- Bitcoin is hovering around $82,000 on Monday, poised to conclude the month with a modest 3% decline from its opening price of $84,400.

- A market analysis expert shares in-depth perspectives on the outlook for Bitcoin as Q2 2025 begins.

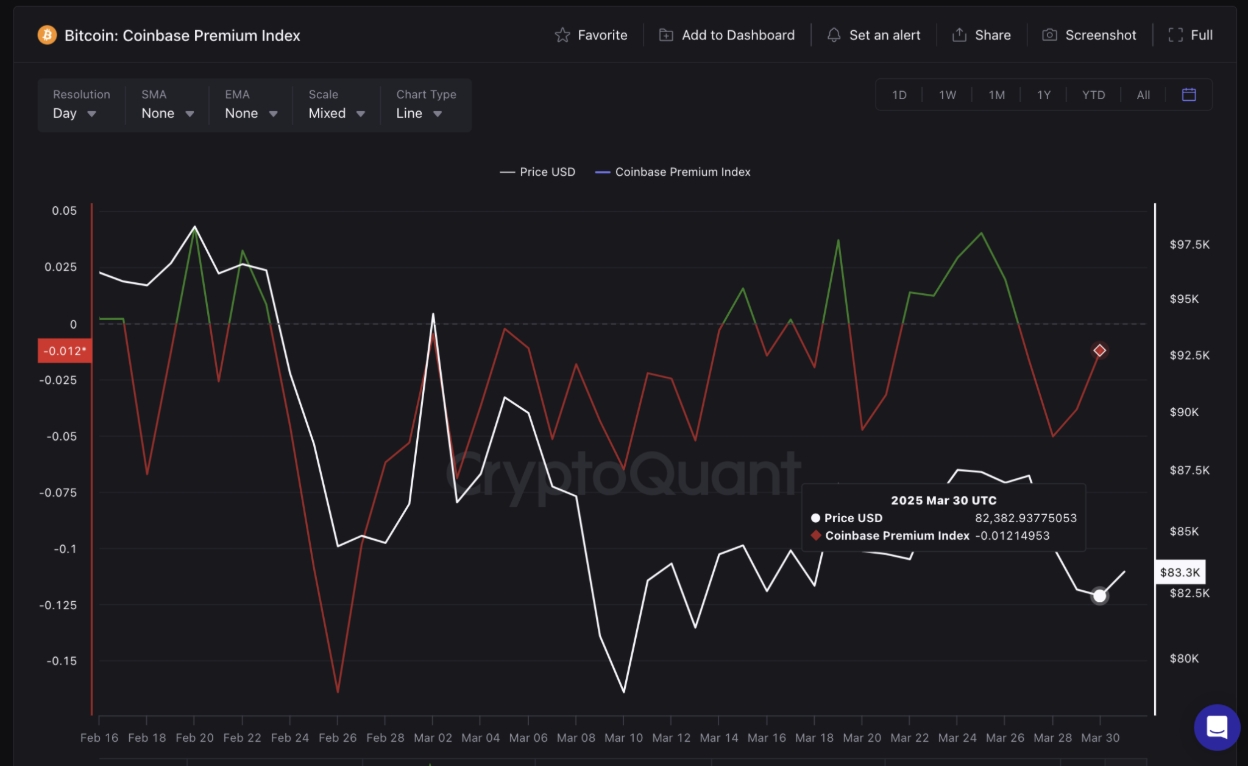

- The ascending Coinbase BTC Premium Index indicates robust buying support from US investors amidst tariff anxieties.

The price of Bitcoin steadied at approximately $83,400 on Monday, representing a 2% decline from the March opening price of $84,430. Following an 18% drop in February, BTC appears set to finish March in the red, with a further 2% decrease. Referencing historical patterns and critical on-chain data trends among US investors, the CEO of CoinBureau, who previously worked at Goldman Sachs, predicts a potential all-time high for BTC by April 2025.

Question 1: Bitcoin’s correlation with US stocks has increased; what implications does this have for short-term price movements?

Expert Analysis: “Many Bitcoin investors today didn’t experience the market cycle of 2017, and for those who did, it feels like an entirely different era given how rapidly the crypto landscape evolves.

