Bitcoin appears poised for a bearish start as March concludes, potentially marking its weakest Q1 results since 2018.

Concerns among cryptocurrency and stock traders are evident, particularly with the recent announcement of 25% tariffs on car imports by US President Donald Trump, alongside threats of tariffs impacting the pharmaceutical sector. Trump’s repeated references to April 2 as “Liberation Day” (the date when an expected set of “reciprocal tariffs” will be determined for various countries) has further unsettled traders.

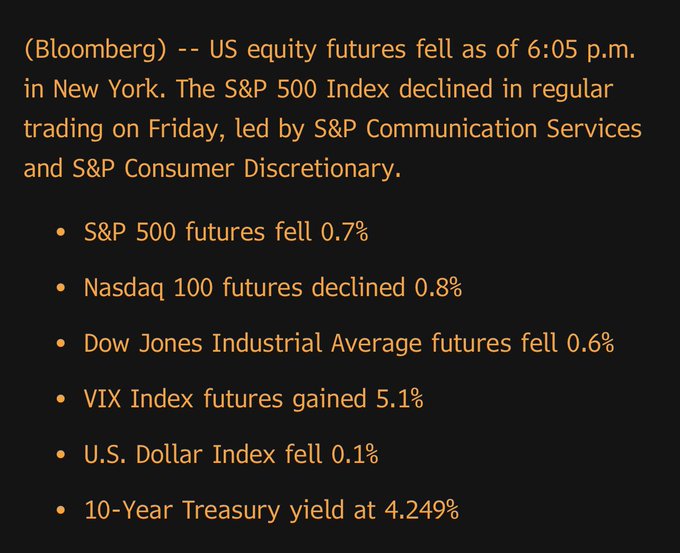

As of this writing, stock futures have already dipped, with the DOW futures down 206 points and the S&P futures dropping by 0.56%. In line with the equity markets, Bitcoin (BTC) has seen its price drop to $81,656 on March 30, marking a seventh consecutive day of lower lows.

Performance of US futures markets on March 30.

After a volatile month, equity markets are trending towards a month-end decline, with the S&P 500 down 6.3%, and the Nasdaq and DOW reporting losses of 8.1% and 5.2%, respectively.

Bitcoin’s ongoing downturn results from weak demand in spot markets and a clear move towards reducing risk among traders hesitant to engage in new positions in Bitcoin’s futures markets.

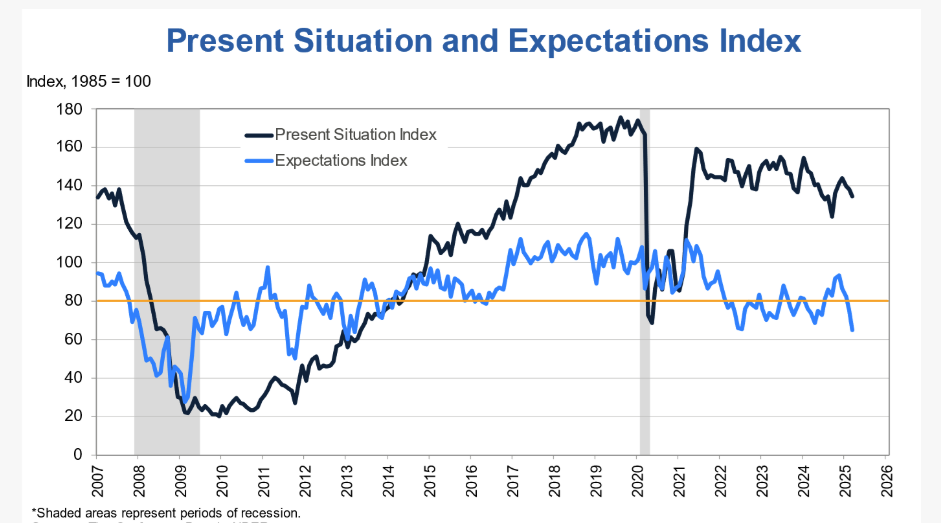

Recent core Personal Consumption Expenditures (PCE) data indicated an unexpected rise in inflation, while the Conference Board’s March consumer confidence figures revealed that the monthly confidence index reached a 12-year low, reflecting respondents’ pessimism regarding income, business conditions, and job outlook.

