Hyperliquid stands out as one of the impressive success stories in the current bullish DeFi market. With daily trading volumes hitting $4 billion, it has established itself as the largest decentralized derivatives platform, capturing nearly 60% of the market share.

While Hyperliquid still trails behind Binance Futures, which sees an average daily volume of $50 billion, recent trends indicate it is starting to make inroads into the territory dominated by centralized exchanges.

What’s fueling Hyperliquid’s meteoric rise?

Launched in 2023, Hyperliquid gained traction in April 2024 with the introduction of spot trading. This, along with a proactive listing strategy and an intuitive on-chain user interface, helped attract a surge of new users.

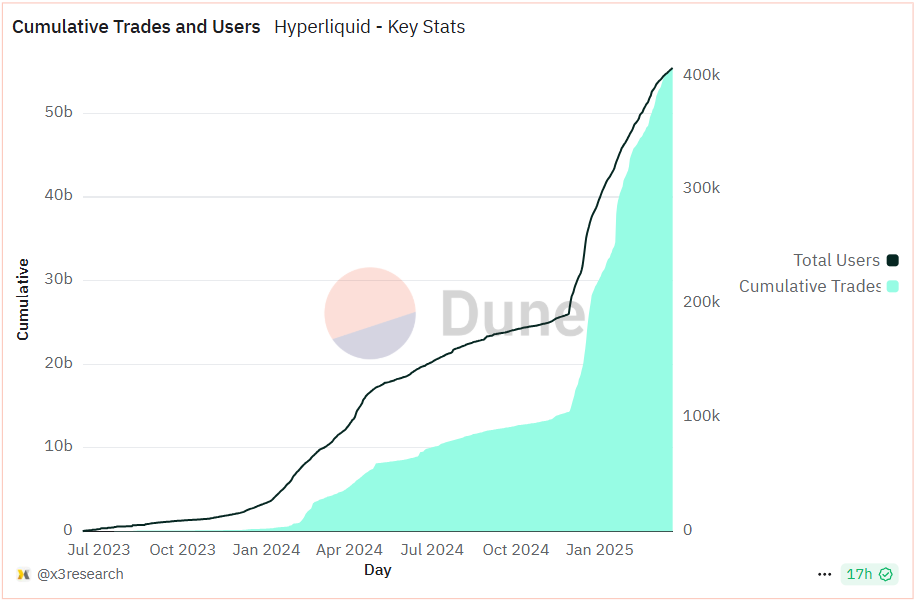

The platform truly took off in November 2024 with the launch of its HYPE token. Trading volume surged, and it now boasts over 400,000 users and has processed more than 50 billion trades, according to recent data.

Cumulative trades and users on Hyperliquid.

Originally a high-performance DEX focused on perpetual futures and spot trading, Hyperliquid has broadened its vision. With the debut of HyperEVM on February 18, it has evolved into a general-purpose layer-1 chain that can support various third-party DeFi applications built atop its framework.

As one of the founding members put it,

“Most layer-1s create the infrastructure with the hope that others will develop groundbreaking applications. Hyperliquid takes a different route: refine a native application and then transition into a comprehensive infrastructure.”

If this strategy proves effective, the liquidity generated by Hyperliquid’s core DEX could naturally flow into the larger ecosystem and vice versa, creating a beneficial cycle.

Related: Hyperliquid surpasses Solana in fees, but is the excitement justified?

Can Hyperliquid become a viable alternative to centralized exchanges?

Currently, Hyperliquid ranks 14th among derivatives exchanges by open interest, sitting at $3.1 billion, according to a major data provider. Although it remains behind Binance’s $22 billion, it outperforms established names like Deribit and the derivatives branches of Crypto.com, BitMEX, and KuCoin. This marks a significant moment, as a DEX is closely contesting with traditional CEXs.

Moreover, as Hyperliquid intensifies its focus on niche trading pairs, it continues to erode the market share of major exchanges. The platform is unique in that it accepts both Arbitrum USDC and native BTC as collateral, positioning it as one of the few decentralized platforms capable of handling BTC wrapping and unwrapping natively, allowing users to leverage BTC for trading via Web3 wallets.

