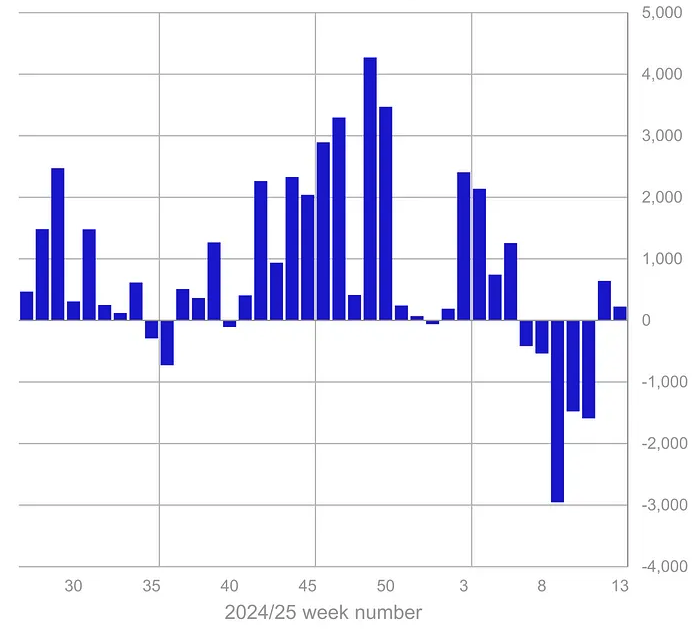

Cryptocurrency exchange-traded products (ETPs) experienced moderate inflows last week, marking a shift from an unprecedented period of outflows.

Global crypto ETPs registered an additional $226 million in inflows during the last trading week, following the previous week’s influx of $644 million, according to reports from March 31.

Even with this two-week upward trend after five weeks of outflows, total assets under management (AUM) continued their decline, slipping below $134 million by March 28.

Weekly crypto ETP flows since late 2024.

Last week’s inflow figures indicate a cautiously optimistic stance among investors, especially as core Personal Consumption Expenditures in the US exceeded expectations, noted the head of research.

Bitcoin Dominates Weekly Inflows

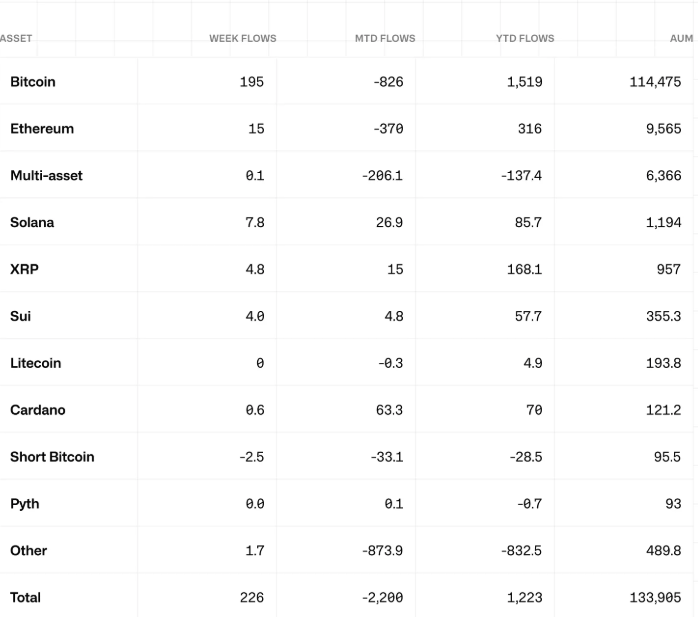

Bitcoin (BTC) investment products accounted for the bulk of the inflows, attracting $195 million over the week. Conversely, short-BTC investment products experienced outflows for the fourth consecutive week, losing $2.5 million.

In total, altcoins witnessed their first week of inflows, summing up to $33 million, following four weeks of outflows that reached $1.7 billion.

Flows by asset (in millions of US dollars).

Among individual altcoins, Ether (ETH) garnered $14.5 million in inflows. Solana (SOL), XRP (XRP), and Sui (SUI) followed with $7.8 million, $4.8 million, and $4 million, respectively.

AUM Hits Lowest Level of 2025 Amid Price Declines

Despite recent positive inflows, crypto ETPs have not managed to reverse the trend in total AUM.

Since March 10, the total AUM for crypto ETPs has declined by 5.7%, dropping from $142 billion to $133.9 billion as of March 28, the lowest point this year.

The decline in AUM could be linked to a downturn in cryptocurrency prices, according to the head of research.

“Recent price decreases have brought Bitcoin’s global ETP assets under management to their lowest level since shortly after the US election, standing at $114 billion,” they remarked.

Bitcoin price chart since January 1, 2025.

Since January 1, 2025, the price of BTC has declined by 13.6%, and the overall market capitalization has fallen nearly 20%, according to data from a notable source.

Magazine: Bitcoin ATH sooner than anticipated? XRP could drop 40%, and more: Hodler’s Digest, March 23 – 29