Current consumer confidence and future expectations data.

Related: Bitcoin’s potential bottom at $80K opens opportunities for TON, CRO, MNT, and RENDER to surge.

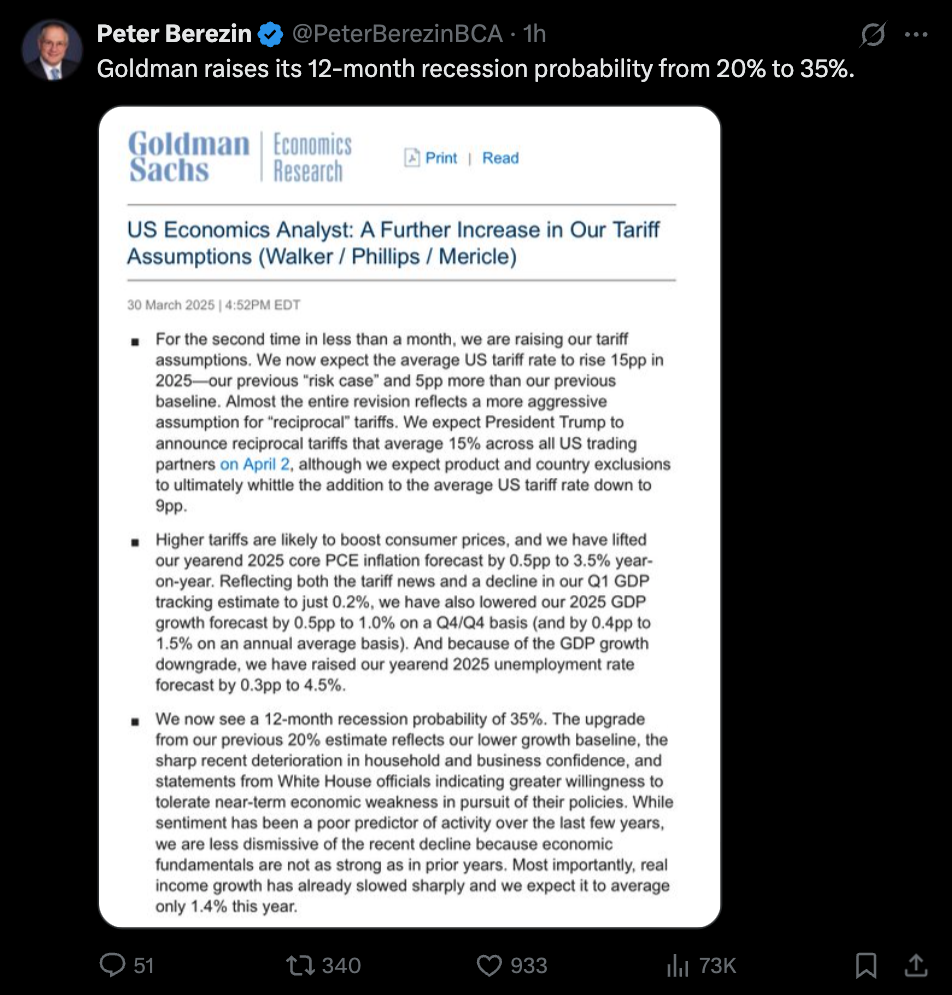

The likelihood of a recession is also increasing, with a recent report adjusting the 12-month recession probability from 20% to 35%. Analysts from Goldman Sachs noted,

“This increase from our earlier 20% estimate reflects a downgraded growth outlook, a significant recent decline in household and business confidence, and indications from White House officials of a willingness to accept short-term economic weakness in pursuit of their policies.”

Increased recession probabilities according to Goldman Sachs.

Is there a silver lining to Bitcoin’s decline?

While several analysts have adjusted their bullish BTC price predictions and are now anticipating a return to the mid $70,000 range, institutional investors remain active buyers, with net inflows into spot ETFs still positive.

On March 30, Michael Saylor, CEO of Strategy, shared a well-known Bitcoin chart on X, humorously stating,

“Needs even more Orange.”

Bitcoin purchases by Strategy.

