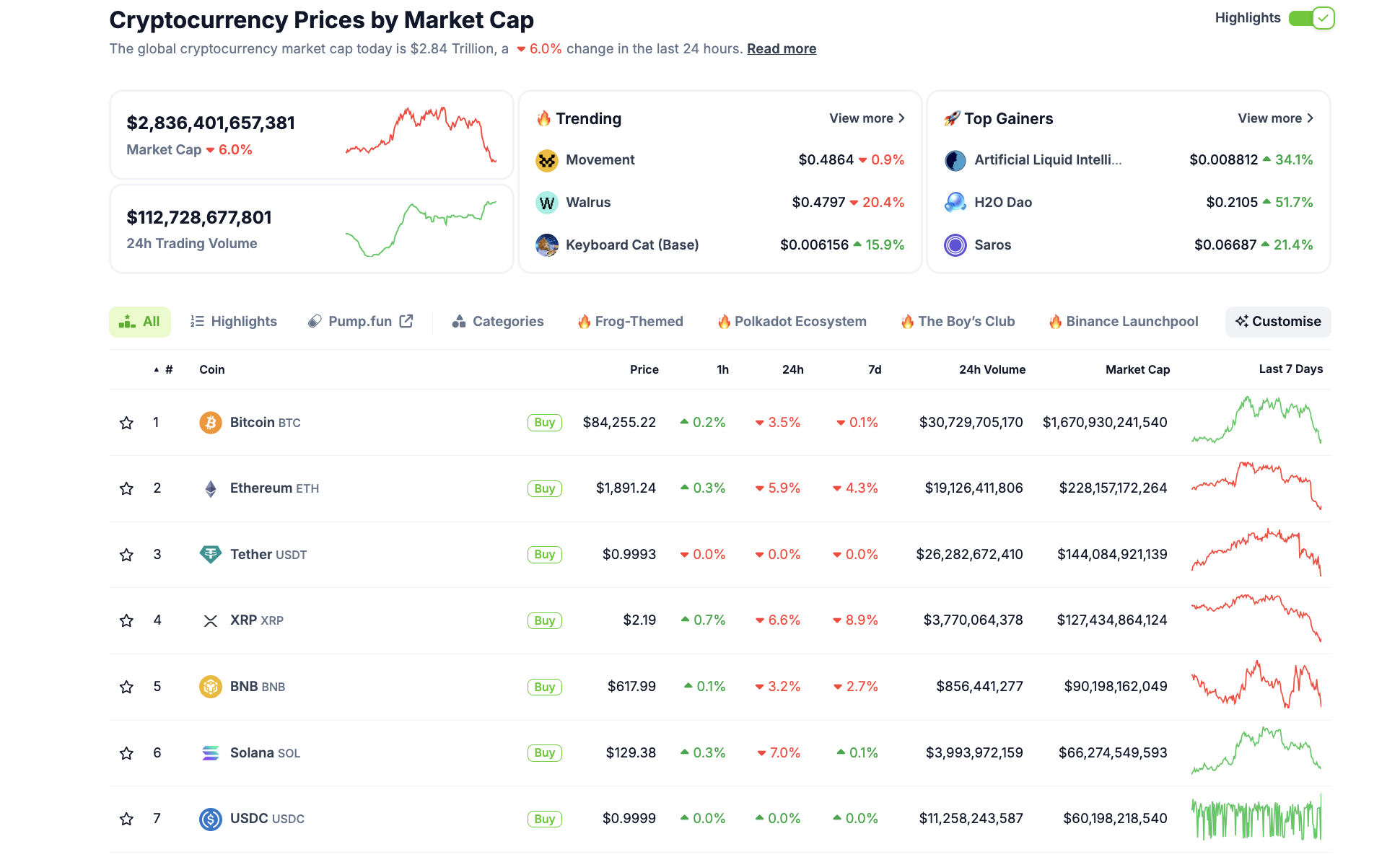

Crypto market performance | March 28, 2025 | Source: Coingecko

Crypto market performance | March 28, 2025 | Source: Coingecko

- The price of Ethereum is currently facing a 6% drop, fueled by profit-taking after strong gains stemming from WLFI’s announcement of a stablecoin launch on its network alongside the BNB chain.

- XRP has seen a 7% decrease as selling pressure mounts from traders cashing in on profits following the SEC’s decision to drop charges against Ripple.

The overall crypto market remains tense. If Bitcoin fails to maintain above the $85,000 threshold, it could lead to further losses for altcoins.

Crypto news updates:

FDIC permits banks to engage in crypto operations without advance approval

The Federal Deposit Insurance Corporation (FDIC) released new guidance on Friday indicating that banks under its supervision may participate in allowed crypto activities without needing prior approval.

This announcement, detailed in Financial Institution Letter (FIL-7-2025), replaces prior guidance from 2022 and aims to clarify regulations for banks that are looking into digital assets.

FDIC Acting Chairman Travis Hill described this change as a move away from previously stringent policies, reflecting a more accommodating stance towards blockchain and crypto integration within the banking sector.

UAE introduces a new dirham symbol ahead of digital currency launch

The Central Bank of the United Arab Emirates (UAE) has unveiled new symbols for both physical and digital dirhams, reinforcing the country’s financial identity and aspirations as a global payment leader.

The newly introduced symbol for the physical dirham combines the first letter of its English name with two horizontal lines, inspired by the UAE flag, symbolizing financial stability.

The symbol for the digital dirham, characterized by a surrounding circle and the colors of the UAE flag, signifies the nation’s step towards adopting digital currency.

While the Central Bank has not yet revealed a specific launch date for the digital dirham, this initiative aligns with the UAE’s broader efforts to modernize its financial systems and enhance cross-border transaction efficiency.

Galaxy Digital resolves $200 million settlement with NY AG over LUNA promotion

The New York Attorney General’s office has finalized a $200 million settlement with Galaxy Digital regarding its promotion of LUNA, the failed algorithmic cryptocurrency responsible for a $40 billion market collapse in 2022.

The settlement claims that Galaxy violated the Martin Act and Executive Law by not disclosing its financial interests in LUNA during its promotion.

Galaxy Digital, led by Michael Novogratz, was one of the prominent investment firms involved with LUNA, which collapsed after its ecosystem failed when the algorithmic mechanism supporting TerraUSD (UST) broke down. Terraform Labs’ founder, Do Kwon, remains detained in Montenegro as he awaits extradition to face fraud and securities charges in the US.

French state bank launches fund targeting smaller cryptocurrencies

France’s state-owned investment bank, Bpifrance, has announced plans to allocate up to €25 million ($26.95 million) for direct investments in lesser-known cryptocurrencies.

This represents the bank’s first dedicated crypto fund, following earlier investments of €150 million in blockchain-related projects.

The initiative seeks to support emerging French crypto start-ups by acquiring tokens before they become available on exchanges.

Arnaud Caudoux, Bpifrance’s deputy CEO, emphasized the strategic significance of this initiative, noting the rapid evolution of crypto regulations in the United States.

This fund aligns with France’s ambitions to position itself at the forefront of blockchain innovation, with government officials reiterating their commitment to fostering a competitive digital economy.