A Japanese company, Metaplanet, is following in the footsteps of prominent firms by concentrating on Bitcoin acquisition. Recently, they issued 2 billion Japanese yen (approximately $13.3 million) in bonds to increase their BTC holdings.

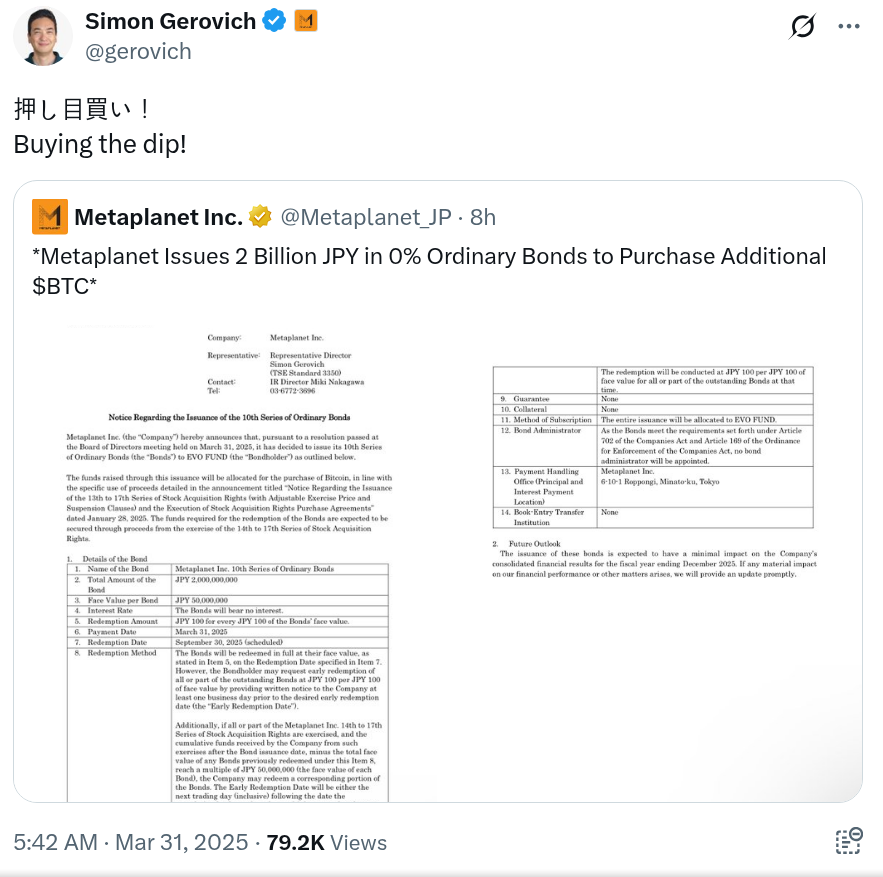

In a filing from March 31, Metaplanet detailed that these zero-interest bonds were issued through its Evo Fund to support its Bitcoin purchases. Investors can redeem these newly minted securities at face value by September 30 this year.

The CEO, Simon Gerovich, shared in a post on X that the firm is capitalizing on the current dip in Bitcoin prices. At the time of this announcement, Bitcoin was trading around $82,000—almost 25% lower than its peak of over $109,000.

Related: Metaplanet sees 4,800% increase in share price as it accumulates BTC

Source: Simon Gerovich

Metaplanet has emerged as Asia’s leading corporate Bitcoin holder and is ranked 10th globally, according to recent data. The company currently owns about 3,200 Bitcoin, valued at approximately $1.23 billion.

Following in the footsteps of giants

Often referred to as “Asia’s MicroStrategy,” Metaplanet’s business strategy closely resembles that of its US-based counterpart, which has made Bitcoin accumulation its primary focus. MicroStrategy holds over 500,000 BTC, valued at nearly $82 billion—representing over 2% of Bitcoin’s maximum supply.

Related: Metaplanet reports first operating profit in seven years, spurred by Bitcoin

Earlier this month, Metaplanet expanded its holdings by purchasing 150 Bitcoin, working towards its target of accumulating 21,000 BTC by 2026. At the start of March, the company’s stock rose 19% in less than a day after a $44 million investment in Bitcoin.

This month, Metaplanet also began exploring a potential listing in the US as they acquired an additional 156 BTC. Gerovich commented:

“We are considering the best way to enhance the accessibility of Metaplanet shares for investors worldwide.”

An increasingly influential company

Metaplanet is also forging connections within the US political sphere. Earlier in March, they appointed Eric Trump, son of former President Donald Trump, to their newly formed strategic advisory board to advance their goal of becoming a “global leader in the Bitcoin economy.” Company representatives noted at the time:

“Eric Trump brings significant experience in real estate, finance, brand development, and strategic business growth, and he has emerged as a prominent advocate for digital asset adoption globally.”

Magazine: Bitcoin ATH may arrive sooner than anticipated? XRP could drop 40%, and more: Hodler’s Digest, March 23 – 29