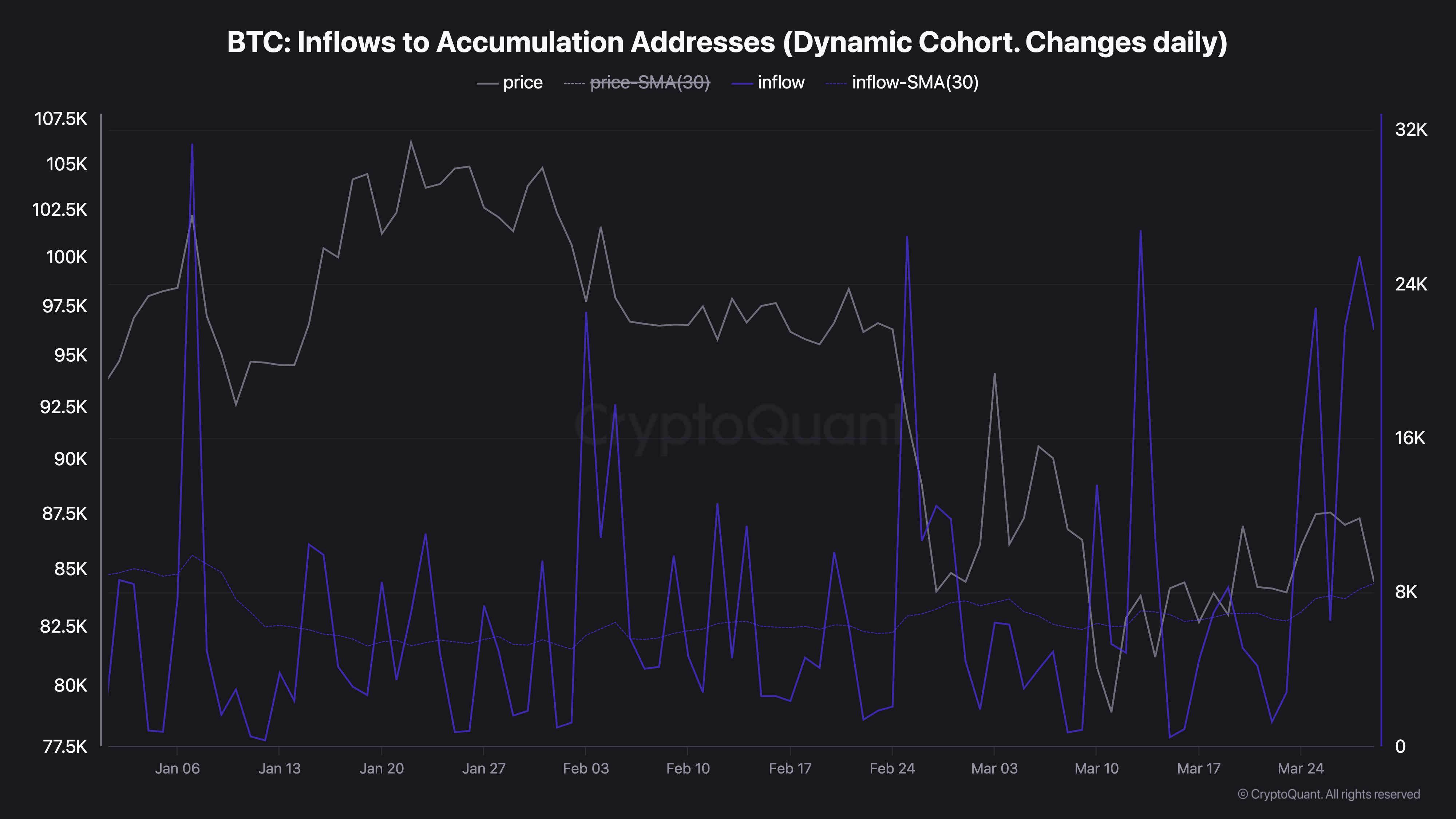

Furthermore, data from CryptoQuant indicates that Bitcoin inflows to accumulation addresses have been consistently rising throughout the month.

BTC inflows to accumulation addresses.

This article does not provide investment advice or recommendations. All investments and trading involve risks, and readers should conduct their own research before making decisions.