What are crypto-based mortgages?

Crypto-backed mortgages represent a type of loan where borrowers utilize their cryptocurrency assets, like Bitcoin (BTC) or Ether (ETH), as collateral to obtain funding for property acquisitions. This method enables you to secure financing without needing to liquidate your digital resources. By maintaining ownership of your cryptocurrencies, you can still capitalize on potential future price increases.

There are several forms of crypto-backed mortgages, including purchase mortgages, cash-out refinancing, and bridge loans.

- Purchase mortgages: These allow you to finance real estate purchases using cryptocurrency as collateral.

- Cash-out refinancing: This option lets you refinance existing mortgages by leveraging your crypto assets to access extra funds.

- Bridge loans: These provide short-term financing to help you manage the transition period between buying a new property and selling your current one.

Crypto mortgages can be particularly attractive if you wish to maintain your crypto assets while acquiring tangible properties. However, it’s crucial to keep in mind the inherent volatility of cryptocurrencies and thoroughly evaluate the risks before opting for this type of mortgage.

Lenders often accept stablecoins such as Tether (USDt) and USDC (USDC), along with prominent cryptocurrencies like BTC and ETH. Some may accept a diverse portfolio of cryptocurrencies for collateral, known as cross-collateralization.

Did you know? With conventional mortgages becoming progressively harder to secure, especially for younger borrowers, alternative solutions are becoming more popular. Financial technology companies are responding to this need by providing adjustable or fixed-rate mortgages backed by substantial cryptocurrency holdings.

Crypto-based mortgages vs traditional mortgages

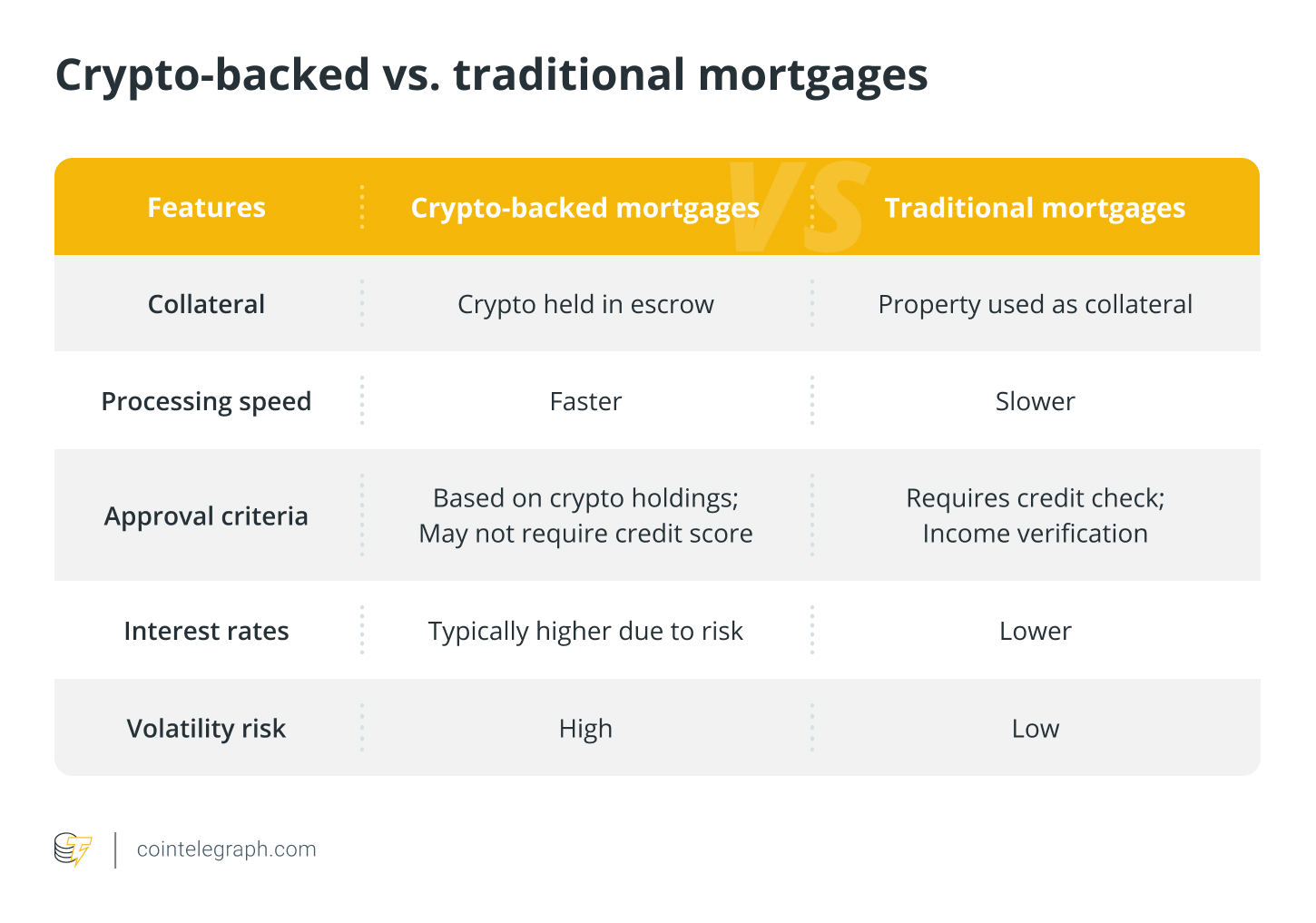

There are key differences between crypto-backed and traditional mortgages, ranging from eligibility criteria to risk levels. Traditional mortgages depend on credit history, income validation, and down payments, while crypto-backed mortgages utilize digital holdings as collateral.

