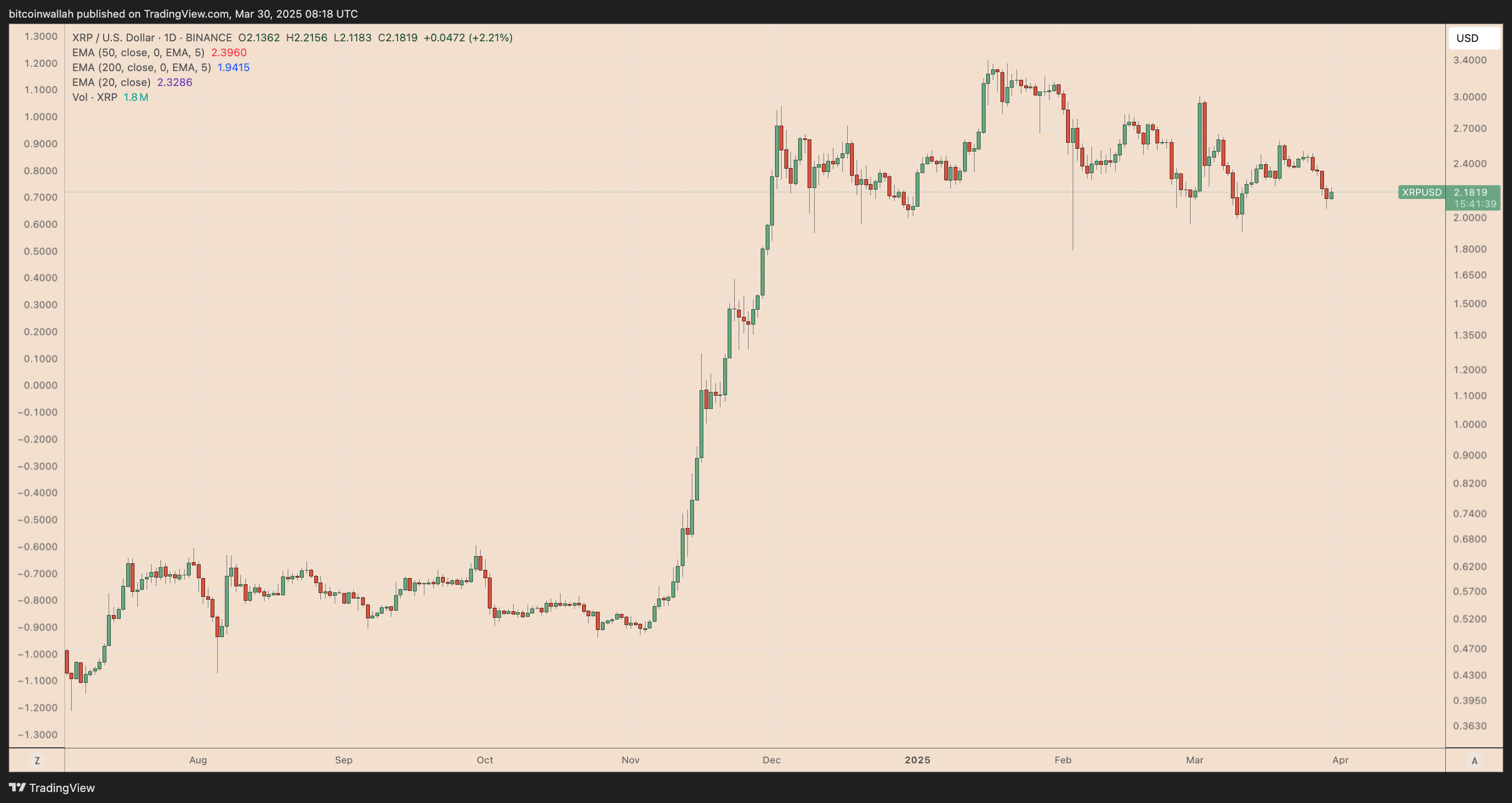

XRP (XRP) has experienced a significant decline of nearly 40%, currently sitting at approximately $2.19, just two months after reaching a multi-year peak of $3.40. This downturn coincides with a larger sell-off in the market, spurred by the ongoing trade tensions initiated by President Donald Trump, even in the face of positive developments such as the SEC ending its lawsuit against Ripple.

XRP/USD daily price chart. Source: TradingView

Nonetheless, XRP remains up by 350% from its low of $0.50 recorded in November 2024, indicating a period of consolidation following a substantial rally. This sideways movement has ignited discussions about whether this marks the conclusion of the bull run or presents a favorable buying moment.

