- Last week, the cryptocurrency market saw a decline of over $130 billion in market capitalization.

- Key cryptocurrencies such as BTC, ETH, XRP, and SOL dropped by 5.9%, 10.9%, 15%, and 10.1%, respectively.

- Recent reports indicate that US tariffs will affect more than $1.5 trillion in imports by the end of April.

Last week, the cryptocurrency market experienced a downturn, losing over $130 billion in total market capitalization. Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) saw decreases of 5.9%, 10.9%, 15%, and 10.1%, respectively, based on data from CoinGecko. Upcoming tariffs announced by President Trump are projected to impact more than $1.5 trillion in imports by the end of April, as highlighted in recent analysis.

Cryptocurrency market cap fell by $130 billion last week

The cryptocurrency and global financial markets continue to feel the pressure from the impending tariff announcements by the Trump administration, scheduled for April 2. According to data from CoinGecko, the cryptocurrency sector suffered losses exceeding $130 billion in market capitalization last week.

Total crypto market cap chart.

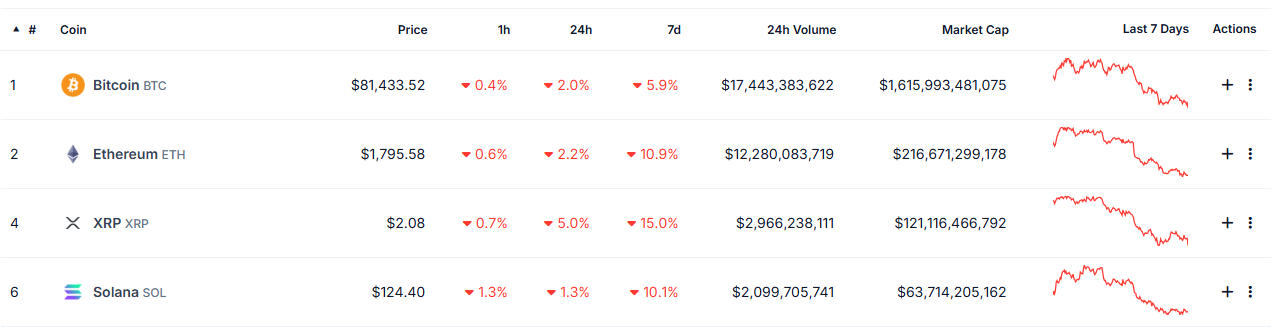

The chart below illustrates the declines for major cryptocurrencies: BTC, ETH, XRP, and SOL fell 5.9%, 10.9%, 15%, and 10.1% respectively over the past week. As of Monday, these cryptocurrencies continue to show downward trends.

Major cryptocurrencies chart.

Recent reports indicate that US tariffs will have an impact of over $1.5 trillion on imports by the end of April.

“President Trump has designated Wednesday as ‘Liberation Day,’ with tariffs exceeding 20% being imposed on more than 25 countries,” stated the recent post.

It’s officially “reciprocal tariff” week:

President Trump has called Wednesday “Liberation Day” with 20%+ tariffs coming on up to 25+ countries.

US tariffs will impact $1.5+ TRILLION worth of imports by the end of April.

Here’s what you need to know.

(a thread) pic.twitter.com/WnaIVcApl0

— The Kobeissi Letter (@KobeissiLetter) March 30, 2025

The analysis clarifies that this is the day President Trump announced “Reciprocal Tariffs,” which will be new tariffs in addition to those already in place.

The Economic Policy Uncertainty (EPU) Index chart displayed below tracks uncertainty in US economic policy since 1985, currently sitting at 600, which is 80% higher than during the 2008 financial crisis. This indicates a significant level of market unease. Historical spikes in this index often precede major market fluctuations, evident during the crises of 2008 and the 2020 COVID-19 lockdown.

This heightened uncertainty typically leads to a risk-averse mentality among investors who may seek refuge in more stable assets like Gold, potentially suppressing demand for cryptocurrencies.

Additionally, according to a recent post, the Trump administration is contemplating “broader and higher tariffs” in anticipation of the Wednesday deadline for reciprocal tariffs.

Reports suggest President Trump is considering a general increase of tariffs by up to 20%. The deadline of April 2 will not only mark the conclusion of tariff uncertainty, according to additional posts.

As uncertainty and volatility grip the global and cryptocurrency markets, there may be further turbulence with possible sell-offs as risk-averse sentiment prevails in the short term. However, in the medium to long run, Bitcoin and other cryptocurrencies could see increased interest as potential hedges against inflation and economic instability, especially if inflation continues to rise and traditional markets struggle. The historical connection between EPU shocks and cryptocurrency volumes, along with Bitcoin’s status as a “haven asset,” lends support to this perspective, despite the significant short-term risks stemming from wider market patterns.

To further understand how the cryptocurrency markets might respond to these tariff measures, insights were gathered from various experts in the cryptocurrency field.