Tracy Jin, the COO of a prominent crypto exchange, cautions that the process of tokenizing real-world assets (RWAs) comes with significant centralized risks that could result in censorship, liquidity challenges, legal ambiguity, cybersecurity threats, and potential asset seizure by state authorities or other intermediaries.

In a recent discussion, she stated that as long as these tokenized assets are subject to government oversight and centralized entities, “tokenization will merely replicate existing financial systems rather than ushering in a true financial revolution.” Jin further remarked:

“The majority of tokenized assets will be created on permissioned or semi-centralized blockchains. This setup empowers regulatory bodies to impose limitations or seize assets. The tokenization of properties like real estate or bonds remains closely linked to national legal frameworks.”

“If the underlying property or business associated with the token is situated in a region with an unreliable legal structure or significant political instability, the risks of confiscation notably increase,” she added.

Experts anticipate that RWA tokenization could evolve into a multi-trillion-dollar sector over the next ten years as global assets transition to blockchain, facilitating increased capital market activity and enhancing fund mobility across borders.

The current market capitalization of the RWA sector.

In Related News: Dubai’s Land Department initiates project for real estate tokenization

Future Estimates of the RWA Market Vary Widely

Tokenized real-world assets encompass a broad range of items, including stocks, bonds, real estate, intellectual property, energy resources, art, private credit, debt instruments, fiat currencies, commodities, and collectibles.

It is reported that over $19.6 billion in tokenized RWAs are currently on blockchain platforms, excluding the stablecoin segment, which reached a market cap exceeding $200 billion in December 2024.

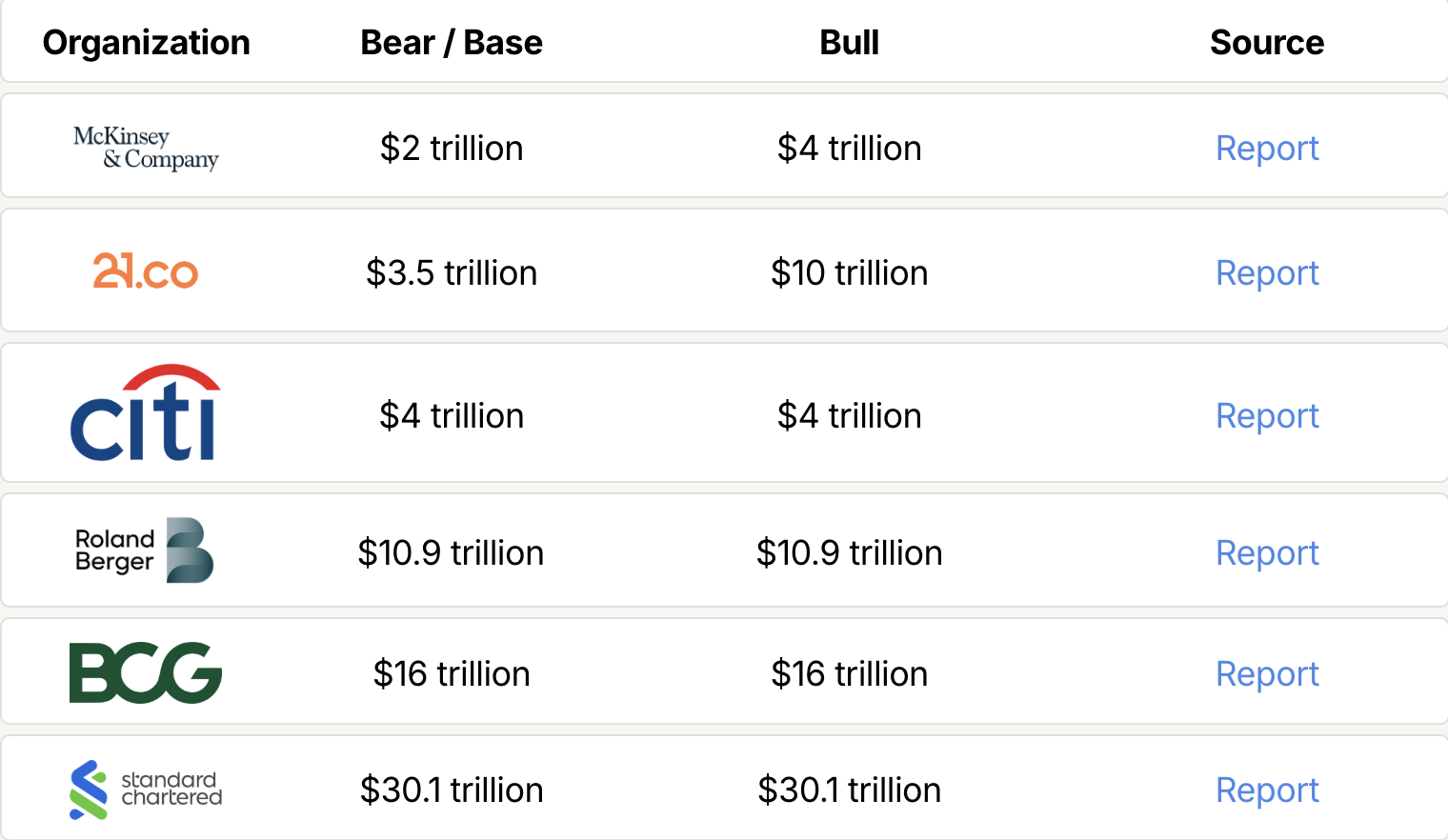

A survey conducted by a research firm evaluated responses from major financial institutions such as Citi, Standard Chartered, and McKinsey & Company, revealing that participants estimate the RWA market could grow to anywhere between $4 trillion and $30 trillion by 2030.

Different financial institutions present varying projections for the future of the tokenized RWA market.

McKinsey & Company anticipates that the RWA market will reach between $2 trillion and $4 trillion by 2030—a comparatively conservative estimate when juxtaposed with others.

Conversely, firms like Standard Chartered and leaders within the blockchain ecosystem believe that the RWA market could soar to as much as $30 trillion within the next decade.

Feature: Real-world yield farming: The impact of tokenization on lives in Africa