- The cryptocurrency market cap experienced a 3% decline on Monday, settling at $2.75 trillion.

- Bitcoin remains attractive to buyers at $82,000 as investors seek protection against the implications of tariffs proposed by President Trump.

- There is a noticeable decrease in interest for XRP, SOL, and ADA as concerns over Paul Atkins’ possible conflicts of interest emerge.

- Toncoin showed significant gains over the weekend but is currently facing challenges at the $4 resistance level.

On Monday, Bitcoin holds steady at $82K as investors protect themselves against the tariffs proposed by Trump, while XRP, SOL, and ADA continue to decline amid scrutiny of Paul Atkins by Congress.

Updates on Bitcoin:

- Throughout the weekend, Bitcoin’s price remained above $82,000 as investors utilized BTC as a safeguard against macroeconomic uncertainties stemming from President Donald Trump’s tariffs.

- The scrutiny from the US Congress regarding Trump’s Securities and Exchange Commission (SEC) chair nominee has added further bearish pressure to BTC’s price movement.

- Michael Saylor announced that Strategy acquired 22,048 Bitcoin for around $1.9 million from March 24 to March 30.

Strategy (MicroStrategy) Total Bitcoin Holdings | Source: SaylorTracker

The total Bitcoin holdings of Strategy now amount to 528,185 BTC, with a current value of about $44 billion, solidifying its position as the largest corporate Bitcoin holder globally.