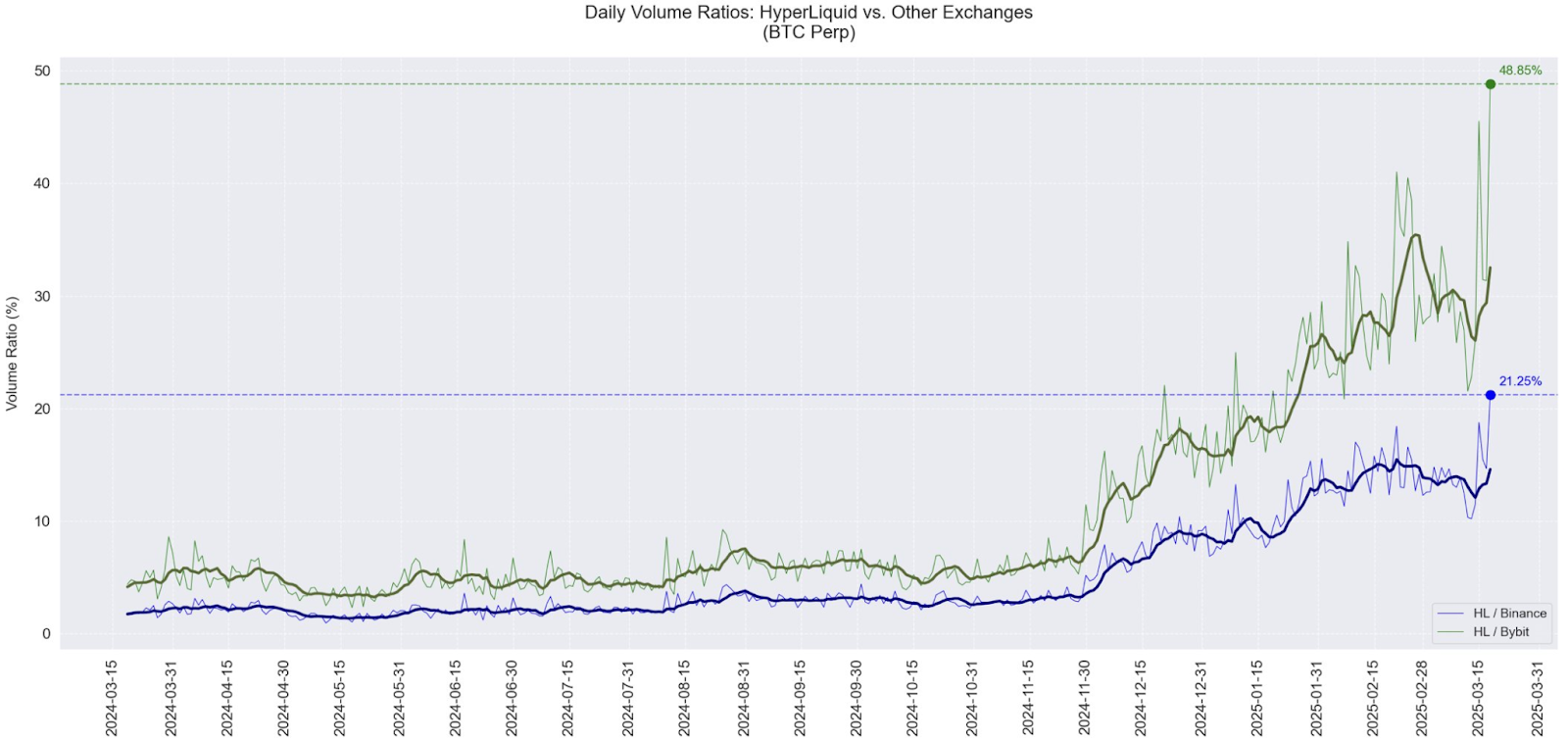

A user noted that Hyperliquid’s share of BTC perpetual futures volume recently reached record levels, nearly matching 50% of Bybit’s and 21% of Binance’s. They commented,

“No DEX has ever approached Tier 1 CEX volumes so closely.”

Daily volume ratios of Hyperliquid compared to other exchanges (BTC perpetual).

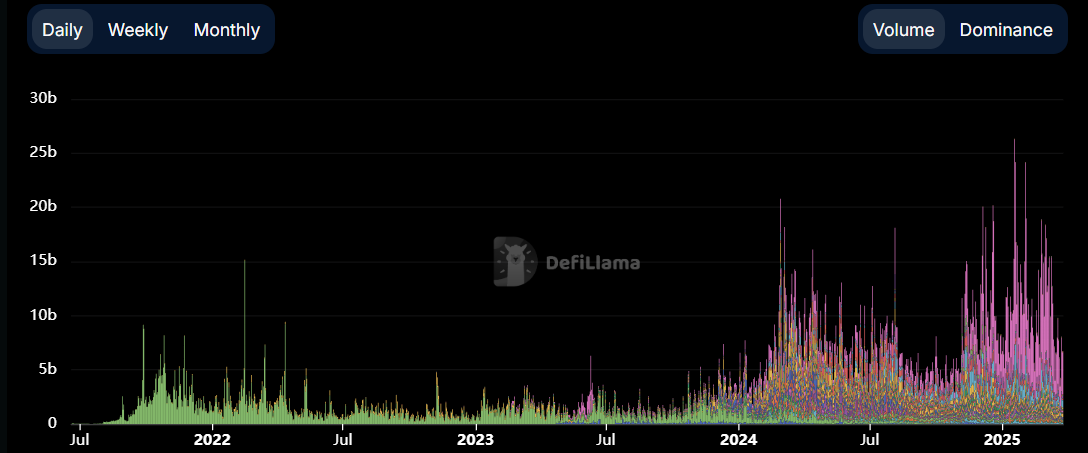

Since 2024, perpetual swaps have experienced a resurgence as a popular trading tool. During the bull market of 2021-2022, the average daily volume for perpetuals hovered around $5 billion. By early 2025, that figure frequently exceeded $15 billion, with Hyperliquid responsible for nearly two-thirds of it.

Data illustrates this transition: while dYdX was dominant between 2023 and 2024, the landscape diversified significantly in 2024, and by 2025, Hyperliquid emerged as the leader.

Breakdown of perpetual volume.

Despite the recent controversy surrounding the JELLY token, which led to trading halts and the delisting of a low-market-cap token that was exploited, Hyperliquid remains a favored choice among DeFi and DEX traders. While it has yet to attract significant institutional investment or reach the same scale as top-tier CEXs, the potential for its layer-1 ecosystem to thrive with developer support might see Hyperliquid evolve into much more than just a leading DEX.

This article does not offer investment advice or recommendations. Every trading decision involves risks, and readers should conduct their own research prior to making any decisions.