The approval process for crypto mortgages often occurs at a faster pace, although they typically come with higher interest rates and exposure to volatility risks. Additionally, regulatory ambiguity can make crypto-backed loans less accepted in real estate markets. A comparison of these two mortgage types is shown below:

How do crypto-backed mortgages work?

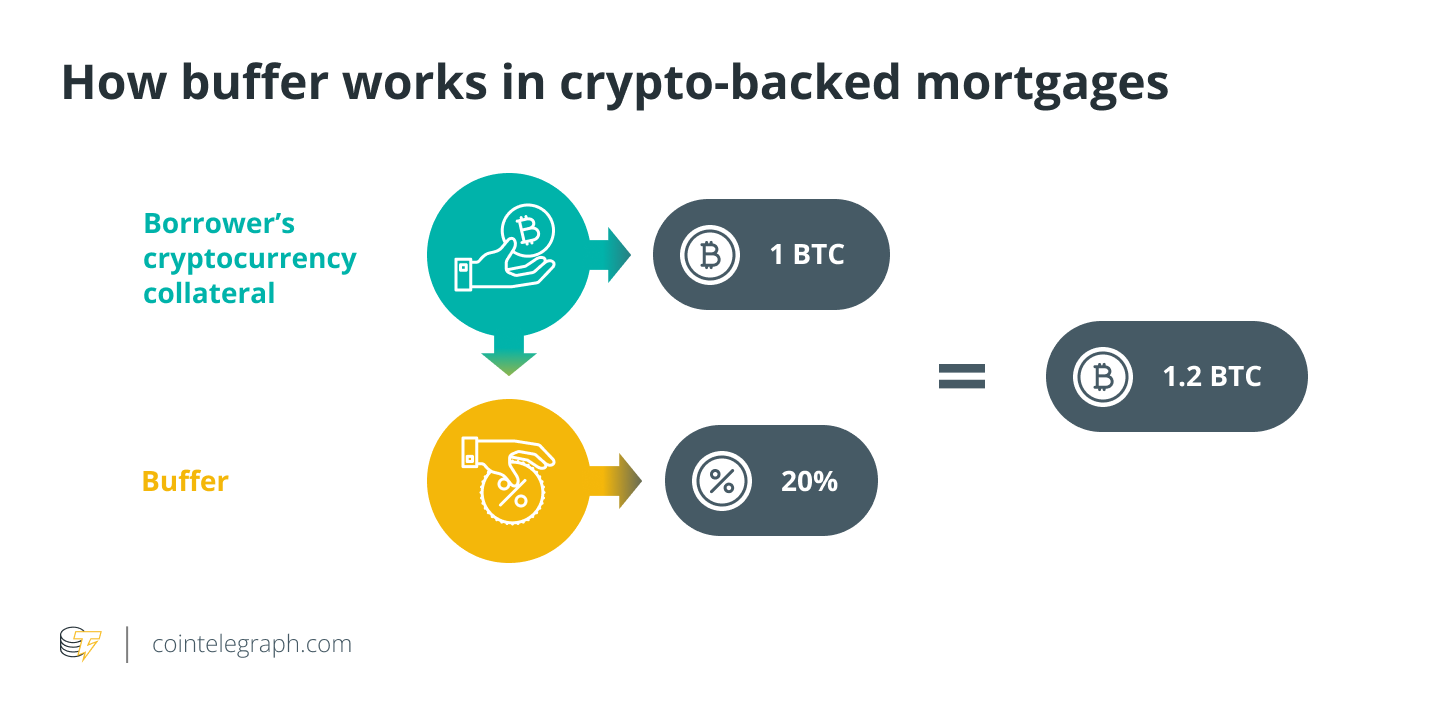

The fundamental principle of crypto-backed mortgages involves lenders evaluating the value of the cryptocurrency that the borrower intends to use as collateral and then determining a loan amount based on that valuation.

To assess the value of crypto assets, lenders may utilize a loan-to-value (LTV) ratio, which signifies how much you can borrow in relation to the value of the collateral.

For instance, with an LTV ratio of 50%, you could borrow $25,000 against crypto assets valued at $50,000. Overcollateralization serves as a protective measure for lenders should the value of the collateral decline. Smart contracts are employed to streamline the enforcement of loan agreements.