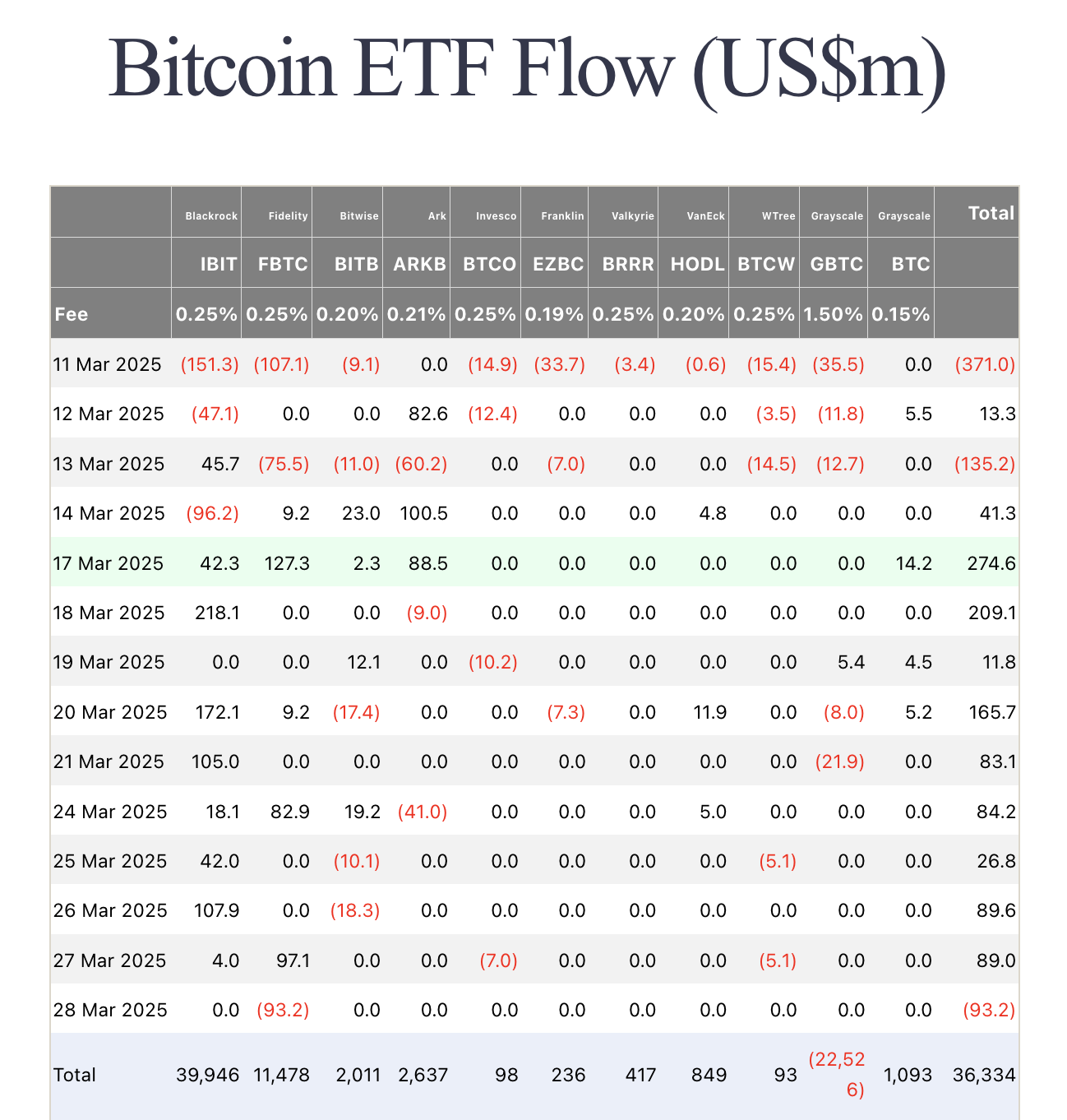

Chart Insight: Bitcoin ETFs End 10-Day Buying Streak

On Friday, Bitcoin ETFs witnessed $93 million in outflows, concluding a 10-day period of positive net inflows.

Data from Fairside indicates that ETFs accumulated $1.07 billion from March 14 to March 27 before a reversal occurred as investors decided to take profits.

Bitcoin ETF Flows as of March 31 | Source: Fairside

An analysis of the Fairside chart shows that all of Friday’s outflows originated from Fidelity’s FBTC.

Conversely, BlackRock’s IBIT and the other nine actively traded US ETFs remained stable, indicating a neutral position from investors.

This situation aligns with growing uncertainty in US stocks as companies reassess how Trump’s proposed tariffs could affect corporate earnings.

With interest rates on hold, stock markets feeling strain, and geopolitical tensions escalating, Bitcoin holders may choose to remain cautious, waiting for clearer macroeconomic signals before making future decisions.

Altcoin Market Update: XRP, SOL, and ADA Decline as Paul Atkins Faces Congressional Scrutiny

The overall cryptocurrency market cap has fallen by 3% in the past 24 hours as traders react to increasing macroeconomic uncertainties and regulatory pressures.

A significant bearish factor emerged from Washington, where former SEC commissioner Paul Atkins is under investigation in Congress for potential conflicts of interest. This controversy has intensified concerns over regulatory overreach, adding to the market’s risk-off attitude.

-638790310109591693.png) Crypto market performance, March 31 | Source: Coingecko

Crypto market performance, March 31 | Source: Coingecko

The price of XRP has decreased by 3.6% to $2.08, marking a total weekly drop of 15.8%.

This asset struggles to find support amidst lower trading volumes. Similarly, Solana (SOL) is down 0.6% over the past 24 hours, sitting at $124.11, which translates to a 12.4% loss for the week. Cardano (ADA) has seen one of the most significant declines, dropping 4.5% to $0.6438 as selling pressure remains strong.

In contrast to the bearish market, Toncoin (TON) saw impressive performance, rising 3.1% before hitting resistance at $4.

This surge was driven by news of a $400 million investment from major Silicon Valley firms, including Sequoia Capital, Ribbit Capital, and Draper Associates.

However, profit-taking has limited additional gains around the $4 resistance level, as broader market uncertainties persist.

Updates in the Crypto News:

FTX to Commence Creditor Payments on May 30, Raising Token Valuation Issues

FTX is set to begin repayments to significant creditors on May 30, distributing proceeds from its $11.4 billion reserve. The exchange, which filed for bankruptcy in November 2022, is providing payouts that could reach 118% of each claim. However, these payouts will be calculated based on crypto values at the time of bankruptcy, neglecting the substantial increases seen since.

Solana, Bitcoin, Ethereum, and XRP have all significantly increased in value, with Solana up about 650% since FTX’s collapse. Despite this gap, creditors will be granted an additional 9% annual interest on their claims during the waiting period.

Trump’s Sons Join Forces with Hut 8 to Launch ‘American Bitcoin’ Mining Venture

Eric Trump and Donald Trump Jr. have partnered with Hut 8 to unveil ‘American Bitcoin,’ a new mining operation aiming to become the world’s most efficient Bitcoin mining entity. This initiative follows a merger between American Data Centers and American Bitcoin, with Hut 8 holding an 80% stake while American Data Centers keeps a 20% share. The company is targeting a hash rate of over 50 EH/s and plans to integrate Bitcoin into its balance sheet.

“By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth,”

– Eric Trump.

American Data Centers, established by Dominari Holdings in collaboration with the Trump brothers, will focus on AI infrastructure in addition to Bitcoin mining.

With this initiative, the Trumps aim to leverage Bitcoin’s long-term growth potential while positioning American Bitcoin as a publicly traded leader in the industry.