For those familiar with the charts from that time, Bitcoin’s current sideways consolidation pattern is strikingly reminiscent of what we encountered in the fall of 2017.

Back then, the leading cryptocurrency spent several months settling around the $4,000 level before soaring about 360% from approximately $4,300 in October 2017 to its previous peak of $19,800 in December.

It’s plausible that we may witness a similar trend if Bitcoin can realign with the trading patterns of 2017.

This analysis isn’t mere conjecture based on overlapping charts; the macroeconomic environment and investor sentiment reflect a situation akin to that of 2017. At that time, the stagnant market was fueled by rising fear, uncertainty, and doubt (FUD) following China’s crackdown on crypto initial coin offerings (ICOs), which had been a significant driver of the 2017 bull run, as well as the closure of domestic crypto exchanges.”

- Q2: As we approach April 2025, the Crypto Fear and Greed Index indicates ‘Extreme Fear’. What are your thoughts on this?

Expert Analysis: The current global sentiment towards cryptocurrency is markedly different, yet the Crypto Fear & Greed Index has just begun to recover from “Extreme Fear” amidst worries over the implications of tariffs imposed by President Trump on risk assets.

The fiasco involving the Libra meme coin, which led to $251 million in losses for investors, has further eroded confidence, with many headlines speculating the end of the bull market.

Crypto Fear and Greed Index, March 31, 2025

Additionally, there is a monetary policy context to consider. Bitcoin typically tracks global liquidity cycles closely (i.e., the total money supply in circulation).

During the 2017 cycle, global liquidity was on the rise, peaking in January 2018, which coincided with the culmination of the previous market cycle. Currently, global liquidity continues to increase, and indicators suggest a substantial influx into the market (due to the end of quantitative tightening, along with factors from China, Europe, etc.).

These macroeconomic resemblances give me a strong belief that BTC is likely to replicate the breakout pattern seen in 2017.

However, as Bitcoin has matured into a more stable asset, a 360% surge seems unlikely. I do anticipate it will break its previous all-time high of $109,354 from January 20, likely reaching around $150,000 in this cycle.

For this to occur, it first needs to surpass a critical resistance level near $93,000, which represents the 50% retracement from a peak of about $109,000 on January 20 and a low of $76,000 on March 11. If Bitcoin reaches $93,000, it could potentially form a Double Top pattern, which often leads to a price rejection.

- Q3: With escalating opposition to Trump’s Crypto Strategic Reserve proposal, what fundamental indicators could bolster your bullish BTC price outlook?

Expert Analysis: The silver lining is that since the Federal Open Market Committee (FOMC) meeting on March 19, Bitcoin has been consistently trading above its 200-day moving average, which historically signals bullish trends.

It has also broken free from its three-month price downtrend and its RSI downtrend, which may indicate a shift in market sentiment and could precede a more significant price rebound.

Coinbase Premium Index, March 2025

In spite of the pushback against Trump’s Crypto Strategic Reserve proposal, there remains consistent demand for Bitcoin from US investors.

The Coinbase Premium Index from CryptoQuant indicates that US investors are willing to pay a premium for BTC on the Coinbase platform compared to prices on offshore exchanges, suggesting a bullish sentiment.

Q4: What is your price prediction for Bitcoin in April 2025?

Expert Analysis: It’s important to note that in the immediate term, we have yet to witness an uptick in trading volume or liquidations within a 24-hour window that would signify a forthcoming price surge.

In fact, daily trading volumes have been diminishing and are now at levels similar to those from October 2024, sitting 75% below the July peak of $132 billion, while liquidations hover around $250 million, indicating that BTC could struggle to escape its current holding pattern in the very near future.

Bitcoin Price Forecast, April 2025

Nonetheless, with Bitcoin’s market volatility recently reaching a six-month high, the landscape could shift dramatically with the right catalyst.

Notably, it is encouraging that the price has been less reactive to tariff news compared to a few weeks ago.

If BTC can breach the $93,000 point, it could potentially skyrocket to a new all-time high in a manner reminiscent of the 2017 surge.