No Buying Opportunity Until XRP Declines Further

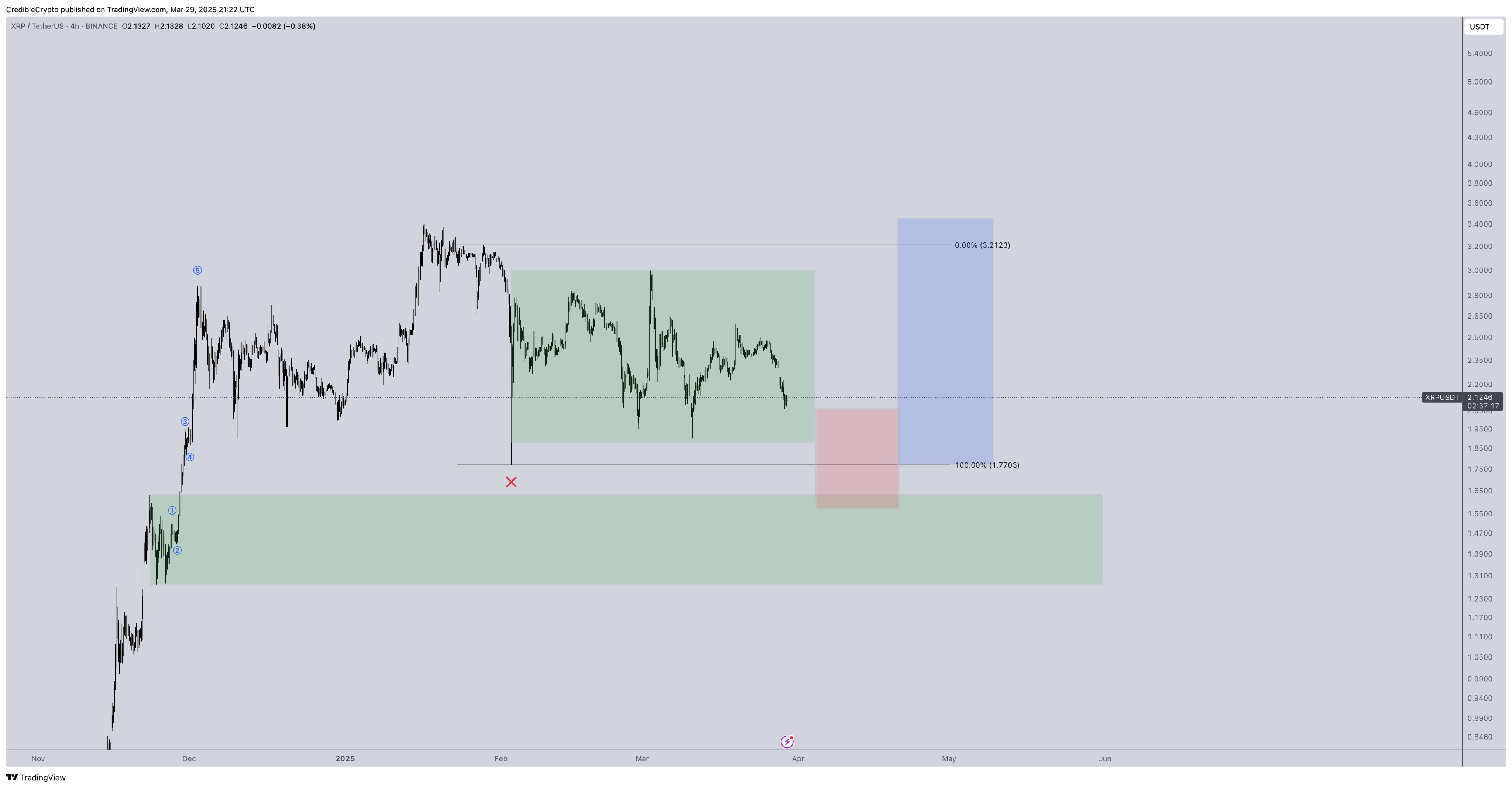

XRP has been trading in a consolidation range between $1.77 (support) and $3.21 (resistance) since January, witnessing several rejections near the upper end of this range alongside a decrease in bullish momentum.

According to analyst CrediBULL Crypto, XRP’s latest bounce attempt faltered just below $2.20, highlighting the prevailing bearish influence. He anticipates that the price may retest the range lows around $1.77 for a possible long entry position.

XRP/USD four-hour price chart. Source: TradingView

The green support zone indicated on the chart extends down to $1.50, marking a high-demand area where buyers may likely step in.

A brief rebound across the market—primarily driven by Bitcoin (BTC)—might instigate a short-term recovery, CrediBULL suggests, noting that a definitive breakout above $3.21 is required to signal a reversal in the bullish trend.

In the meantime, XRP continues to trade within a sideways pattern, as CrediBULL’s strategy focuses on monitoring price movements at the support level of $1.77 before making any long commitments.

Source: X

XRP Bull Flag May Indicate 450% Price Surge

CrediBULL pointed out that XRP’s current trading range between $1.77 and $3.21 serves as a consolidation phase, awaiting a breakout to confirm the next directional trend. Notably, this range could potentially form a bull flag, according to analyst Stellar Babe.

XRP/USD weekly price chart. Source: TradingView/Stellar Babe

A bull flag pattern appears when the price consolidates within a parallel channel following a robust uptrend. The pattern triggers a breakout when the price surpasses the upper trendline, potentially climbing by the height of the previous uptrend.

Related: XRP price could drop another 40% as Trump tariffs unsettle risk-takers

Stellar Babe’s analysis indicates that if XRP surpasses the flag’s upper boundary at $3.21, the projected target—based on the height of the flagpole—could reach approximately $12, representing a 450% increase from current levels.

XRP’s Five-Year Channel Foresees a Rally to $6.50

XRP is presently consolidating within a long-term bullish framework. According to recent analysis, the cryptocurrency is trading within a five-year ascending channel, with the current price action resembling the rally observed from March 2020 to April 2021, based on both price behavior and momentum indicators.

XRP/USD weekly price chart. Source: TradingView/InvestingScoope

Despite the recent downturn, the overarching bullish cycle remains intact as long as XRP holds above the 50-week moving average. The analysis suggests that this phase resembles March 2021, which preceded a significant breakout. Should the pattern persist, XRP could be gearing up for its next upward movement with a target of $6.50 in the coming months.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.