Here’s a step-by-step breakdown of how crypto-backed mortgages operate:

- Step 1: Find a lender – Seek out a financial institution or decentralized finance (DeFi) platform that offers crypto-backed mortgages. Compare lenders based on their interest rates, fees, and the cryptocurrencies they support.

- Step 2: Apply and submit proof of ownership – Fill out an application for a loan against your cryptocurrency holdings and provide proof of ownership. The lender will evaluate the value of your crypto assets to determine your borrowing capacity. Some lenders might also consider your credit history and other financial factors.

- Step 3: Move crypto to escrow account – Upon approval, you’ll need to transfer the required cryptocurrency amount into an escrow account, which serves as security for the mortgage loan.

- Step 4: Prepare the loan – Finalize the loan agreement, detailing key terms like repayment schedules, interest rates, and procedures should the collateral’s value fall. Typically, if the crypto’s value decreases, you may need to provide additional assets to keep the loan overcollateralized. Failing to do so may lead the lender to liquidate your crypto deposits.

- Step 5: Disbursal of loan – Loan funds are usually provided in fiat currency for the purpose of acquiring a property.

- Step 6: Make mortgage payments – Repay the loan according to the established terms. The interest rate might fluctuate based on the market value of the collateralized cryptocurrency.

- Step 7: Recover your collateral – Once you fulfill all payment obligations, you can retrieve your cryptocurrency from escrow. If you default on the loan, the lender may liquidate your collateral to settle the debt.

Did you know? Historical data shows that when fixed-rate mortgages were first introduced in 1971, interest rates were about 7.5%. However, by 1980, they had skyrocketed to nearly 20%.

Benefits of crypto-backed mortgages

Crypto-backed mortgages provide a pathway to invest in real estate without the necessity of selling your digital assets. You can utilize your crypto holdings to capitalize on growth in the real estate market.

Some notable advantages of opting for a crypto-backed mortgage include:

- Faster and more straightforward process: Compared to conventional mortgages, crypto-backed loans usually feature quicker and more efficient approval processes. Smart contracts are utilized to seamlessly implement loan conditions, enhancing efficiency.

- Liquidity without liquidation: You can access the funds necessary for real estate investments without having to sell your crypto holdings. This is particularly useful during rising real estate markets, allowing you to retain your crypto assets while sourcing necessary finances.

- Potential for investment growth: Crypto-backed mortgages allow you to benefit from the appreciation of both real estate values and your cryptocurrency investments.

- Wider accessibility: These mortgages open financing avenues for individuals lacking traditional credit histories. If you’re new to a country and don’t have financial records, crypto-backed loans can serve as a feasible option.

- Tax benefits: Since you’re not selling assets, you can sidestep immediate capital gains taxes, enabling you to access value without triggering tax events.

Challenges in crypto-backed mortgages

While crypto-backed mortgages present unique benefits, they also come with a range of challenges that must be addressed. Factors like price volatility and regulatory uncertainty can influence the feasibility and expenses tied to obtaining a mortgage using cryptocurrency.

Here are some significant challenges associated with crypto mortgages:

- Higher costs: Compared to traditional mortgages, crypto-backed loans frequently have elevated interest rates. Lenders regard these loans as riskier, which is reflected in the higher costs designed to safeguard against potential losses.

- Price volatility: Due to the highly fluctuating nature of cryptocurrencies, their values can change dramatically. If the value of your pledged crypto collateral decreases, you may need to add more assets or pay down a portion of the loan to avoid liquidation.

- Limited market acceptance: Many property sellers might hesitate to work with buyers who have secured loans through cryptocurrencies, potentially restricting your purchasing options.

- Regulatory ambiguity: The legal environment governing crypto-backed mortgages is still developing. Changes in regulations can affect the availability, terms, or tax implications of these loans, generating uncertainty for borrowers.

Did you know? There is currently $12.1 trillion in outstanding mortgage debt across 84 million loans, with the average American mortgage holder indebt of $144,593. These home loans account for a substantial 70.2% of total consumer debt in the US, underscoring their significance to the country’s economic stability.

How to decide on a crypto-backed mortgage?

Before committing to a cryptocurrency-backed mortgage, it’s essential to conduct a comprehensive evaluation of your financial situation and risk appetite.

Start by reviewing your cryptocurrency portfolio to determine how much of your holdings you could use as collateral and consider potential future performance of those assets.

Due to the volatility associated with cryptocurrencies, collateralizing a single asset may be precarious. Diversifying your collateral through various cryptocurrencies can help mitigate the risk of significant losses if values fluctuate.

It’s also vital to closely examine the loan conditions. A solid understanding of the interest rates, repayment plans, and any associated fees is crucial. Assess the risks like liquidation of your assets if their values drop sharply or if you fail to comply with repayment obligations.

Given that crypto-backed mortgages are a relatively novel financial tool, seeking professional advice may be beneficial if you feel uncertain. Consulting with financial and real estate specialists who are knowledgeable about crypto lending can help you navigate the process, structure your loan benefit effectively, and align your mortgage decision with your long-term investment goals.